Lower USD lifts the markets, Euro and Pound continue their climb

April 04, 2019 @ 14:49 +03:00

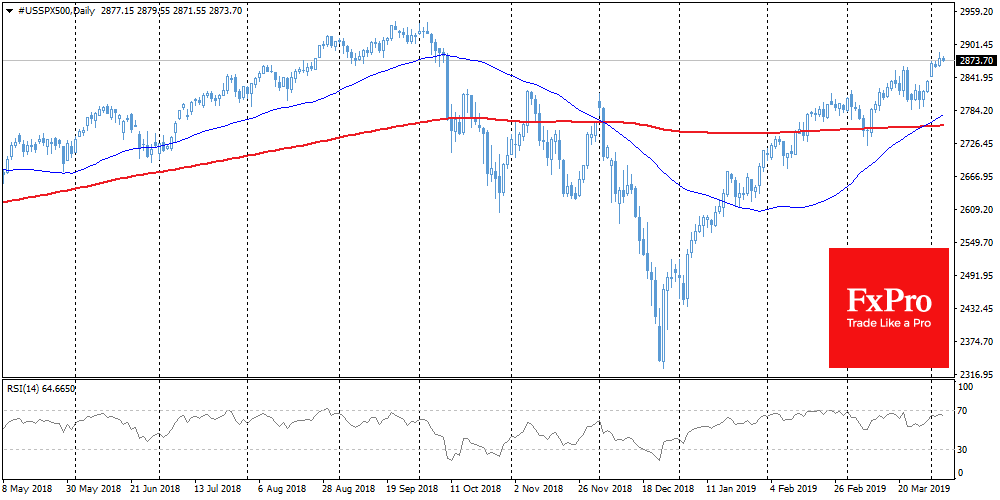

Stocks Chinese indices jumped to 13-month highs. The China A50 added almost 9% for the week as part of the last rally. The S&P 500 gained 0.2% at the close of trading session on Wednesday, but index futures are losing ground at the beginning of trading in Europe, reflecting the wary mood of market participants before important Friday data.

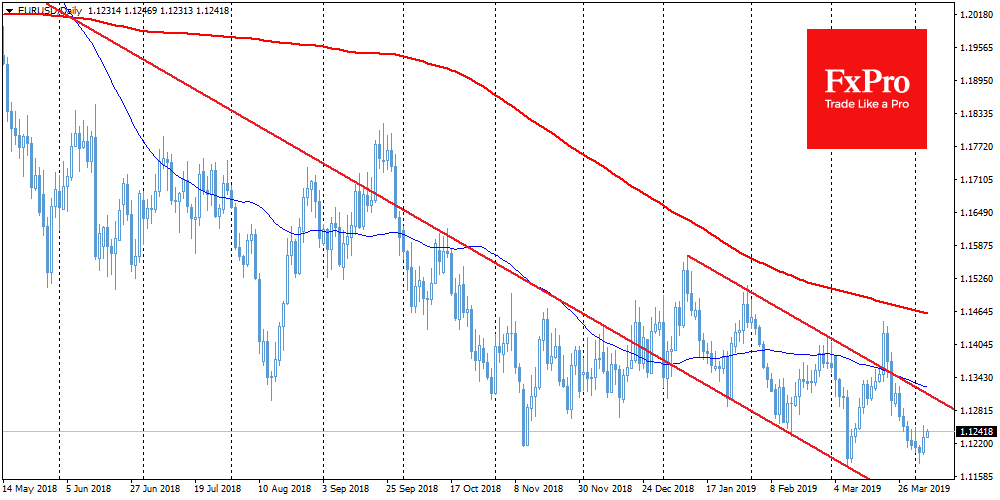

EURUSD EURUSD rebounds from levels near 1.1200. The EUR growth on Thursday supported by an unexpected improvement of PMI estimates in the services sector for the eurozone countries, although during the previous months these publications over and over again became an unpleasant surprise for the euro. In turn, data from the United States caused disappointment, showing a decline in the growth impulse of the largest global economy: ADP showed private sector growth by 129K, worse than expected 184K, and Non-Manufacturing ISM instead of growth from 59.7 to 58.1 declined to 8-month low at 56.1. At the moment, EURUSD trades at 1.1240 with the nearest important resistance level at 1.13, and local support levels are located far below, in the area of 1.07.

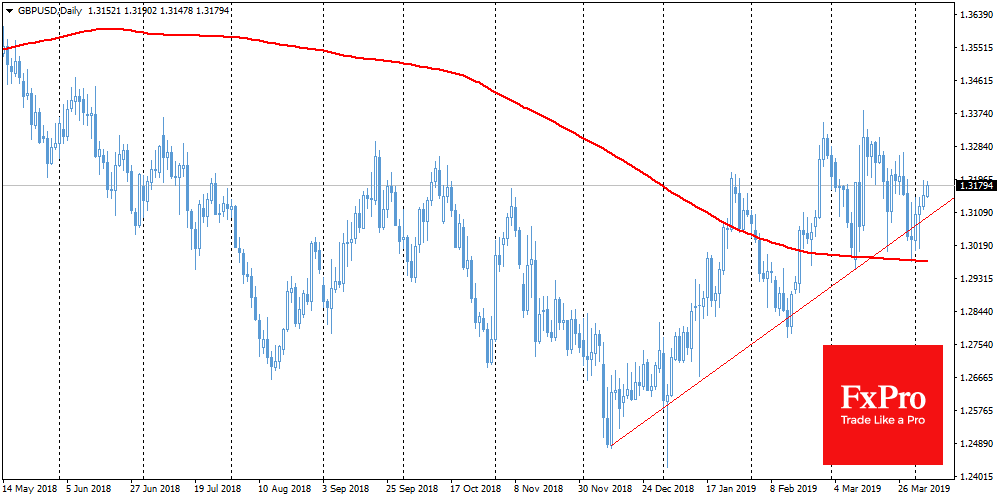

GBPUSD The British pound is growing thanks to Brexit news. GBPUSD is trading at 1.3170, offsetting the decline a week ago after the country’s legislators rejected the option to exit without a deal. May and the opposition leader Corbin are looking for ways to compromise and intend to ask the EU for a longer postponement. Nevertheless, representatives of the European Union are increasingly insistently urging not to give a further delay, since this does not lead to any progress in the negotiations.

Alexander Kuptsikevich, the FxPro analyst