Technical analysis - Page 61

May 12, 2025

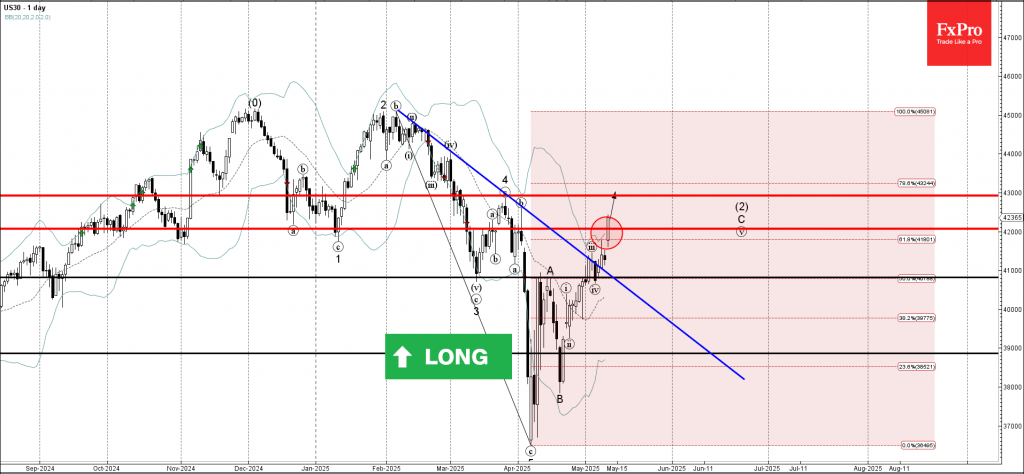

Dow Jones: ⬆️ Buy – Dow Jones broke the resistance area – Likely to rise to resistance level 43000.00 Dow Jones index recently broke the resistance area between the resistance level 42000.00, 61.8% Fibonacci correction of the downward impulse from.

May 12, 2025

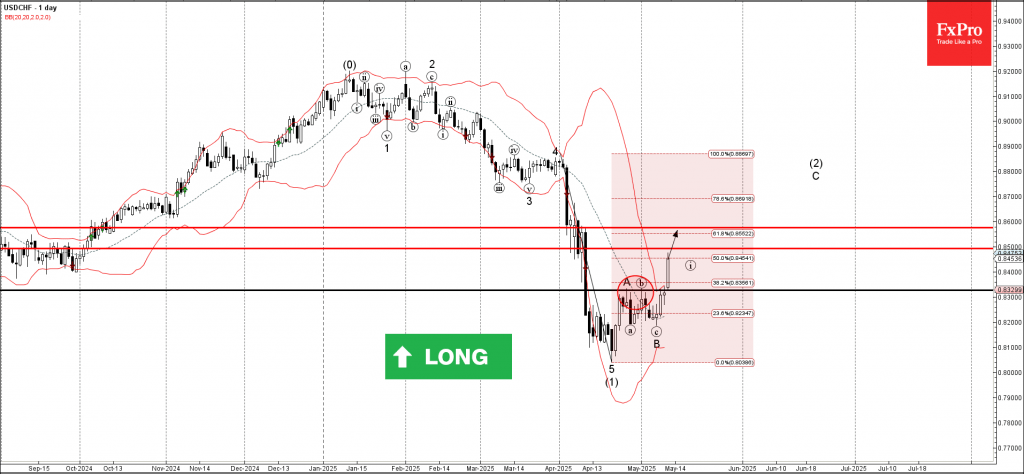

USDCHF: ⬆️ Buy – USDCHF broke resistance area – Likely to rise to resistance levels 0.8500 and 0.8600 USDCHF currency pair recently broke the resistance area between the resistance level 0.8325 (which stopped the previous waves A and (b)) and.

May 10, 2025

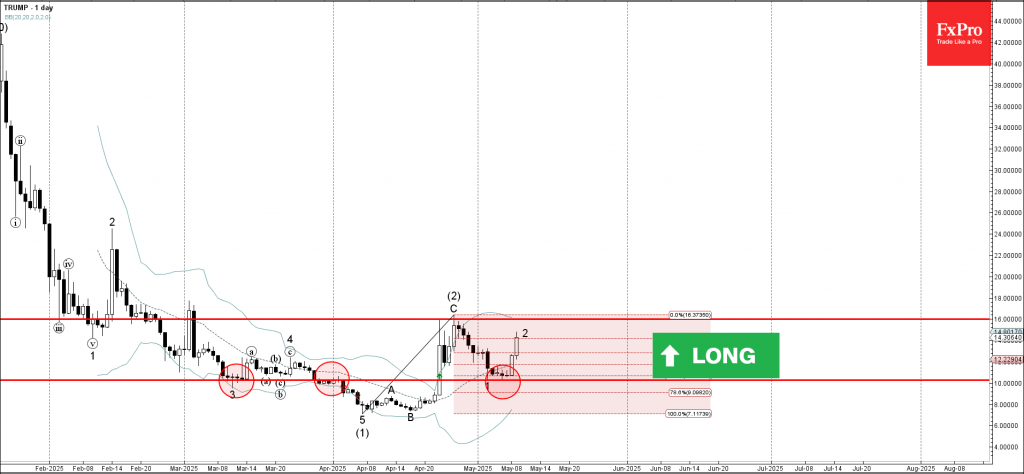

Trump Coin: ⬆️ Buy – Trump Coin reversed from support area – Likely to rise to resistance level 16.000 Trump Coin recently reversed up from the strong support area between the round support level 10.00 (which also reversed the price.

May 10, 2025

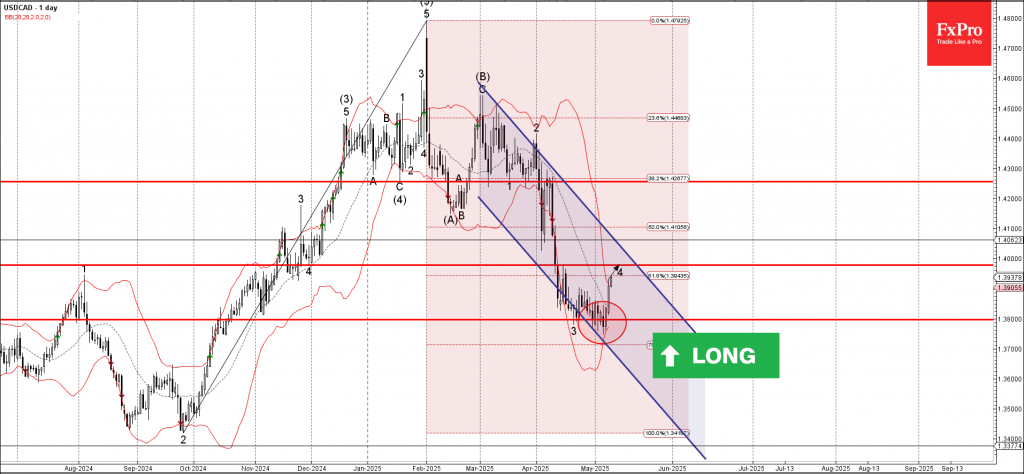

USDCAD: ⬆️ Buy – USDCAD reversed from support area – Likely to rise to resistance level 1.3980 USDCAD currency pair recently reversed up from the support area between the support level 1.3800 (which has been reversing the price from April),.

May 9, 2025

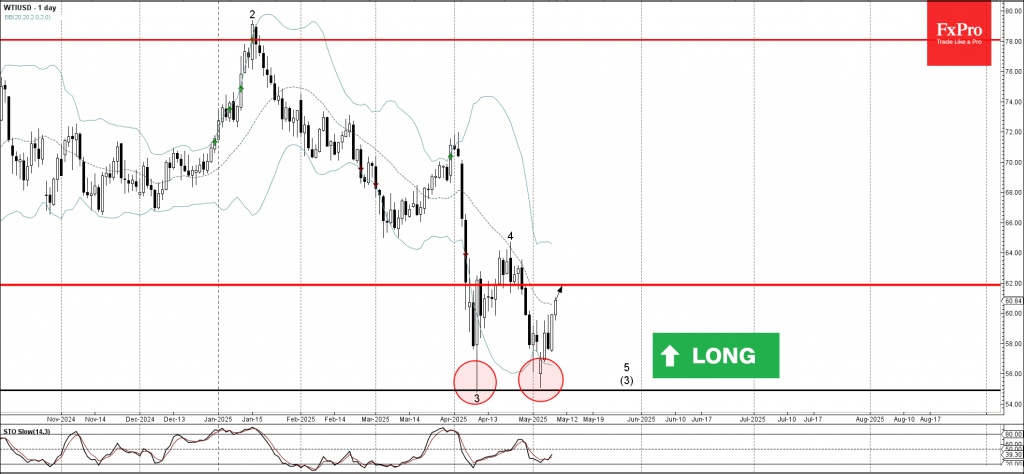

WTI: ⬆️ Buy – WTI reversed from support area – Likely to rise to resistance level 62.00 WTI crude oil recently reversed up from the strong support area between the support level 54.90 (which stopped wave 3 at the start.

May 9, 2025

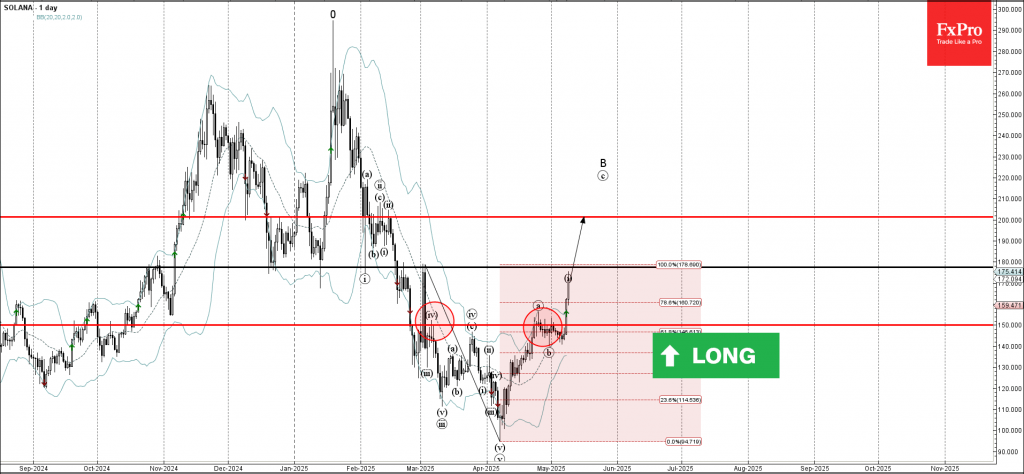

Solana: ⬆️ Buy – Solana is approaching the resistance level 177.50 – Likely to rise to resistance level 200.00 Solana cryptocurrency recently broke the resistance area between the resistance level 150.00 (which has been reversing the price from March) and.

May 9, 2025

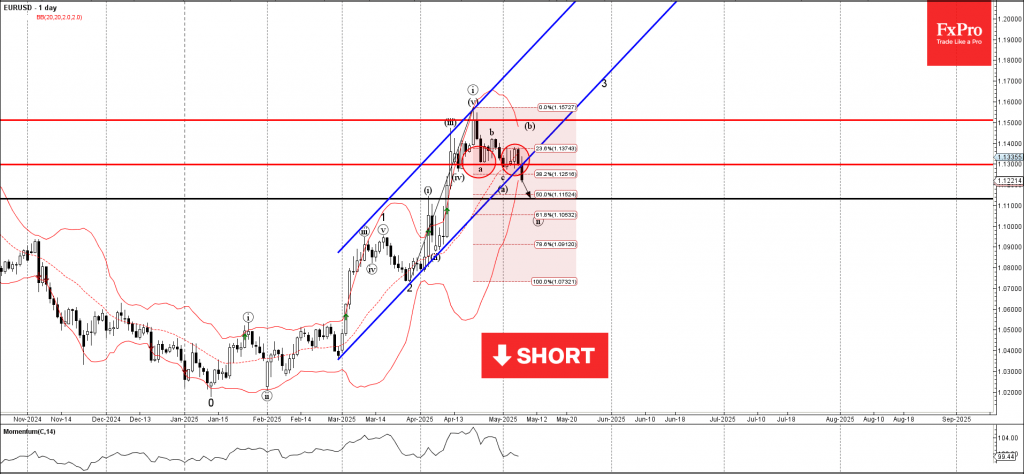

EURUSD: ⬇️ Sell – EURUSD broke support zone – Likely to fall to support level 1.1130 EURUSD currency pair recently broke the support area between the support level 1.1300 (which has been reversing the pair from the start of April),.

May 9, 2025

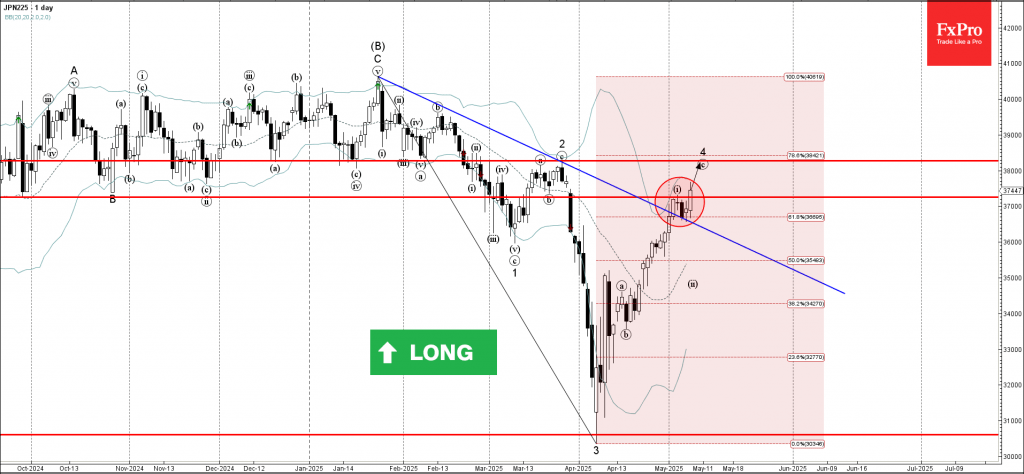

Nikkei 225 index: ⬆️ Buy – Nikkei 225 index broke the resistance zone – Likely to rise to resistance level 38275,00 Nikkei 225 index recently broke the resistance area between the resistance level 37255.00, resistance trendline from January and the.

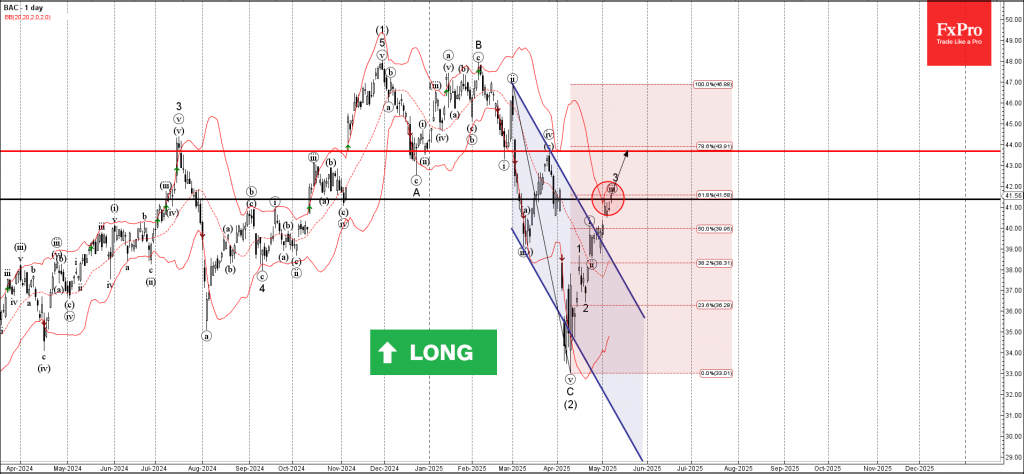

May 8, 2025

Bank of America: ⬆️ Buy – Bank of America broke the resistance zone – Likely to rise to resistance level 44,00 Bank of America recently broke the resistance area between the resistance level 41.35 and the 61,8% Fibonacci correction of.

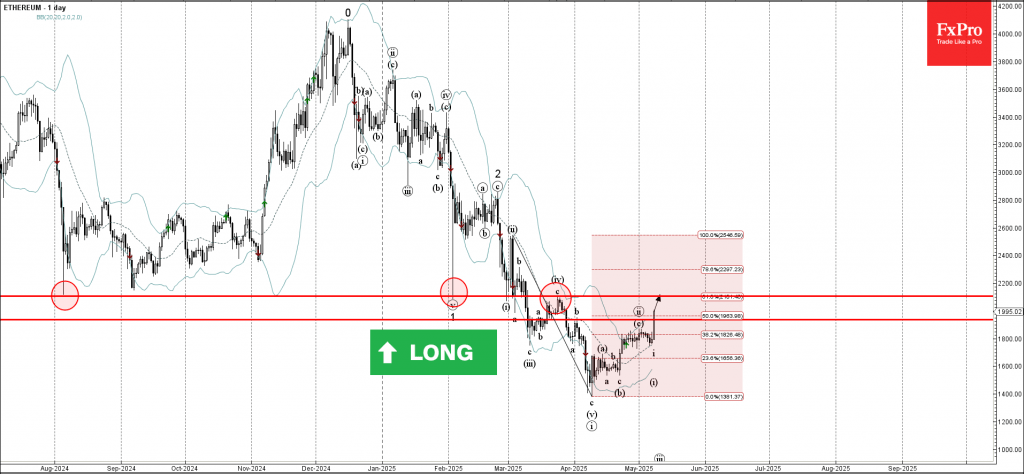

May 8, 2025

Ethereum: ⬆️ Buy – Ethereum broke the resistance zone – Likely to rise to resistance level 2100,00 Ethereum cryptocurrency recently broke the resistance area between the major resistance level 1935,00 (former monthly top from April) and the 50% Fibonacci correction.

May 8, 2025

EURNZD: ⬆️ Buy – EURNZD reversed from support level 1.8845 – Likely to rise to resistance level 1.9200 EURNZD currency pair recently reversed from the support level 1.8845 intersecting with the lower daily Bollinger Band and the 61.8% Fibonacci correction.