Rushing to shares is a mistake during financial repressions

August 31, 2020 @ 12:35 +03:00

Stock markets continue to move upwards, spurred by a combination of positive data and central banks actions.

Macroeconomic indicators include higher than expected US personal income and outlay growth, rapid GDP recovery in Canada and an increase in China Services PMI. All these statistics have eased fears of an uneven recovery in consumer activity.

Sceptics may note that the trend reversal was only achieved with unprecedented stimulus. However, it may take several quarters to overcome the economic consequences fully. However, this does not prevent markets from updating historical highs, which is mainly due to central banks and government policies.

Earlier last week, the Fed announced changes that assume that rates will remain low for longer. The ECB will also complete a review of its policy framework in the coming months and is expected to make the same move. The Bank of Canada is also in the process, due to announce changes in 2021. Banks in developing countries acted unconventionally soft earlier this year, cutting rates despite the collapse of national currencies. In contrast, in the past, they preferred to protect them.

Combined with received cheques and compensations from governments people and companies while being limited in their spending, an impressive amount of money was created and went to the financial markets.

However, there are no free lunches in the economy, so debts have fallen on governments’ shoulders. In many cases, these levels are approaching post-war records.

Looking at the volume of public debt, we believe that we should not wait for a return to normal policy in the foreseeable future.

Moreover, there are more and more statements from those who talk about some form of looming financial repression. This is a policy under which investors are forced to buy government debt securities while inflation and currency depreciation prevent investors from earning money in real terms.

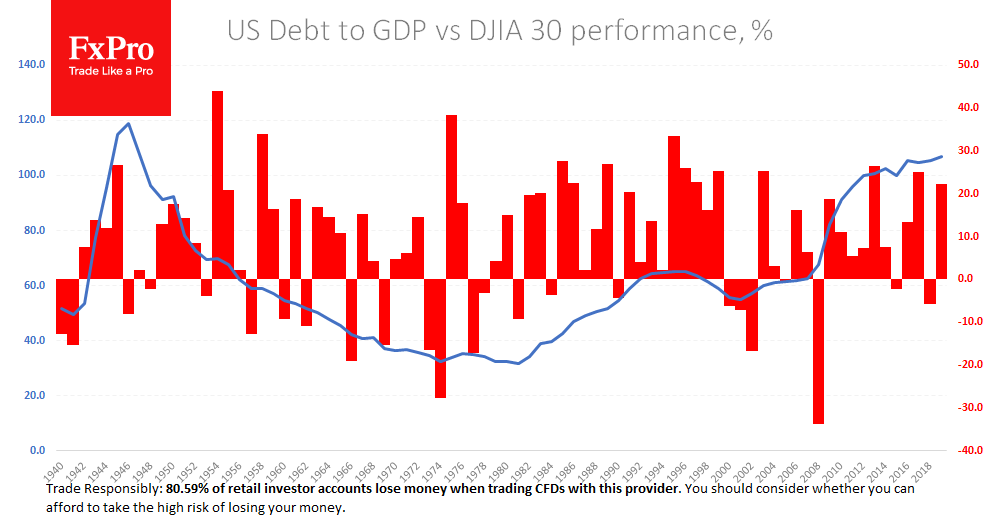

The Bank of Japan is now sticking to this policy in general, targeting the yield of 10-year bonds at 0% and seeking to drive inflation to 2%. After World War II, the US, with the help of the Fed, similarly ‘deflated’ more than half of government debt in 10 years, from 116% of GDP in 1946 to less than 60% in 1957. Throughout this time, the Federal Reserve controlled the yield on government bonds. The population was also encouraged to purchase national government bonds for patriotic purposes.

However, this policy is only very briefly positive for the stock market. In the long run, debt growth is favourable for the market, which is further confirmed by this year’s market dynamics. Deeper market failures often accompany periods of declining public debt to GDP in the long run.

Even worse, the Fed’s next actions made it attractive to invest in booming European and Japanese markets, ensuring an accelerated recovery that took place despite the strengthening of their national currencies. Later this policy leads to stagflation (stagnation and inflation) in the 1970s and a collapse of the dollar. The situation can now develop much faster, albeit on a less extreme scale. This means that the dollar may be under methodical pressure in the coming years as long as the US continues to deflate its debt.

The FxPro Analyst Team