The rise of Oil is due to fall

July 23, 2020 @ 11:36 +03:00

Crude oil is rising this week, but its strengthening is more related to the decline of the dollar, rather than to the growth of demand. It is worth watching this growth with increased caution, as fundamental factors continue to form obstacles for a further sustainable energy price strengthening.

The American currency lost 1.2% since the beginning of the week, accelerating its decline for the fifth consecutive week. Such a steady and growing decline of the world’s main reserve currency shifts investors’ interest towards assets that are not subject to inflation. Gold is the stand-out winner, followed by most commodities. Historically, oil has been strengthening several times stronger than the declining dollar but now the recovery of oil prices is limited by natural factors.

The Fed can quickly fill the markets with liquidity and make access to credit much easier. This allowed the commodity market to move away from stress levels, but even stock speculators are unlikely to push the oil price too high away from the fundamental indicators, which are still on the bear side.

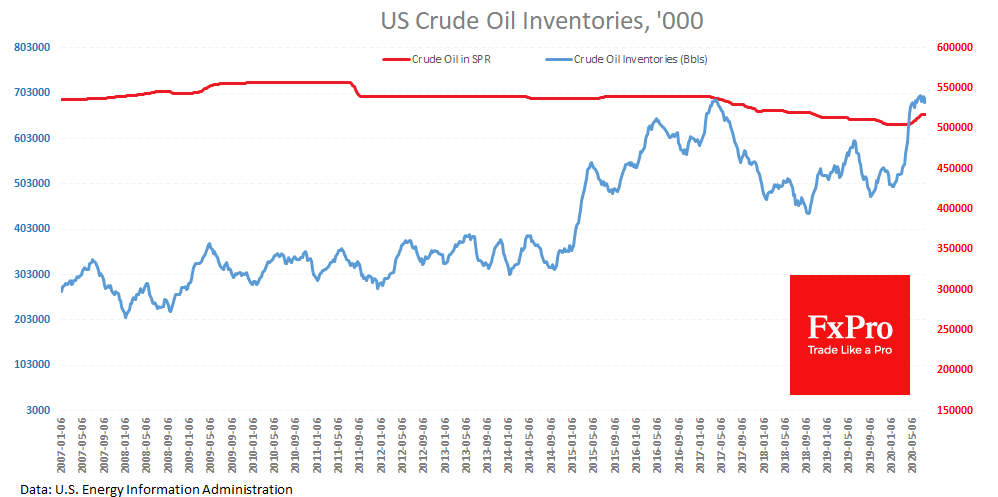

The U.S. oil reserves data showed that they remain close to record highs, 20.5% higher than last year. And at the same time, the producers are already gradually increasing their production. Thus, reserves remain high, although they usually decline at this time of year.

In addition, OPEC+ has agreed to increase quotas from August, which will increase oil supplies to the markets. Observations indicate that China has stopped buying oil for storage facilities and even reduced them slightly. All these are clear signals that both producers and consumers have found the current levels sufficient to increase sales.

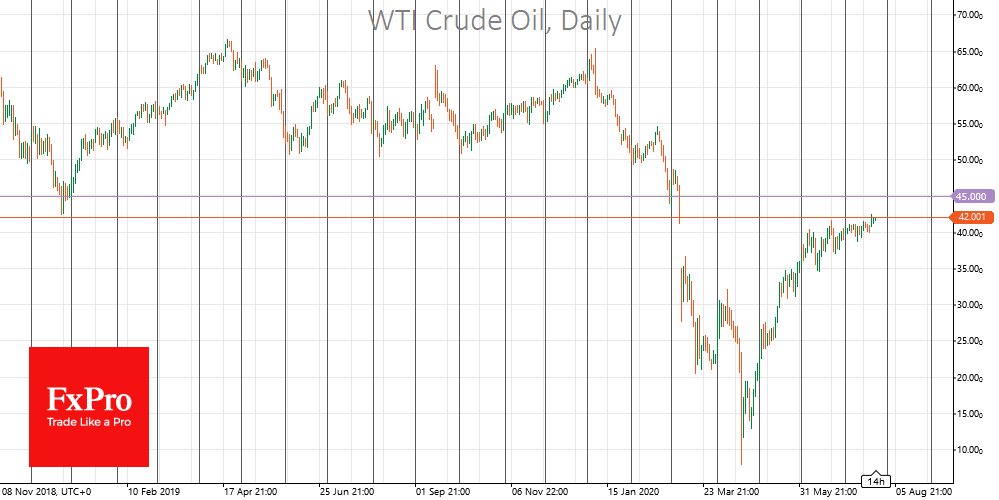

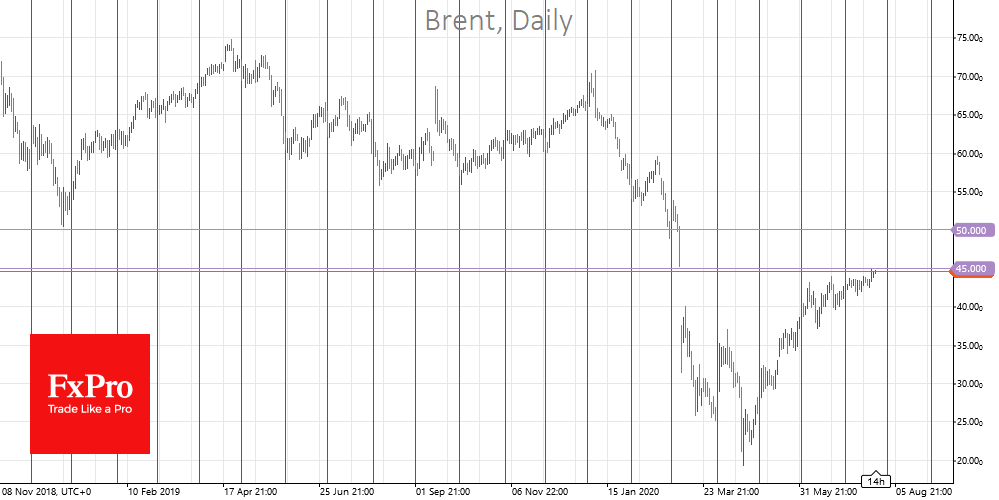

Technical analysis suggests that the oil growth impulse may be finally lost at $42-45 per barrel of American WTI. For Brent, the area of $45-50 promises to become a similar resistance zone. The lower boundary corresponds to the levels before OPEC+ broke the agreement in the spring, while the upper boundary represents an important round level and the December 2018 low area.

If the dollar weakening gathers momentum in the coming days, oil can achieve maximums quite quickly. However, it is important to understand that in case of a sudden reversal of the U.S. currency, the market sentiment may also switch sharply to the “black gold” sell-off. Against this background, oil doesn’t seem like the best defence asset against dollar decline and a bet on economic recovery.

The FxPro Analyst Team