Technical analysis - Page 85

January 29, 2025

– Baidu continues weekly upward correction – Likely to rise to resistance level 95.00 Baidu continues to rise strongly inside the upward correction which started earlier from the major multi-year support level 80.00 (which has been reversing the price from 2022). The.

January 29, 2025

– Alibaba broke resistance zone – Likely to rise to resistance level 100.00 Alibaba recently broke the resistance zone between the resistance level 93.50 (a former yearly high from December) and the 61.8% Fibonacci correction of the downward impulse from November..

January 28, 2025

– AUDUSD reversed from the resistance zone – Likely to fall to support level 0.6200 AUDUSD currency pair recently reversed down from the resistance zone between the pivotal resistance level 0.6300 (former powerful support from the end of 2023) and the.

January 28, 2025

– Nasdaq-100 reversed from support zone – Likely to rise to resistance level 22000.00 Nasdaq-100 index recently reversed up from the support zone set between the key support level 20820.00 (which has been reversing the index from December), lower daily Bollinger Band.

January 27, 2025

– NVIDIA broke support zone – Likely to fall to support level 115.00 NVIDIA opened today with the sharp downward gap breaking the support zone located between the support level 126.65 (former monthly low from December) and the 38.2% Fibonacci correction of.

January 27, 2025

– Apple reversed from support zone – Likely to rise to resistance level 237.00 Apple recently reversed up from the support zone located between the key support level 220.00 (which has been reversing the price from October), lower daily Bollinger.

January 27, 2025

Nikkei 225 index recently reversed down from the strong resistance level 40285.00 (upper border of the tight sideways price range inside which the pair has been moving since October) standing close to the upper daily Bollinger Band. The downward reversal.

January 27, 2025

Gold recently reversed down from the resistance zone between the key resistance level 2789.00 (former multi-month high from October), resistance trendline of the daily up channel from November and the upper daily Bollinger Band. The downward reversal from this resistance.

January 24, 2025

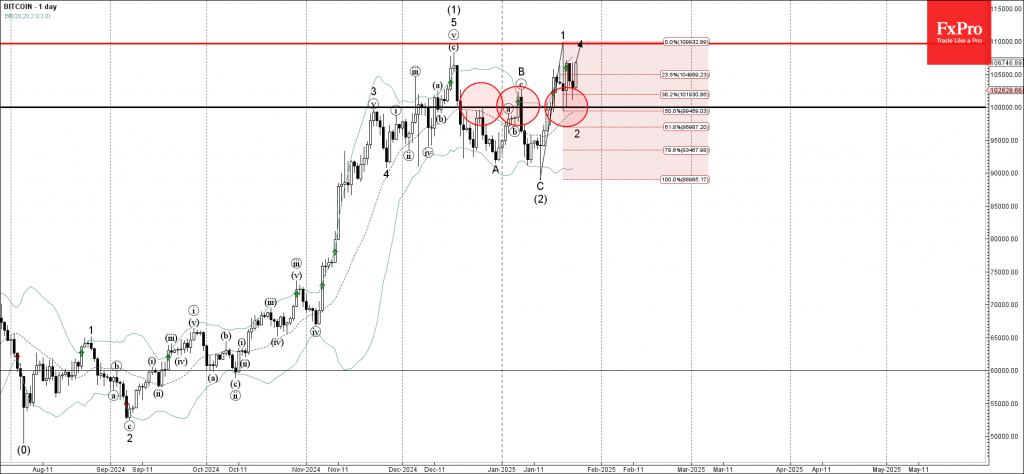

– Bitcoin reversed from support zone – Likely to rise to resistance level 109,675.00 Bitcoin cryptocurrency previously reversed up from the support zone between the round support level 100,000.00 and the 50% Fibonacci correction of the upward impulse from the.

January 24, 2025

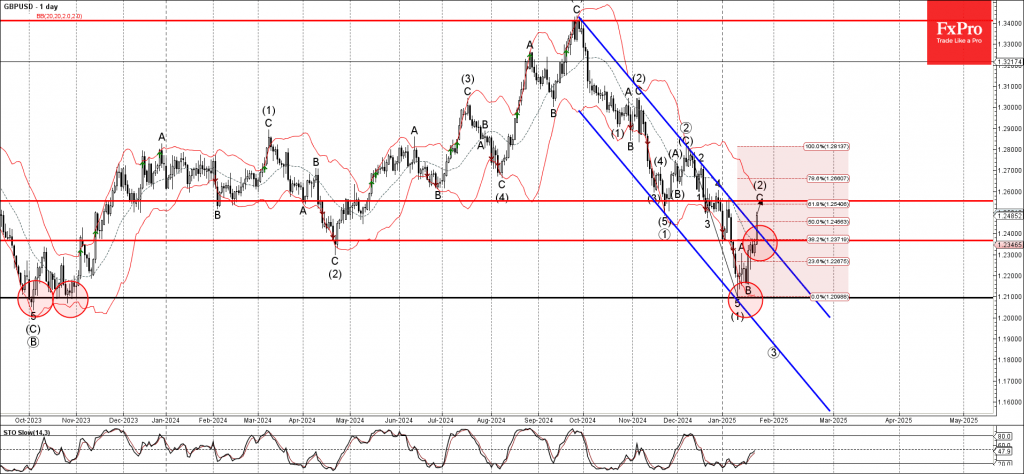

– GBPUSD broke resistance zone – Likely to rise to resistance level 1.2555 GBPUSD currency pair recently broke the resistance zone lying at the intersection of the resistance level 1.2365, resistance trendline of the daily down channel from October and.

January 24, 2025

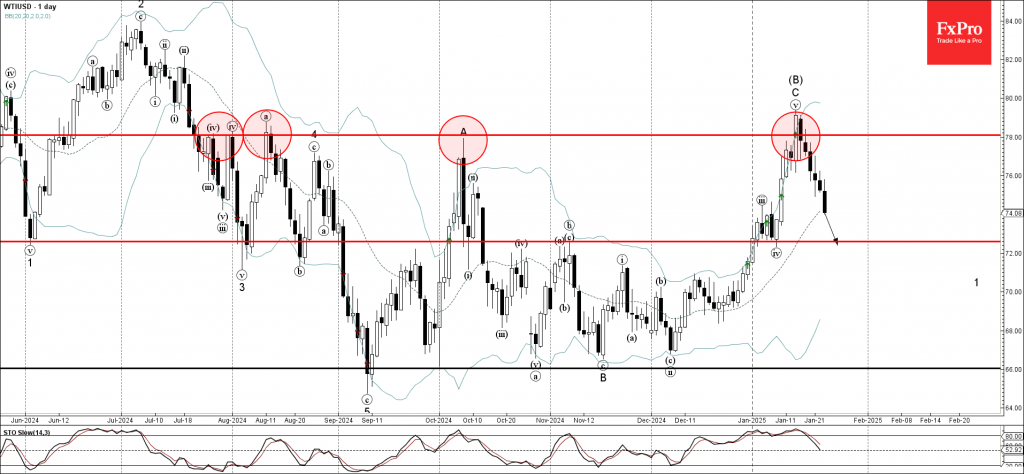

– WTI crude oil reversed from resistance level 78.00 – Likely to fall to support level 72.60 WTI crude oil recently reversed down from the major resistance level 78.00 (has been repeatedly reversing the price from July, as can be.