Will the U.S. employment report save the dollar?

August 07, 2020 @ 12:18 +03:00

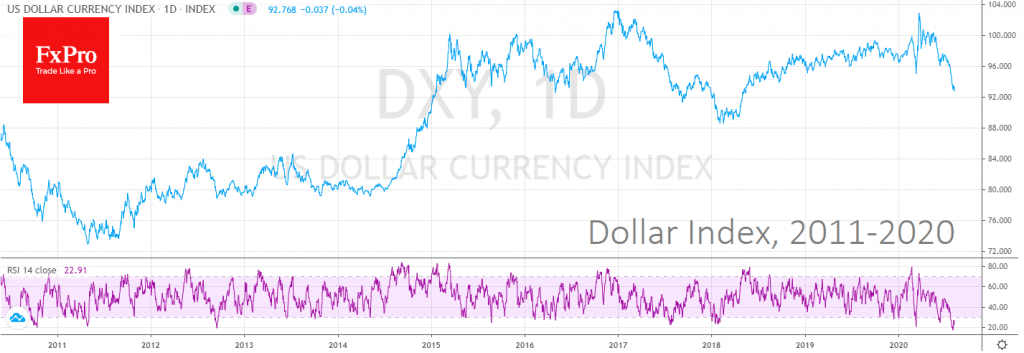

The American currency has been declining for the seventh consecutive week. The dollar index against the six most popular currencies recently fell to its lowest level since May 2018 and is losing more than 10% from its March peaks.

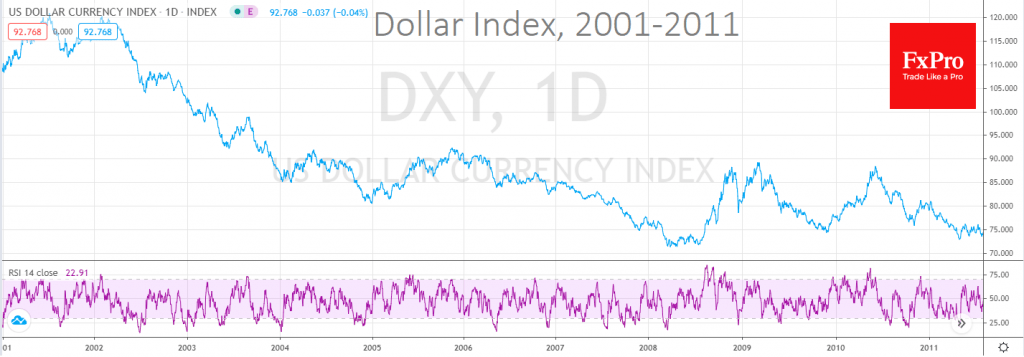

On the daily charts, traders can see that the RSI for dollar index has remained in the oversold zone for two and a half weeks. The last time we observed such a long period of stable pressure was in February-March 2008. After that, the dollar index consolidated for some time and later turned into a 12-year growth trend.

However, it would be too naive to expect the dollar to reverse solely based on this indicator. In the period from 2000 to 2008, we repeatedly faced periods of just as much or even more prolonged pressure on the U.S. currency, followed by a sideways range and new sell-offs.

Therefore, it can be perilous for medium-term traders to expect a rebound based on the oversold criteria.

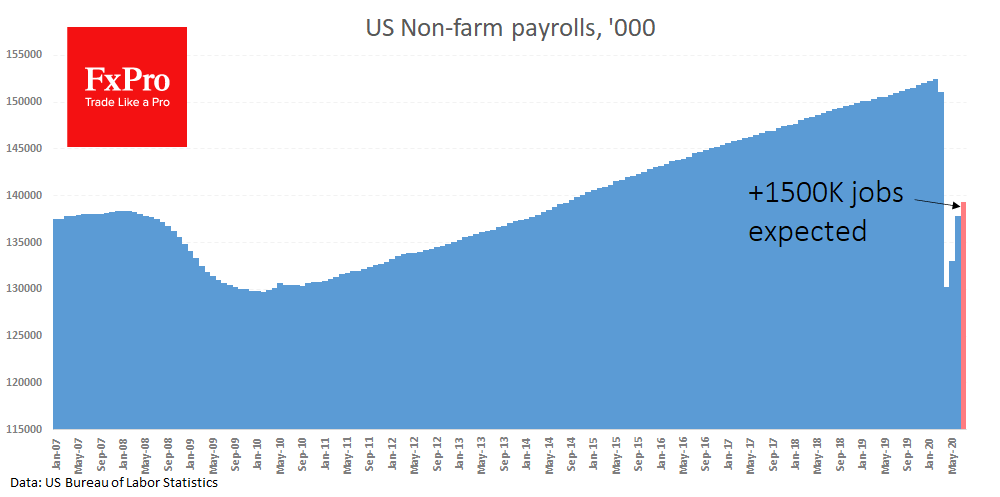

The technical picture is sometimes shadowed by essential fundamental news, and this is a potential case today. Before the start of trading in the U.S., data will be published on the labour market, Nonfarm Payrolls and the unemployment rate. On average, analysts predict the return of 1.5 million new jobs. However, weak private sector employment report from ADP (+167k) creates the possibility of a damper recovery.

In May and June, 2.7 mn and 4.8 mn people returned to work at their own expense after the forced leave. However, there are increasing reports of long-term staff reductions. Credit card activity and mobile traffic tracking indices show a recovery slippage of 10-30% below pre-lockdown levels. This means that we should not expect a cheerful recovery in employment. Many remain unemployed.

For the dollar, this suggests hard times ahead, as it will force the Fed and the government to consider new stimulus to save the economy from the W-shaped recession and support its V-shaped rebound. Without new programs and easing, along with a weak economy, the dollar may grow rapidly. Under these conditions, the rising prices of securities in the hands of Americans will be sold to pay for their daily expenses.

The FxPro Analyst Team