What the moves of Gold, Crude Oil and FX tell now

March 26, 2020 @ 18:04 +03:00

Global markets were very enthusiastic in their reaction to the approval of massive stimulus packages in the United States and Germany. The US indices climbed two consecutive days, which was the first time this month. German DAX, as well as Japanese Nikkei, recorded three days of growth, which was the first time in six weeks.

However, investors should carefully read the signs of this bounce.

Following the period when all assets declined against the dollar, a new stage is coming. The market beta (sensitivity to fluctuations in major indices) tends to change. Unfortunately, it is impossible to predict these changes in advance. One the reaction of different assets to the recent stock markets rebound can help investors to assess changes of the financial landscape.

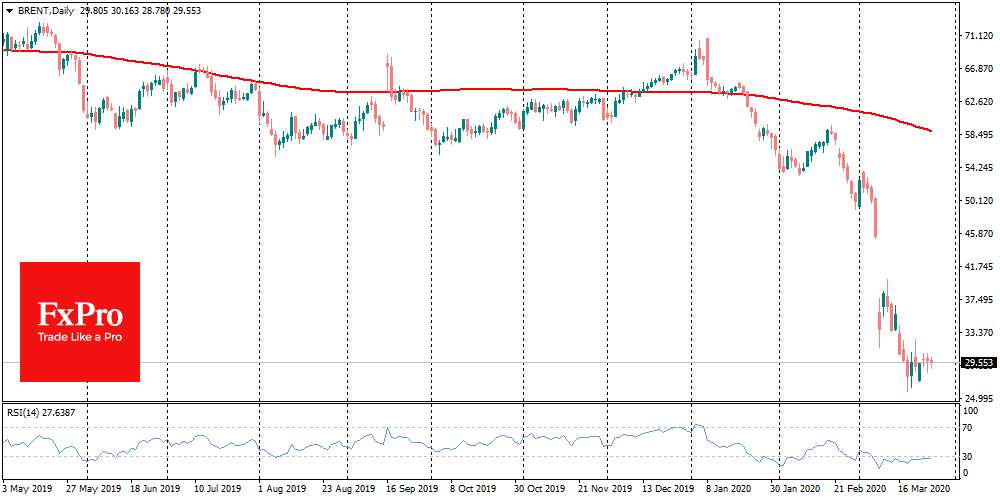

Crude Oil The problems of the oil market are still far from over. This asset, for the most part, ignored the rebound of stock indices. The logic of investors is quite clear: quarantine measures around the world have only intensified in the past days. The promised cash injections into the economy in the EU and the US are too far from the Crude Oil market. At the moment, we have not reached the turning point for demand. Only China demonstrate some positive shifts. But even there, because of the collapse of exports, one should not expect a full recovery soon. Besides, supply shocks have not gone anywhere: Saudi Arabia and some OPEC countries still promise to fill the world with oil above all needs. Russia’s Gazprom has a similar tactic for supplying Europe with natural gas. There is too much energy for the current state of the economy, causing a “price correction” to the current reality.

Gold Massive stimulus packages were pulling up the price of gold. And this dynamic may well turn into a long and steady trend, but later. The first 20 days of March showed that in a period of close to panic demand for the dollar, gold is vulnerable no less than stocks. But as the world central banks and governments did actively “fix this”, gold heads up. From the last Friday, it rose by 12% to $1,636 on Wednesday morning. Later, prices corrected by 2% to $1,600.

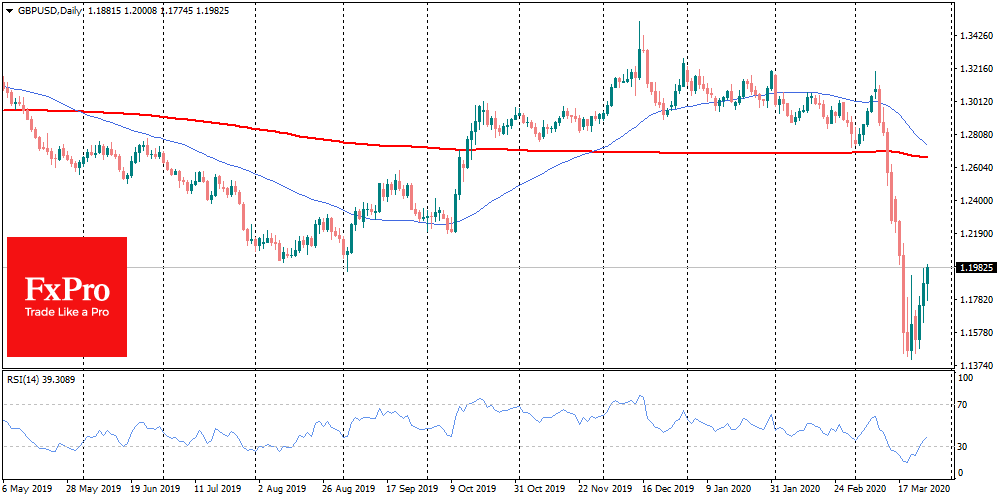

FX At the same time, the foreign exchange market has been behaving much more steadily during the last week. The dollar is retreating against its main competitors, losing for the fifth consecutive trading session on the dollar index. This is an important signal that the Fed has managed to fill the markets with dollar liquidity to a sufficient extent. In this light, the decline of USDJPY and USDCHF should be taken as a sign of dollar weakening, and not of the recovery of the markets’ demand for safe-heavens. The most liquid pairs – EURUSD and GBPUSD – is recovering at an accelerating pace, having pushed back from the bottom last Friday.

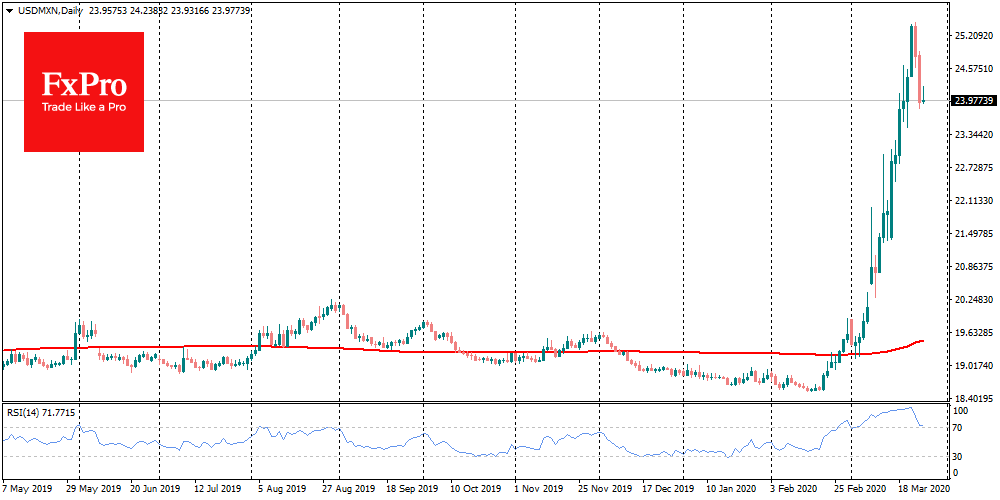

Despite the raw material price decline and QE measures launched in Australia and Canada, the currencies of these countries are also recovering, taking USDCAD, AUDUSD away from recent extremes. The same can be said about the dynamics of USDNOK, USDMXN, which are also retreating after a real takeoff earlier this month.

The FxPro Analyst Team