The sale-off settled down but there are no buyers yet

May 30, 2019 @ 13:44 +03:00

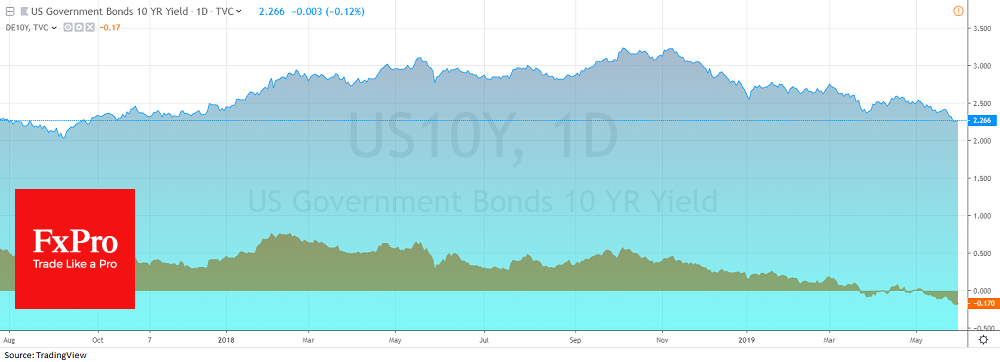

Market focus Demand for defensive bonds and currencies received its impulse on Wednesday amid a wave of fears of protracted trade wars. However, by the beginning of trading in Europe, there has been some recovery in key stock indexes, as well as a decline in demand for defensive debt securities. Bonds of Japan, the United States, and Germany moved away from the multi-month minimum yield rates achieved on the eve.

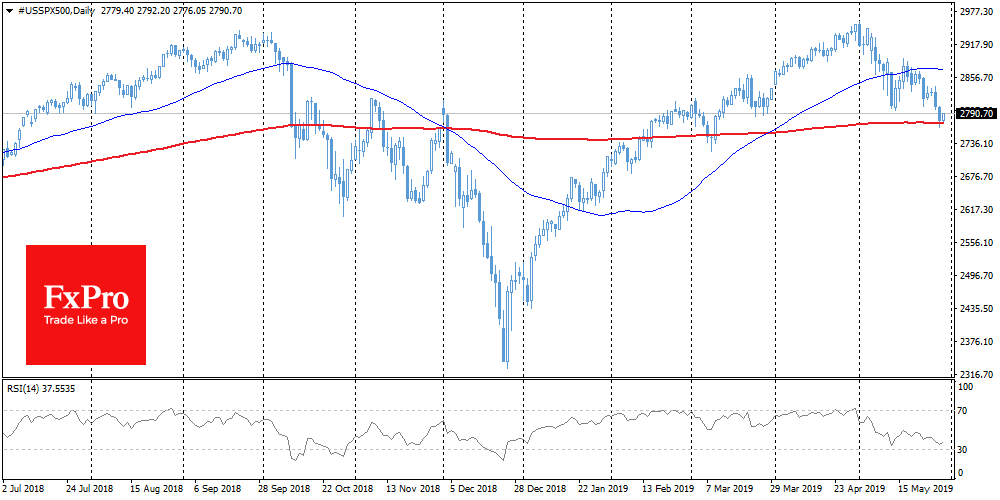

Stocks Futures on the S&P 500 declined on Wednesday intraday by 1.4%, however, they received support on a move to MA200. The relatively positive moment is the strengthening of purchases at the end of the American session. Very often, this is a good signal regarding the mood for the next day. On Thursday morning, SPX (futures on the S&P 500) add 0.4%. The touch of MA200 in March caused an influx of new buyers, becoming the basis for a nearly two-month rally. It is necessary to closely monitor the dynamics of the index near these levels. Over the past 5 years, the decline to the levels of MA200 has turned into an increase in purchases 16 times. But there were also 6 episodes when a decline under this line caused an increase in pressure with a dropped potential near 10%.

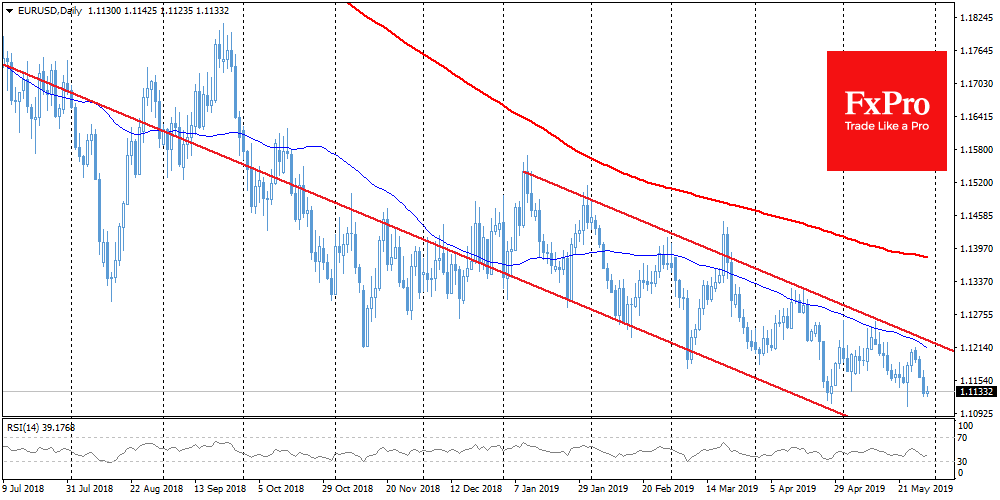

EURUSD The single currency remains close to local minimums, dropping to 1.1130. In April and earlier in May, near these levels, the EURUSD received support, rebounding from the 2-year lows. A similar trend with the approach to 2-year highs is marked on the dollar index. Strengthening the USD against most competitors is a warning sign for the markets, as it is often accompanied by increased demand for defensive assets.

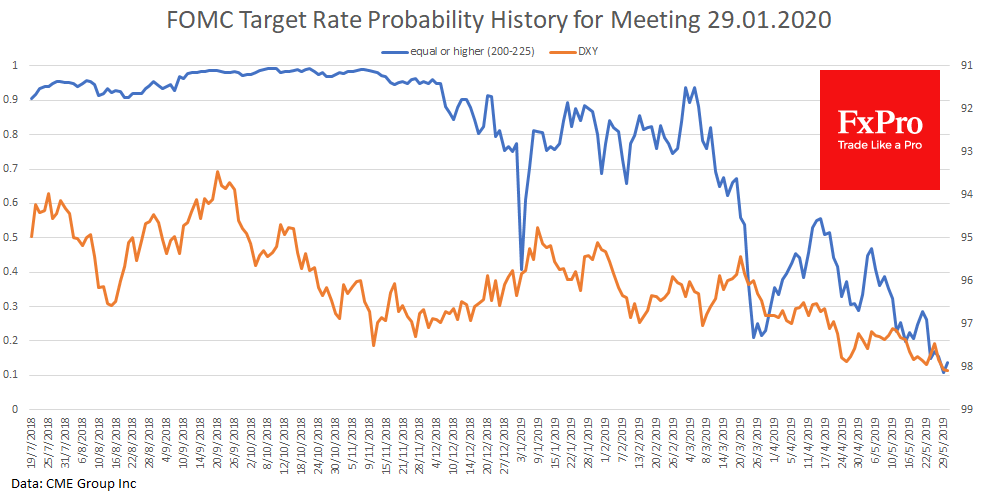

Chart of the day: CME FedWatch Tool On Thursday morning, there is an increase in the likelihood that the rate will be maintained at the current level by the beginning of next year. On the eve, the probability of lowering rates from current levels to the beginning of next year was estimated at 90% by the markets – these are the highs during the observation period. On Thursday morning, there is a slight decline to 86%, which also helps stock markets to form a rebound. In theory, higher yield rates on debt markets should help the US dollar. However, in practice, investors expect even more decisive actions from other central banks, which from March retained demand for the dollar, although from September to December last year, the dollar grew, on the contrary, due to expectations of the Fed’s tough policy.

The FxPro Analyst Team