Tech stocks and gold lead the rebound as dollar declines

August 18, 2020 @ 13:24 +03:00

It seems that after a short recharge, the markets have returned to the trends of recent months: outperforming growth in stocks of technology companies, strengthening gold and a declining dollar.

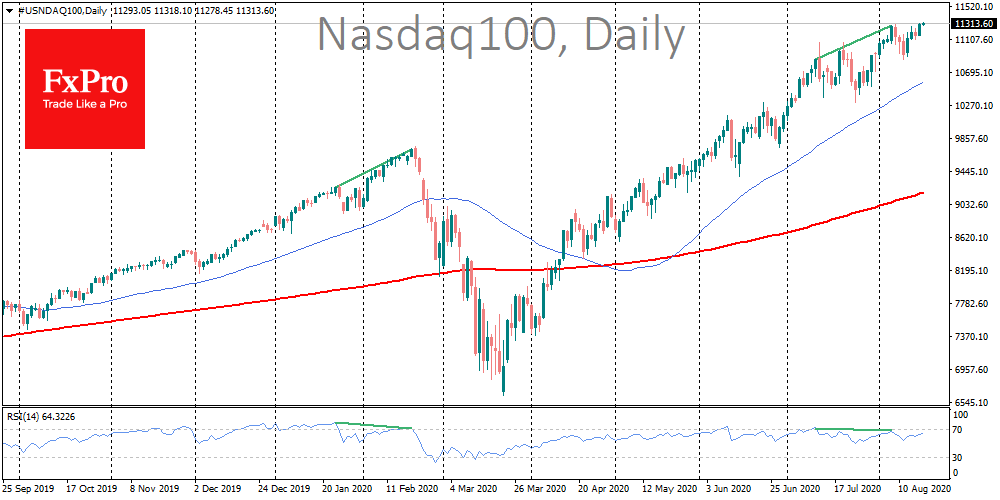

The Nasdaq100 index updated its historical highs to 11300, adding almost 30% YTD and 70% from the bottom in March. Together with it, the S&P500 continues cautiously approaching the historical highs. The correction, which outpaced the growth stocks, proved to be very short-lived. Dow lost 0.3% overnight and is once again lagging behind Nasdaq and S&P500, reversing last weeks trend.

This is a sign of the time, not only for the USA. China is experiencing a real IPO boom for IT. Liberalization of access to the domestic market, accompanied softer monetary policy and potential difficulties with IPOs in the US attract investors to the Chinese market.

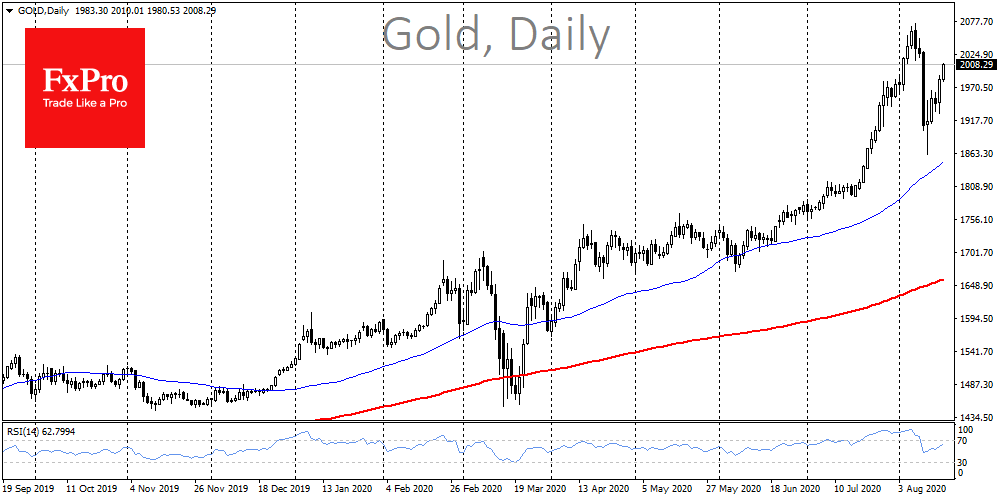

The sale of gold earlier this month attracted the interest of buyers who were waiting for a correction to enter the market. As a result, the price is again approaching $2000. Silver has recovered 70% of the correction at the beginning of the month.

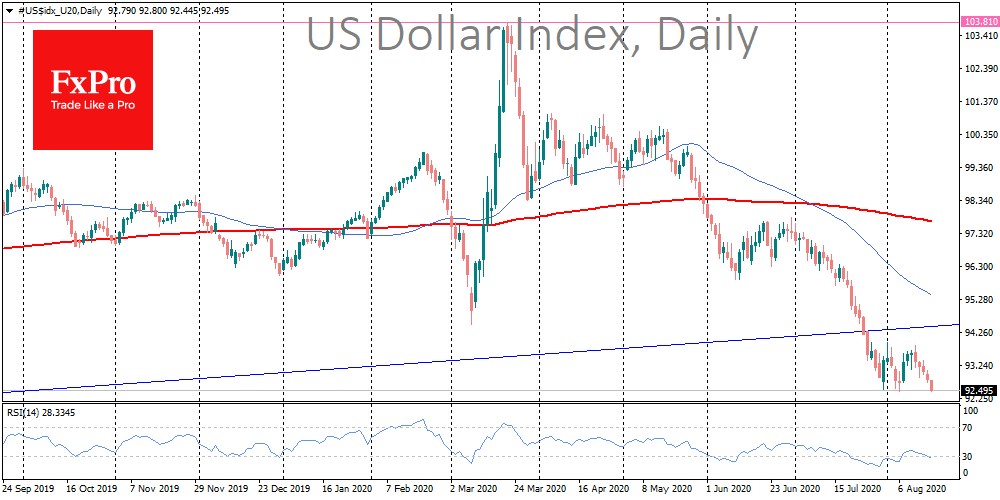

The common denominator of the growth of shares and metals is the weakening of the dollar. Its steady decline causes investors to seek refuge for their capital from depreciation in real terms.

The most significant growth impulses are seen in the least liquid markets with fewer sellers.

However, it is challenging to be on the bulls’ side, taking into account macroeconomic factors. Market growth due to cheapness of money, rather than strong domestic demand, sooner or later will choke.

Firstly, many investors have invested in the market in an attempt to ride the growth wave. Buying is now largely performed by the lowest link in the market hierarchy – novice retail investors. And the big question is, to whom will they sell?

Secondly, the lockdown has left many people out of work. This failure of income was smoothed or even exceeded by government checks, but this had a short-term effect. Growth shares often do not yield dividend income, so they will be sold to compensate for the drop in wages.

Tens of millions of people in the United States and hundreds of millions around the world remain unemployed, and we are hearing about new plans for long-term employee reductions. Markets may reboot quickly and return to growth. However, the economy is not doing so fast, and these macroeconomic factors promise to hurt markets in the coming months.

The FxPro Analyst Team