FxPro: Goldilocks start of the year for markets?

January 07, 2019 @ 13:09 +03:00

News from the US sharply increased market growth and put pressure on the dollar at the end of last week. If, as a result of today’s trade negotiations between the United States and China, significant progress can be achieved, it can be said that the markets are in a Goldilocks situation.

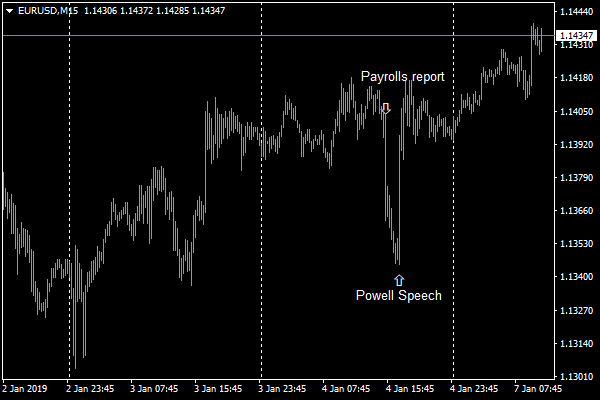

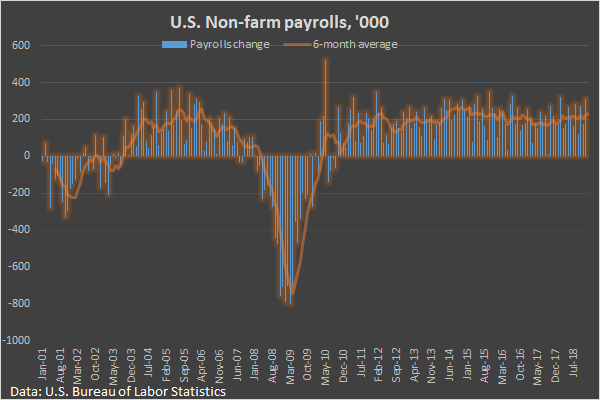

A very strong labor market report, published on Friday, says that the U.S. economy remains well-conditioned, showing no signs of slowing down, as markets had feared at the end of the year. The number of jobs in December increased by 312k, the growth of wages accelerated to a maximum in the last 9 years at 3.2% y/y. This is good news for stock markets and commodities, but they also caused an initial surge in demand for the dollar sending EURUSD from 1.14 to 1.1345.

The dollar failed to continue this dynamic, as Fed Chairman Powell said that is not on a preset path of interest rate hikes. Markets took this as a signal to pause for, at least, the coming months. This is also positive news for stock indices and commodities, but negative for the dollar, which rose last year amid the four Fed rate hikes.

If the Fed softens its rhetoric on fears of market turbulence, the situation that developed during the Greenspan period before the financial crisis might repeat: Fed raised rate too slowly, observing cooling in some sectors, while others (housing market in that case) were clearly overheated. Nevertheless, soft policy allowed the stock and commodity markets rally to be extended for a few more years before economy and financial sector collapsed.

In addition to the soft rhetoric of the US Fed, the Chinese central bank softened its policy last week, reducing the required reserve ratio, which is intended to spur lending and increase growth.

In addition to economic growth and monetary policy, the third important point for markets is the US-China trade negotiations. Today there will be first trade negotiations this year, and the American side seems to be determined to seek concessions from China against the backdrop of clear signs of a slowdown in the second world economy.

This sentiment looks too optimistic, and the Chinese are unlikely to retreat in the negotiations, preferring stimulus for their own economy. Potentially, it is impossible to exclude a breakthrough in negotiations, then the markets can turn into growth with the new force, reckoning both on favorable macroeconomic conditions and softness of the key central banks.

Alexander Kuptsikevich, the FxPro analyst