Technical analysis - Page 88

January 6, 2025

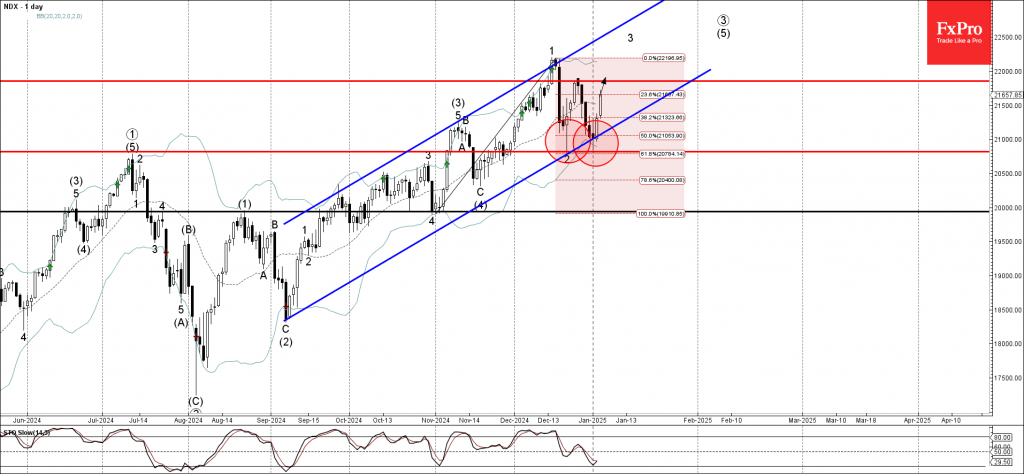

– Nasdaq-100 reversed up from support zone – Likely to rise to resistance level 21855.00 Nasdaq-100 index recently reversed up from the support zone located at the intersection of the support level 20820.00 (low of the previous minor correction 2),.

January 6, 2025

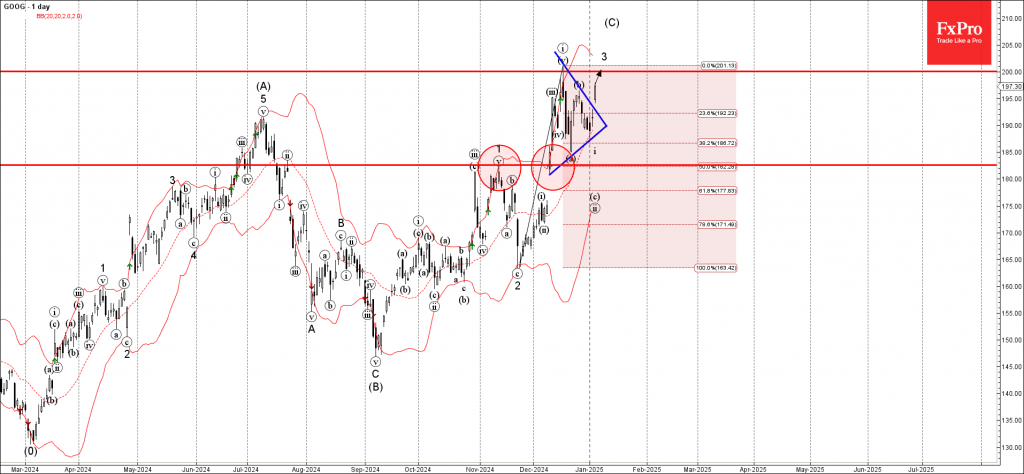

– Google broke daily Triangle – Likely to rise to resistance level 200.00 Google under the bearish pressure after the earlier breakout of the resistance trendline of the daily Triangle from the start of December. The bottom of this Triangle.

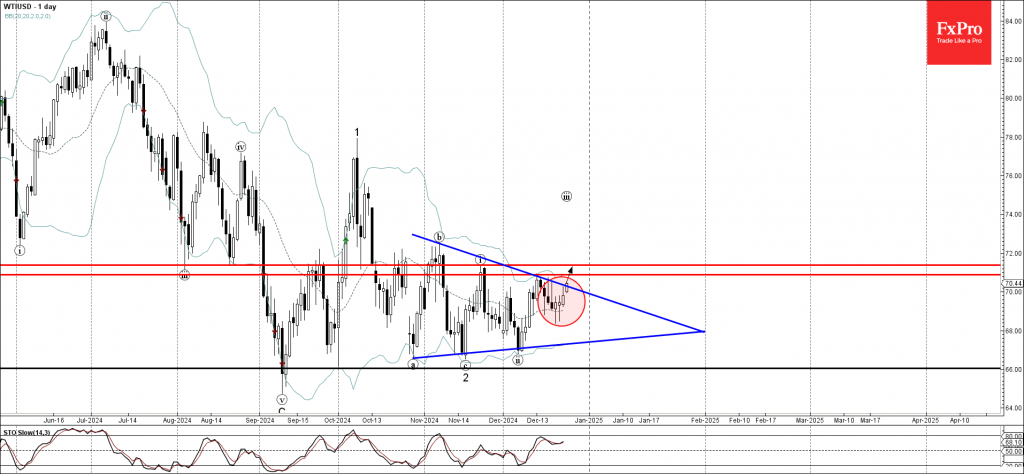

January 3, 2025

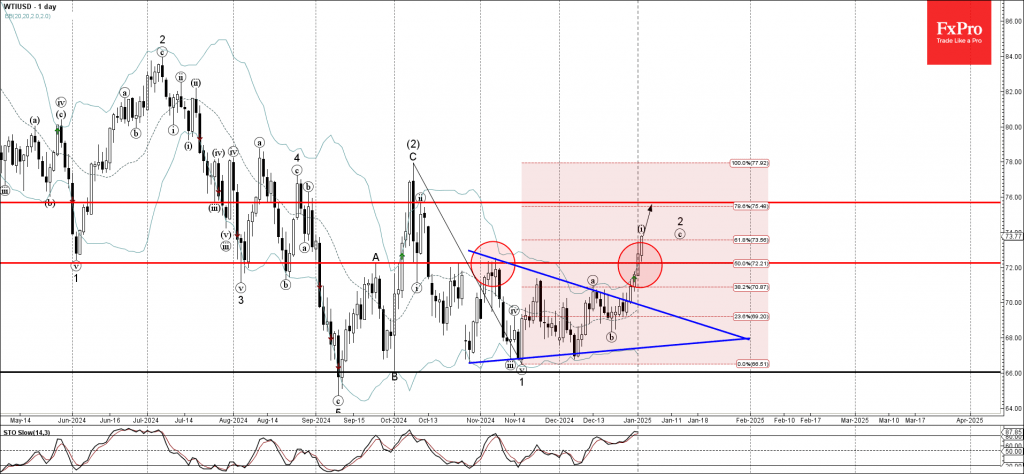

– WTI crude oil broke resistance area – Likely to rise to resistance level 76.00 WTI crude oil rising sharply after the earlier breakout of the resistance area located between the key resistance level 72.25 (top of the previously broken.

January 3, 2025

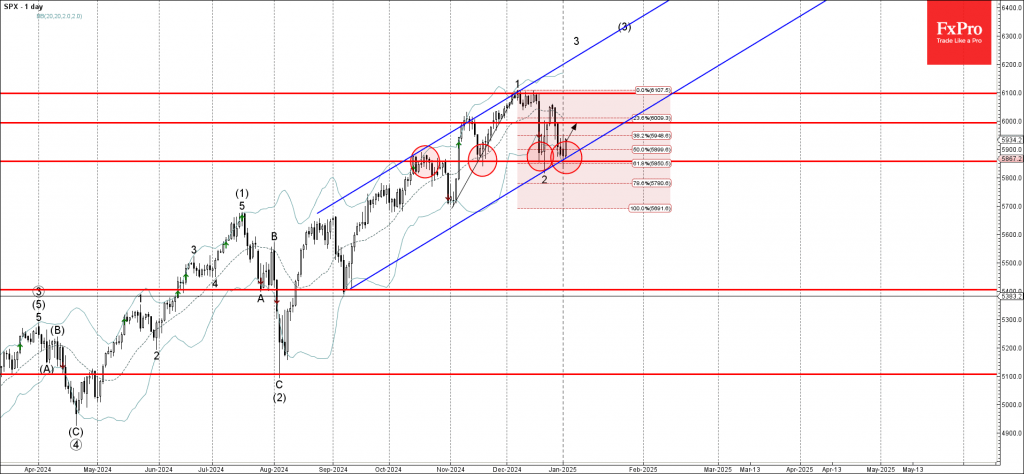

– S&P 500 reversed from support area – Likely to rise to resistance level 6000.00 S&P 500 index today reversed up from the support area located between key support level 5855.00 (former resistance from October, which has been reversing the.

December 31, 2024

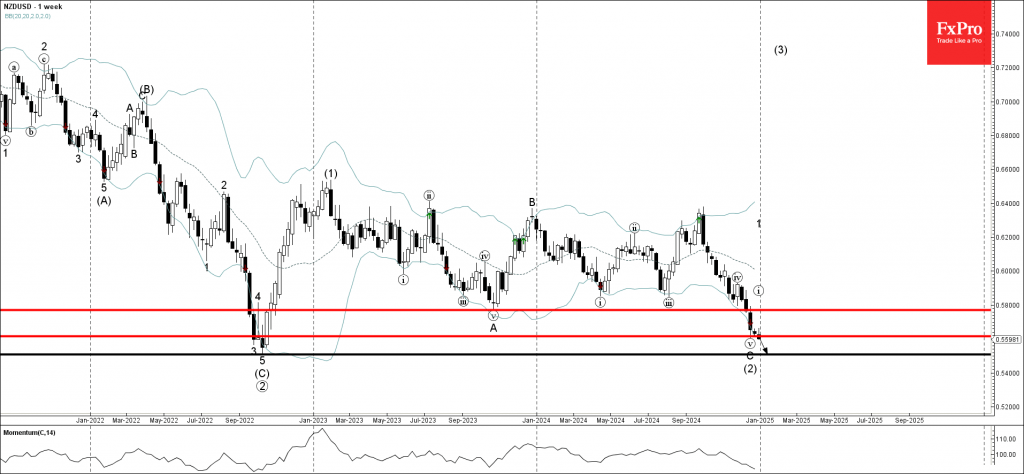

– NZDUSD broke key support 0.5600 – Likely to fall to support level 0.5500 NZDUSD currency pair under the bearish pressure after breaking the key support 0.5600, which stopped the previous long-term ABC correction (2) earlier this month. The breakout.

December 31, 2024

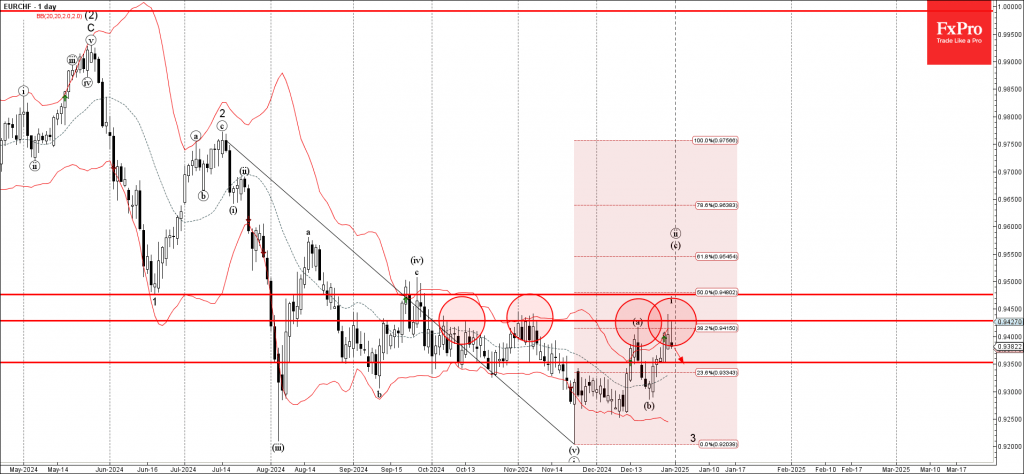

– EURCHF reversed from resistance zone – Likely to fall to support level 0.9350 EURCHF currency pair today reversed down from the resistance area located between pivotal resistance level 0.9430 (which has been steadily reversing the price from the start.

December 31, 2024

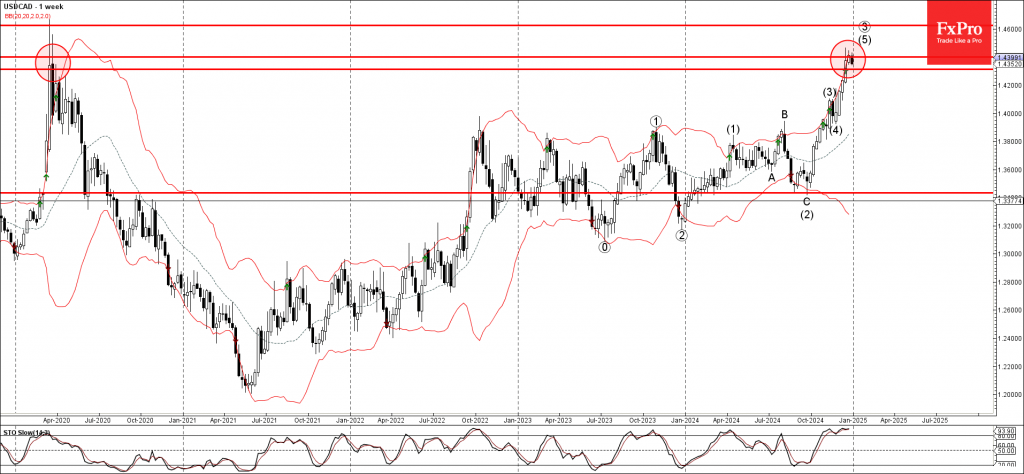

– USDCAD reversed from resistance zone – Likely to fall to support level 1.4400 USDCAD currency pair recently reversed down from the resistance zone surrounding the major long-term resistance level 1.4400 (which stopped the sharp uptrend at the start of.

December 31, 2024

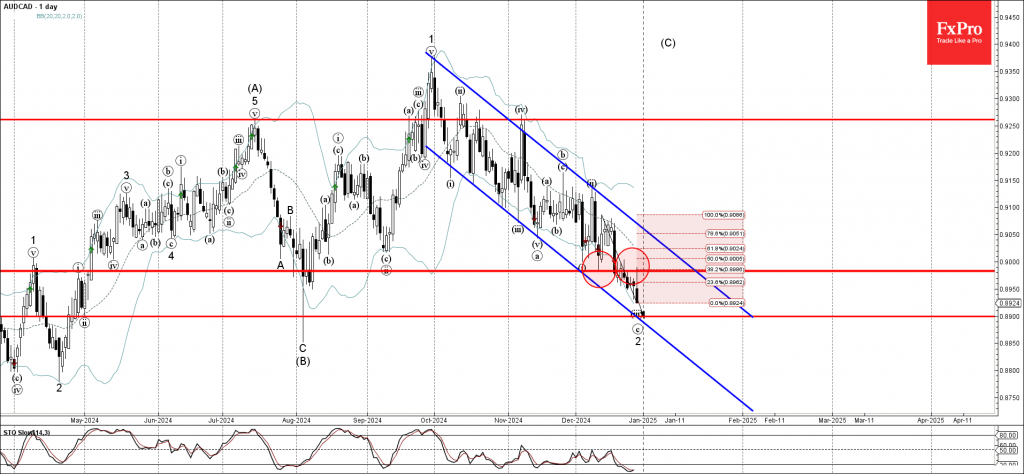

– AUDCAD reversed from resistance level 0.8980 – Likely to fall to support level 0.8900 AUDCAD currency pair recently reversed down from the key resistance level 0.8980 (former support from the start of December) intersecting with the 38.2% Fibonacci correction.

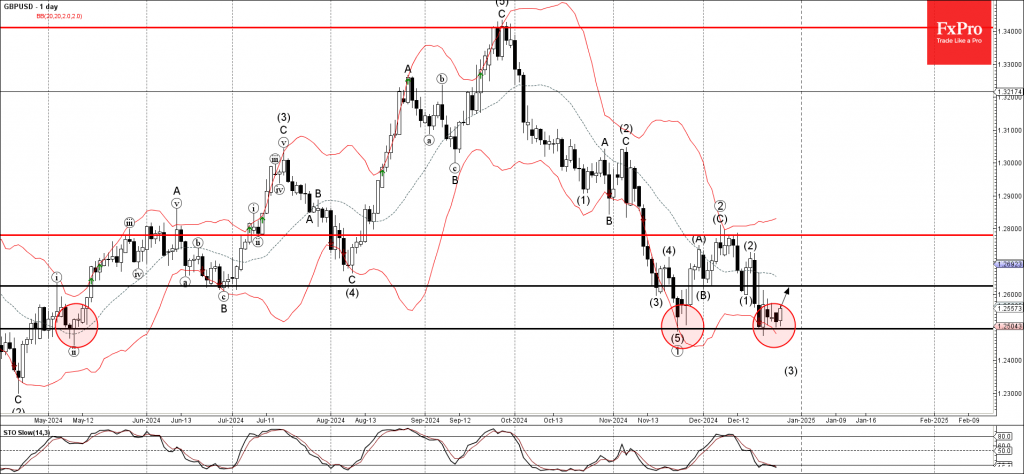

December 27, 2024

– GBPUSD reversed from support level 1.2495 – Likely to rise to resistance level 1.2625 GBPUSD currency pair recently reversed up from the pivotal support level 1.2495 (which has been steadily reversing the pair from May) intersecting with the lower.

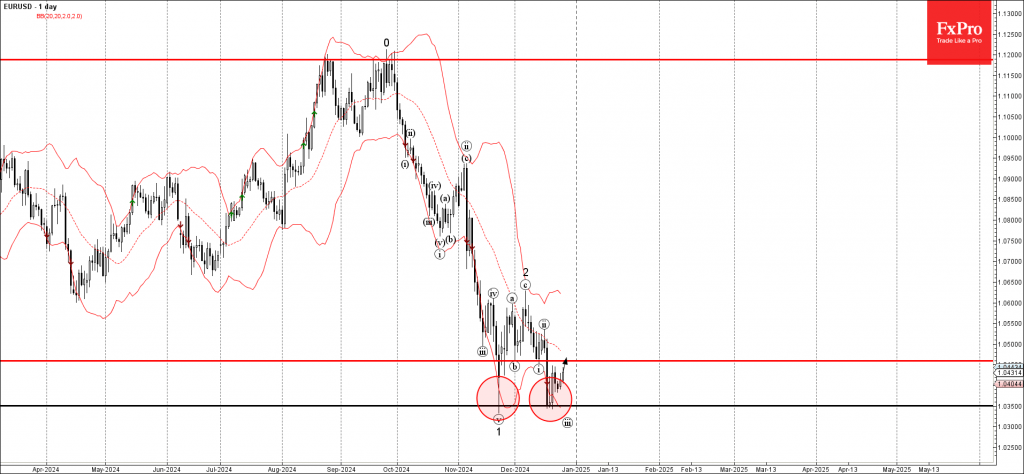

December 27, 2024

– EURUSD reversed from powerful support level 1.0350 – Likely to rise to resistance level 1.0460 EURUSD currency pair recently reversed up with the daily Morning Star from the powerful support level 1.0350 (which stopped the previous sharp downward impulse.

December 26, 2024

– WTI broke daily Triangle – Likely to rise to resistance level 70.90 WTI crude oil today broke the resistance trendline of the daily Triangle from the end of October, inside which the price has been moving from October. The.