FxPro: Euro and pound are ready for growth

November 23, 2018 @ 12:07 +03:00

Euro and Pound had risen after the draft declaration between the UK and the European Commission. Market reaction seems very moderate, as it is not the end of the negotiations on Brexit. However, there is a good chance for the currencies to turn towards growth in the long run.

The outgoing year can be called “a year of trade conflicts” that have eroded the demand for risky assets and, what is more important, noticeably cooled down the global growth rate. Europe is affected by too many of them: trade disputes with Britain, the decline in demand from China due to trade wars with the United State and direct US tariffs on European products. All these factors are hindering the economic growth and make pressure on the common currency and the British pound.

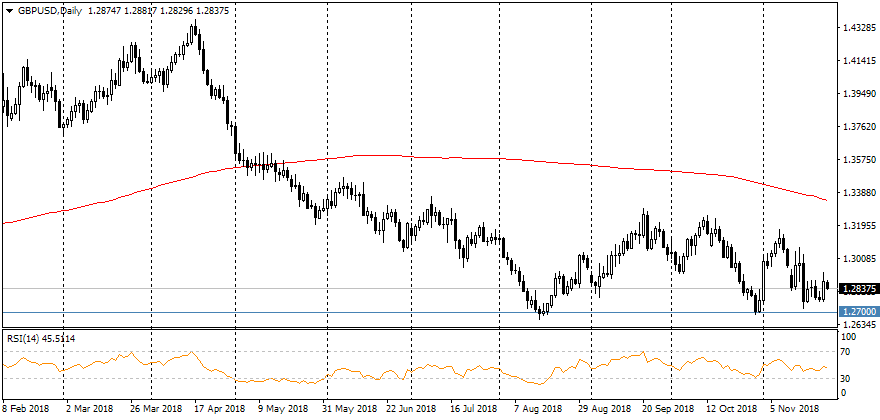

Market participants are mostly skeptical about further negotiations. Change of the investors’ attitude would become a driver for Sterling. British currency had received such support several times on dips to the 1.2700 region since August – and now there is a similar case. Previously GBPUSD had been managed to grow into the 1.31-1.32 area. Now investors are waiting the voting in British Parliament, which will take place the second week of December.

The single currency has bounced from the 17-month lows in recent weeks but now is developing the downward trend by the EURUSD. Sustainable breaking above 1.14 can be a signal of players’ confidence in future prospects. In addition, there are several fundamental factors on the euro side: winding down ECB’s QE by the end of the year and move to the next stage in the form of rate hikes. The Fed takes a more cautious stance, which undermines the dollar’s position.

Technical picture attracts attention too. The impulses of the euro weakening since May had sent quotes to the new local lows. However, the RSI is displaying powerful impulse to decrease. Such divergence may be the pivot point for rolling back into 1.17 area and may lay ground for a more substantial rally in the 1.23 area next year.