Technical analysis - Page 91

December 5, 2024

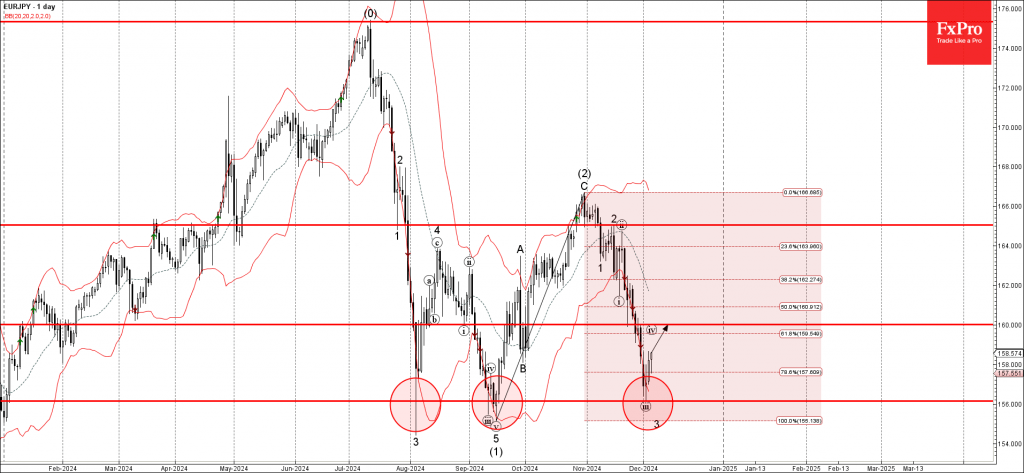

– EURJPY reversed from key support level 156.00 – Likely to rise to resistance level 160.00 EURJPY currency pair recently reversed up from the key support level 156.00 (which has been reversing the pair from the start of August) standing.

December 5, 2024

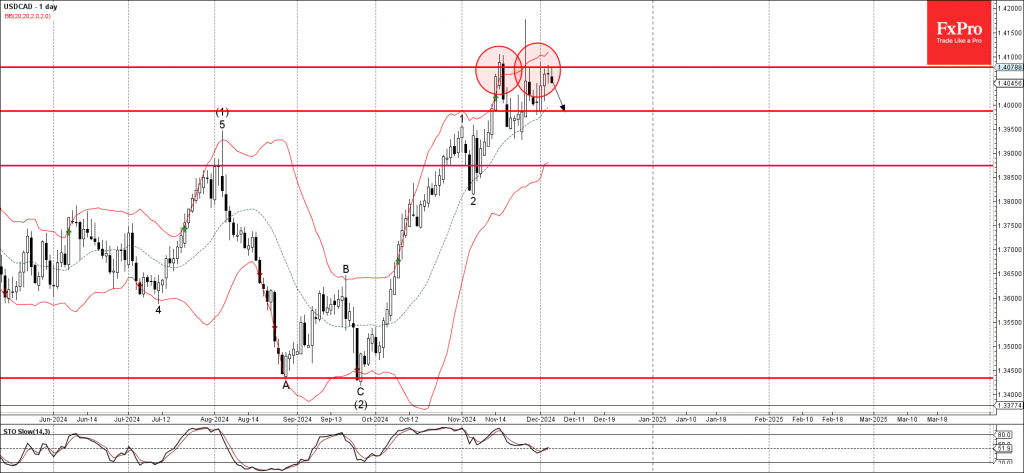

– USDCAD reversed from pivotal resistance level 1.4080 – Likely to fall to support level 1.3990 USDCAD currency pair today reversed down from the pivotal resistance level 1.4080 (which has been reversing the pair from the start of November) standing.

December 5, 2024

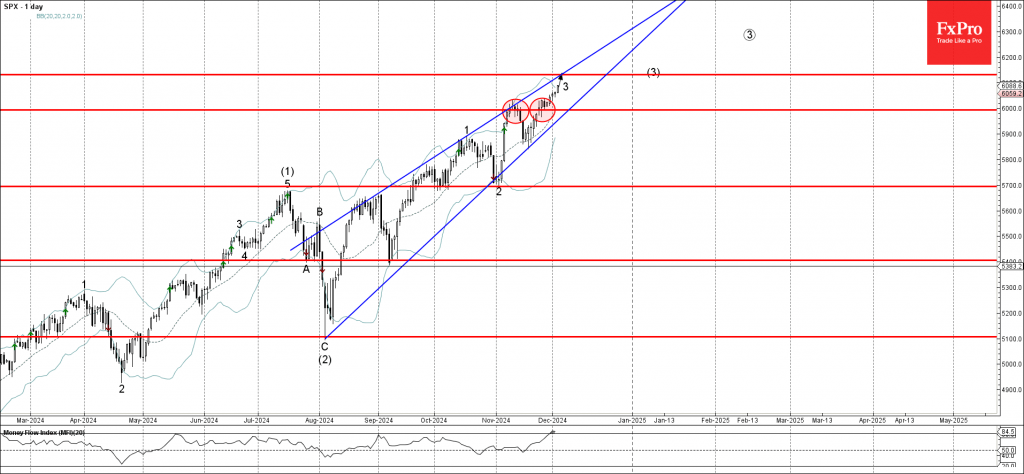

– S&P 500 broke round resistance level 6000.00 – Likely to rise to resistance level 6130.00 S&P 500 index continues to rise steadily after breaking the round resistance level 6000.00, which stopped the earlier upward impulse wave at the start.

December 5, 2024

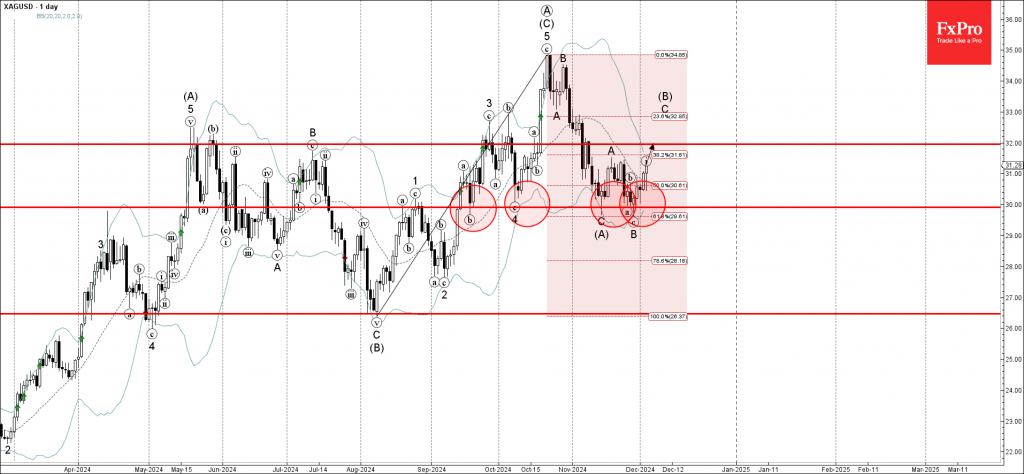

– Silver reversed from round support level 30.00 – Likely to rise to resistance level 32.00 Silver recently reversed up from the round support level 30.00, which has stopped all previous downward corrections from September. The support level 30.00 was.

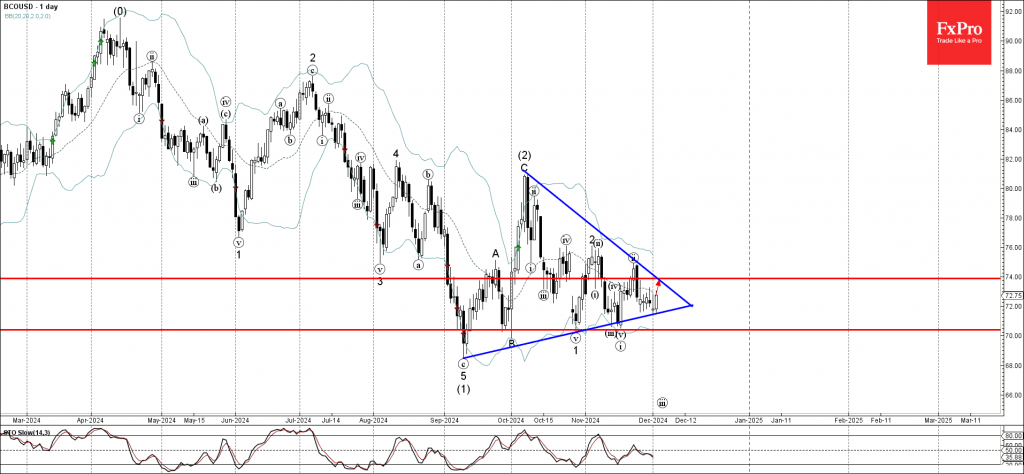

December 3, 2024

– Brent crude oil rising inside daily Triangle – Likely to rise to resistance level 74.00 Brent crude oil recently reversed up from the support trendline of the daily Triangle inside which the price has been moving since September. The.

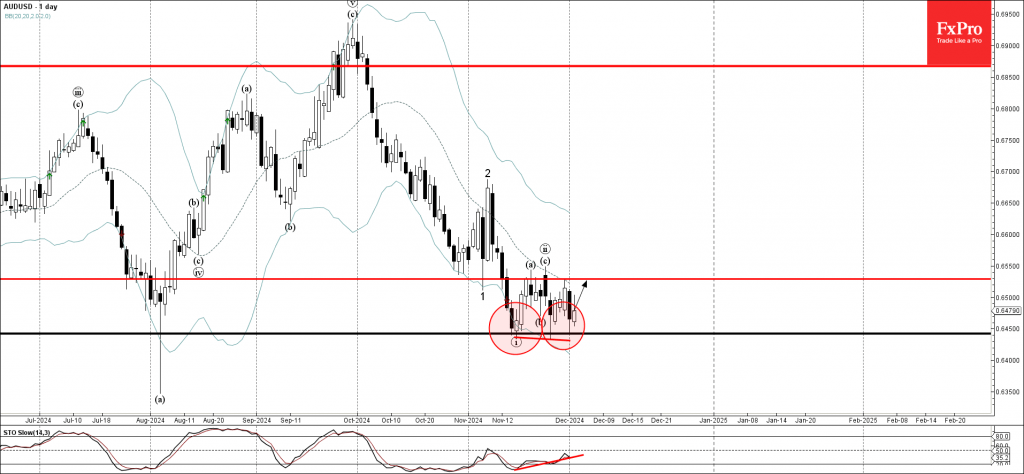

December 3, 2024

– AUDUSD reversed from strong support level 0.6450 – Likely to rise to resistance level 0.6530 AUDUSD currency pair recently reversed up from the strong support level 0.6450, which has been reversing the price from the start of August, as.

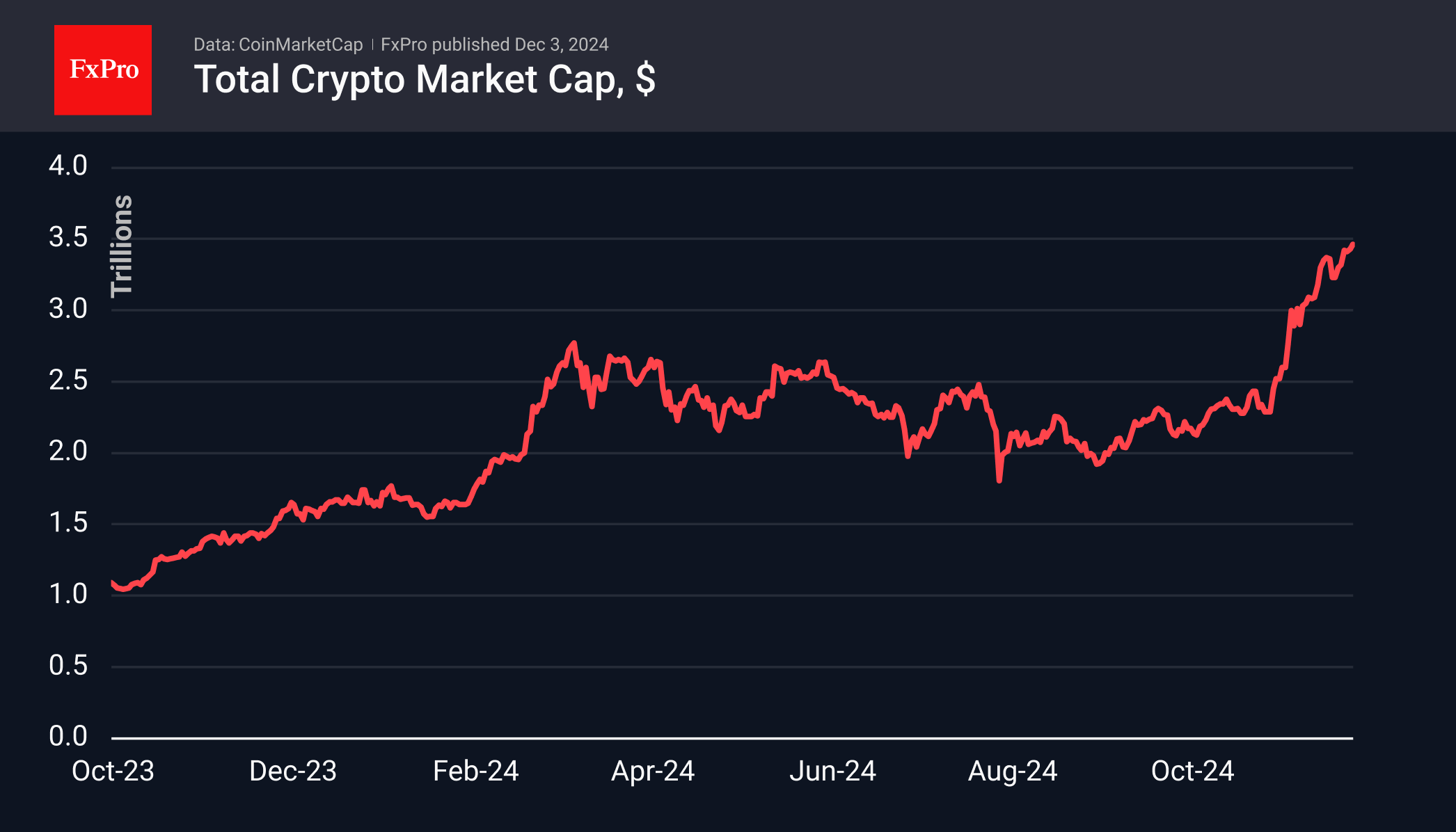

December 3, 2024

Bitcoin is unable to break $100K, but altcoins are thriving. XRP's price quadrupled, and global investment in crypto funds rose by $370 million. MicroStrategy bought more BTC.

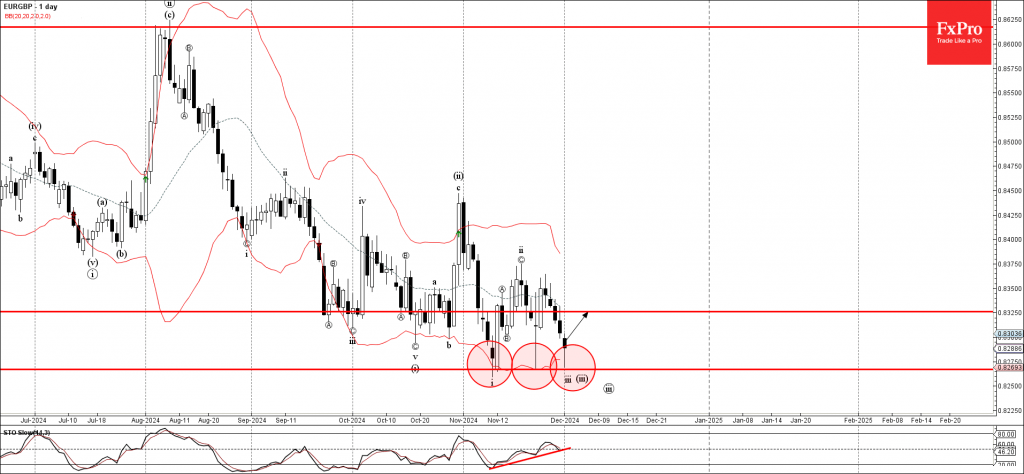

December 2, 2024

– EURGBP reversed from support zone – Likely to rise to resistance level 0.8325 EURGBP currency pair today reversed up from the support zone located between the strong support level 0.8265 (which has been revering the pair from the start.

December 2, 2024

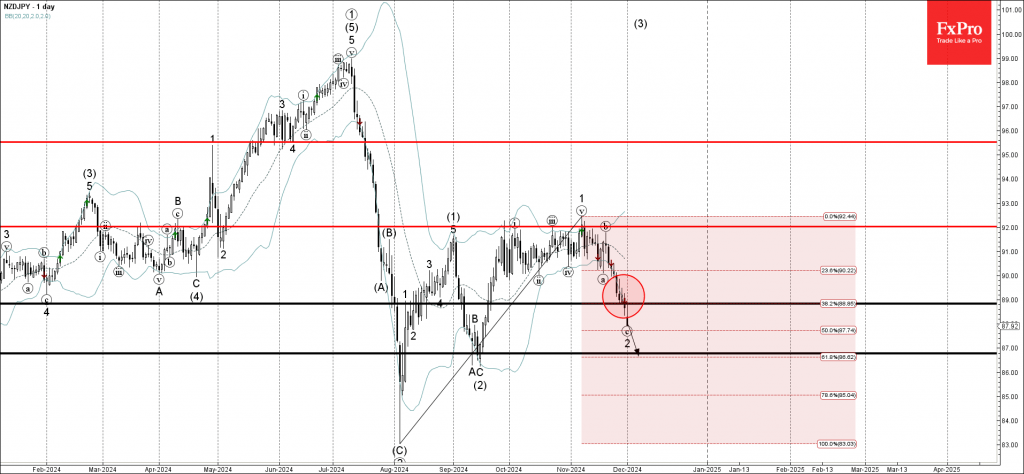

– NZDJPY broke support zone – Likely to fall to support level 86.75 NZDJPY currency pair recently broke the support zone located between the support level 89.00 and the 38.2% Fibonacci correction of the upward price move from the start.

November 29, 2024

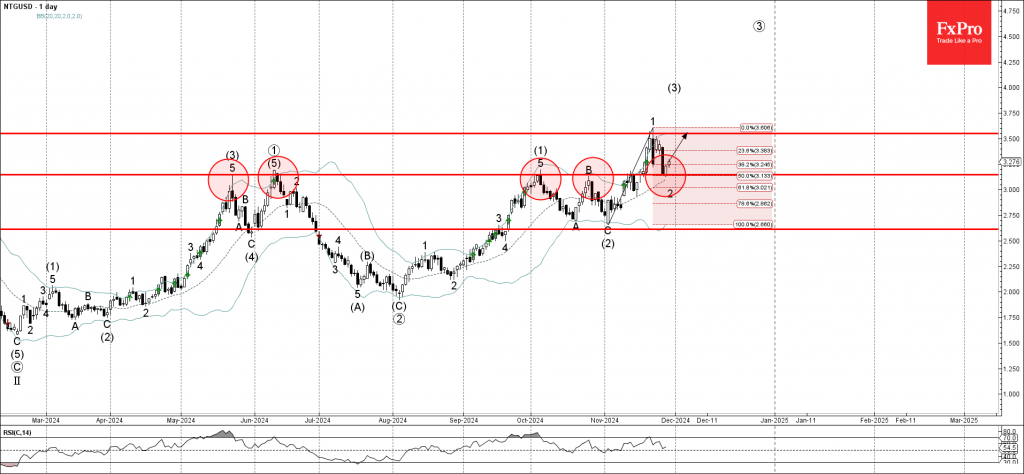

– Natural gas reversed from support zone – Likely to rise to resistance level 3.550 Natural gas recently reversed up from the support zone located between the support level 3.150 (former multi-month high from May, June and October), 20-day moving.

November 29, 2024

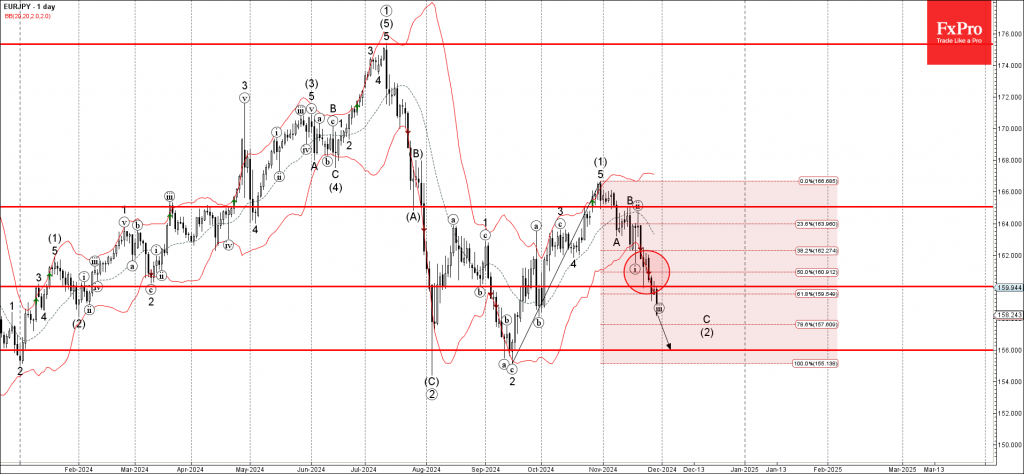

– EURJPY broke support zone – Likely to fall to support level 156.00 EURJPY currency pair recently broke the support zone located between the support level 160.00 and the 61.8% Fibonacci correction of the upward impulse from September. The breakout.