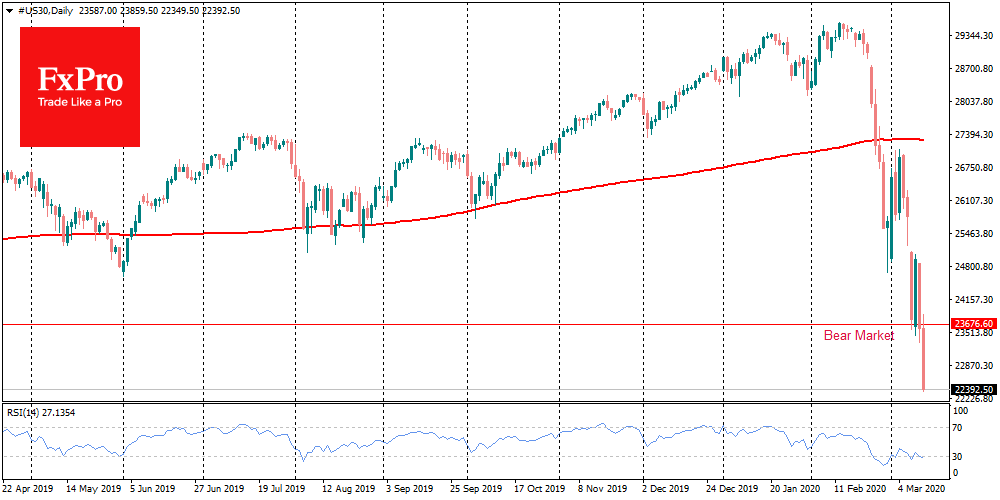

US bear market knocked down world stocks

March 12, 2020 @ 13:10 +03:00

Major indices have entered the bear market territory, breaking the 11-year bull-cycle. The Dow Jones index closed trading on Wednesday with a 20.2% loss from the peaks of a month ago, which triggered increased turbulence and pressure from sellers. As a result, futures on the Dow Jones lost another 4.3% in the morning, falling to the December 2018 low.

European markets are feeling even worse. EuroStoxx50 fell to the levels of 2013, getting some support from buyers by the beginning of trading in Europe. From the peak levels on February 20, the index has already fallen by 30%.

Trump’s announcement that European tourists, except the UK, are banned from entering the US, reinforces the negative for Europe. Even in these conditions, the closeness of the US and British politicians is evident. However, the rate of spread of disease in Italy remains frighteningly high, despite the quarantine.

The decline of markets demonstrates that investors consider the measures, announced by governments and central banks, to be insufficient. Almost daily, we hear about new liquidity support measures and monetary policy easing. However, the effect of these measures in the markets lasts for minutes.

The Fed’s emergency rates cut last Tuesday failed to inspire optimism in buyers. The emergency measures from the Bank of England yesterday also did not bring buyers back to the British markets.

It is possible that the speed, at which the markets are absorbing the stimulus, only increases the anxiety of investors in the following days.

Today it is the turn of the ECB to pull out its “monetary bazooka”. Now it seems that Lagarde doesn’t have time for delays with the massive support measures. Eurozone countries have the highest number of virus-affected after China. In Italy alone, the number of infected rose by 2,000 per day, despite the country-wide quarantine.

The FX market shows that it does not expect a sharp decline in rates from the ECB, which leads to the strengthening of the euro against its main competitors. Eventually, a strong euro rate would be a disservice for economic recovery.

Thus, very active steps are required from the ECB to support stock markets and contain the strengthening of the euro. If the European Central Bank can be bold enough in its support measures, it could put pressure on the single currency but also ease some sell-off in European markets.

The FxPro Analyst Team