Quadruple witching day may not so bad this time

June 19, 2020 @ 18:11 +03:00

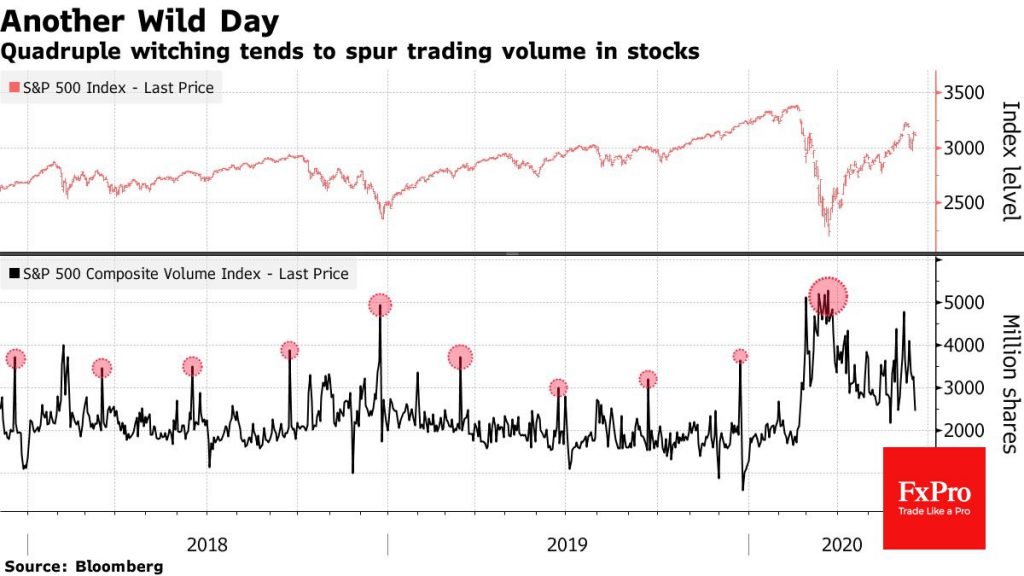

This Friday may be very turbulent for stock markets on the so-called Quadruple witching day. There are four such days a year when market participants switch from expiring futures and options to individual stocks contracts and futures and options on stock indices. Massive switching to contracts with later expirations leads to an increase in trading volumes on exchanges.

For example, trading volumes on the previous such day, March 20, were about twice as high as the average levels for the quarter. This day three months ago, the S&P500 index was near its minimum. It lost 3.7% on March 20, at the start of trading on Monday and futures on the S&P500 crashed another 4%, but soon returned to growth.

A similar Quadruple witching day occurred in December 2018, after which, the market groped for the bottom and went up.

No less memorable is the expiration of oil futures in late April. Then, the switch of investors to contracts with later dates of expiration caused oil to go into negative territory.

The examples above set up investors that on “such days” monumental movements and historical reversals of trends can occur in the markets.

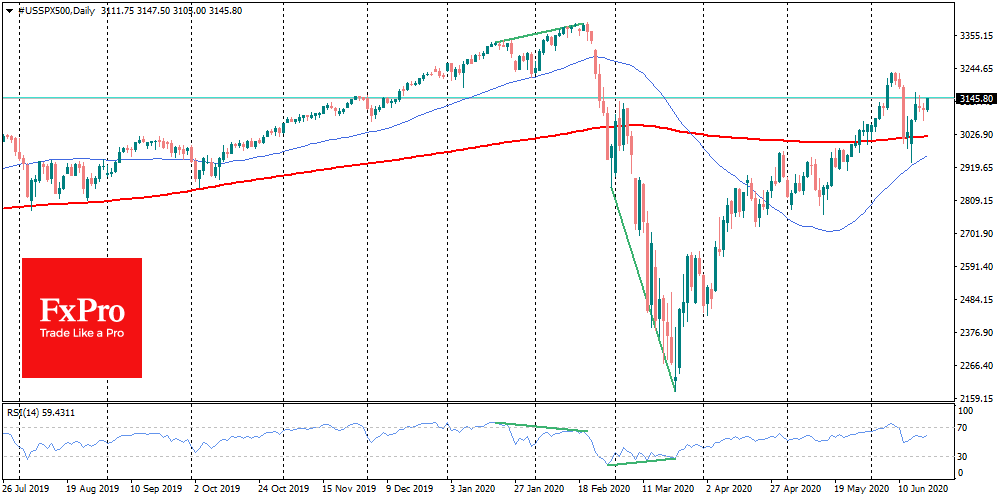

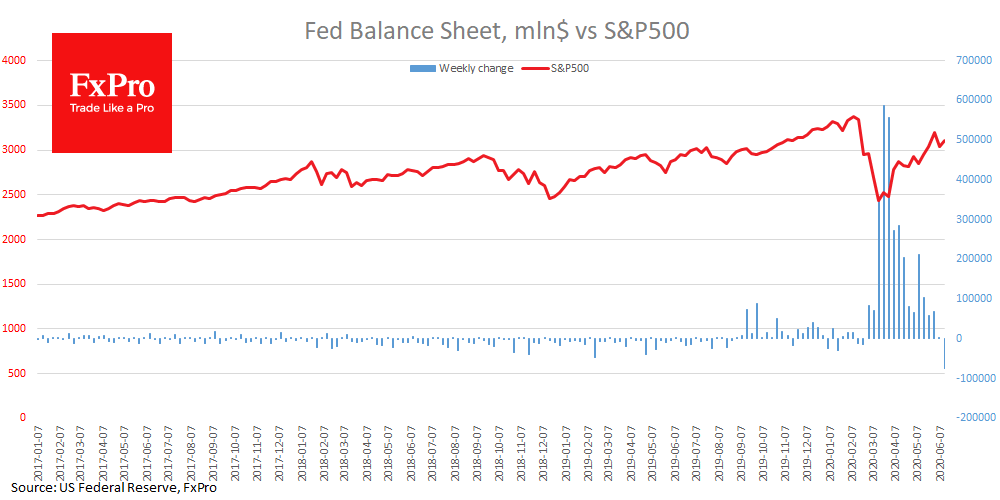

Things are much more complicated with the current situation as it now. The market is not at the bottom, but it does not storm in on historical highs (we are talking about the S&P500). Often in such cases, there was either a slight correction or indices and stocks continued their growth.

Thus, it is not too prudent to experience natural fear this Friday, as there is much more of a chance that despite a surge in volatility, key indices will be able to avoid monumental movements today.

However, there is no smoke without fire, so it’s best to keep your finger on the pulse. Moreover, in the foreign exchange markets, craving for the dollar and the Japanese yen is developing, which indicates investor alertness.

It is worth paying attention to how the S&P500 skids all week, turning down from 3150 – the March highs. This may indicate severe pressure from sellers, which can undermine investor confidence. There are reasonable doubts about how stocks can be so high in times of rising costs (due to enhanced security measures), falling company revenues and overall high unemployment on top of fears of a new wave of the virus spreading.

The FxPro Analyst Team