Inflation threat vs Asian virus

February 13, 2020 @ 14:00 +03:00

The markets have returned to a cautious mood associated with a jump in the number of cases of coronavirus infection. New methods of disease assessment have led markets to doubt that the spread of the disease is restrained, triggering the launch of a correction in financial markets. Chinese bourses show the most significant intraday decline after the collapse on start trading in February. Futures for US indices are rolling back from their historic highs reached overnight. European markets are also starting the day with the decline from their highs on Wednesday.

Nowadays, however, not only summaries of the number of infected and affected people are in the investors’ focus but also macroeconomic data. The macro focus of the week is on the comparison of the industrial production and inflation in different regions. Earlier this week, China surprised with an unexpectedly sharp growth in consumer prices in January to 5.4% YoY, the highest rate since October 2011. This is surprising against the backdrop of virtually stagnant producer prices. China loses its status as a deflationary force. Also, due to the coronavirus and measures to restrict movement within the country, the republic may face an even higher price spike this month.

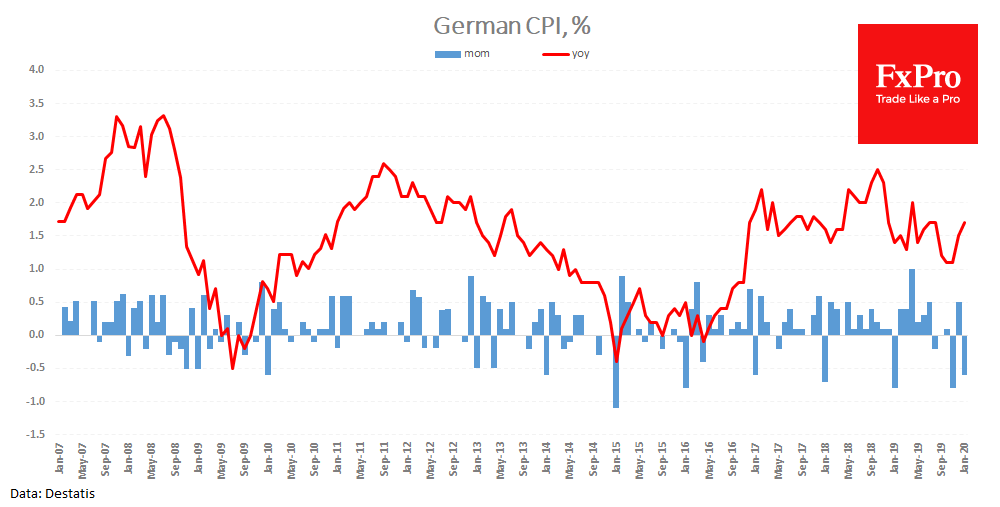

Consumer inflation in Germany is also systematically gaining momentum, reaching 1.7% YoY, according to official estimates released earlier today. This contrasts with 1.1%, which was observed in October-November when ECB launched the QE program.

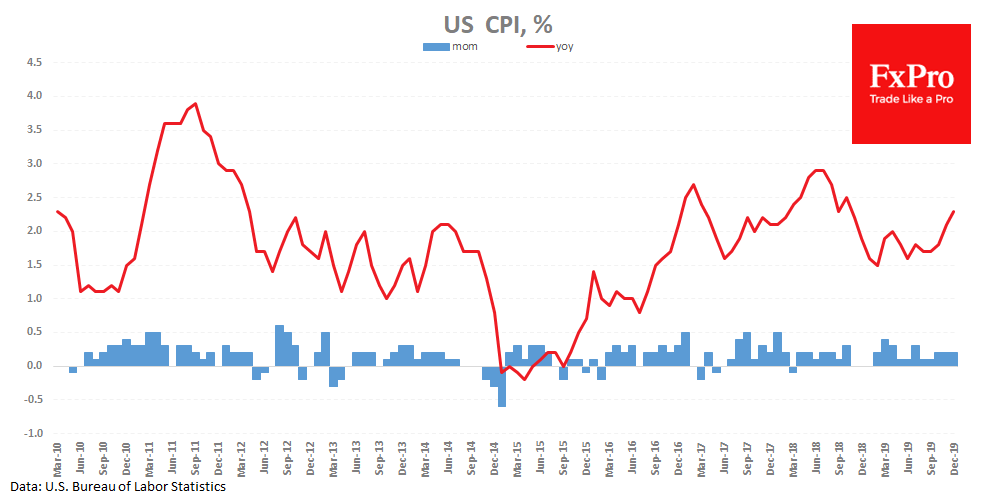

A similar trend observes in the US. Consumer inflation estimates are due to release today expected to accelerate to 2.5% y/y. US inflation lows were also witnessed just before the Fed policy easing – in the middle of last year.

Accelerated consumer price growth could be a restraining force for central banks in Europe, the United States, and China, as they consider the need for new stimulus. However, in each case, the central bank also looks at the dynamics of production and services.

In this context, the weak production performance of the eurozone and the likely decline in China in the coming months could overcome the fear of accelerating inflation after new stimulus.

In the United States, too, last months show a decline in industrial output against the previous year to -1.3% y/y in December. The latest January data will be released on Friday. The Fed monitors industrial production statistics independently so that these data may become a determining factor in the CB’s policy. If it turns out to be visibly stronger than in Europe, it could breathe new life into the dollar rally, which returned to the DXY highs of 2019 and reached highs against the euro since April 2017.

The FxPro Analyst Team