Fears of trade wars pushed markets to important levels

May 23, 2019 @ 11:42 +03:00

Market focus On Wednesday, the United States announced that they were considering sanctions ‘like Huawei’ for other Chinese companies, the US military sent two ships to the shores of Taiwan. Markets are losing faith in the early conclusion of a trade deal, which provokes a decline in stock markets in Asia and in Europe, and also supports the demand for the dollar.

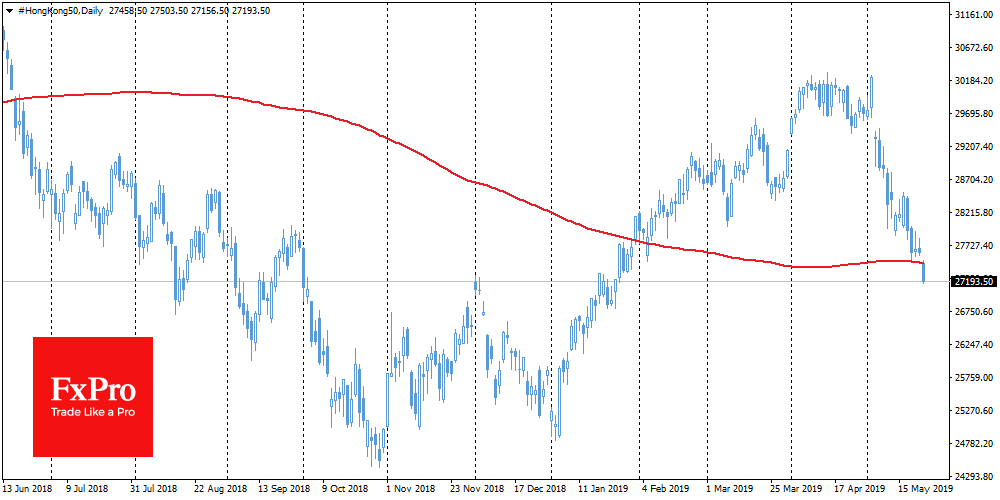

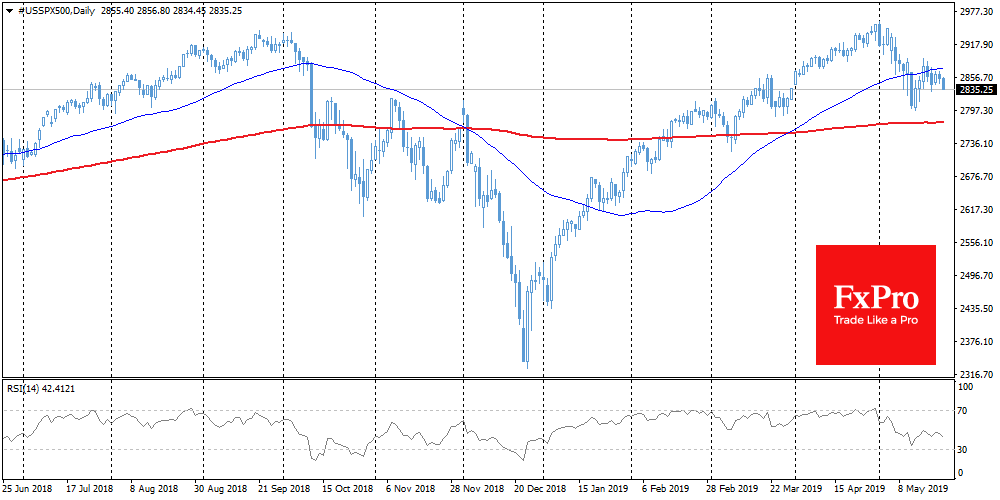

Stocks Chinese Heng Seng fell on Thursday morning to 4-month lows, dropping in the morning below the 200-day moving average. The impressive start of stock markets at the beginning of the year turned into an even sharper sale. American indices, in particular, SPX have retained a significant part of their growth since the beginning of the year, decreased by 4.1% since the beginning of the month against 10% of Heng Seng.

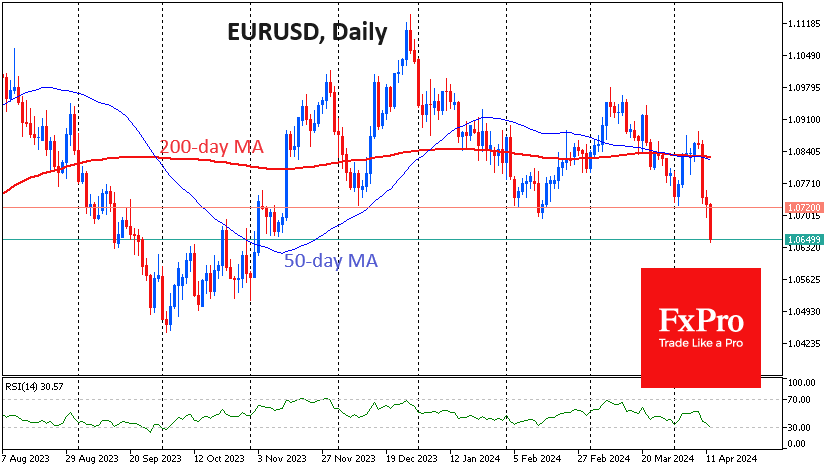

EURUSD The single currency is melting under the pressure of anxiety around trade wars and generally high demand for defensive assets such as the dollar and the Japanese yen. EURUSD pair dropped to 1.1130 in the morning, which is one step away from two-year lows reached in late April. Decline under 1.1100 is able to increase the pressure of sellers due to the triggering of stop orders after taking an important round level.

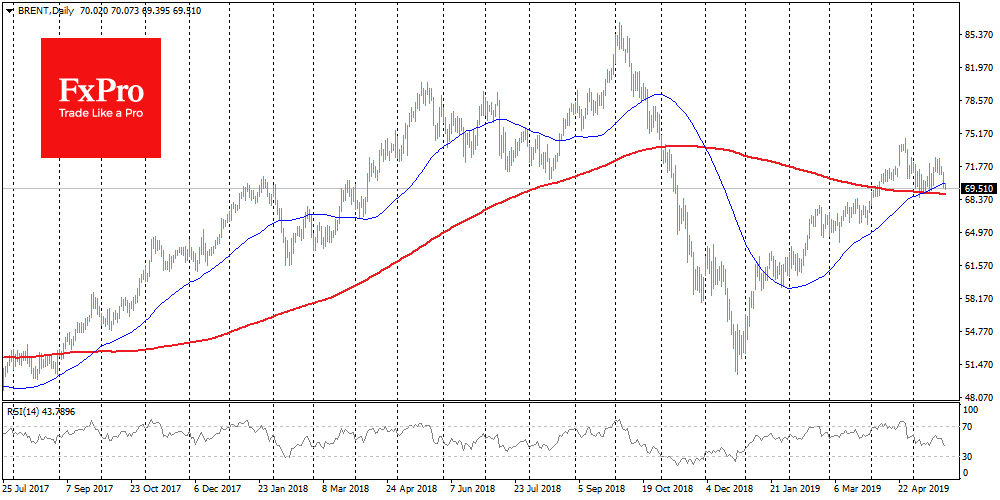

Chart of the day: Brent Oil remains under pressure this week. On Wednesday evening, Brent fell below the round level of $70 and the 50-day MA and is trading near $69.50. Among the important next levels, it is worth noting $69 – the 200-day average. The decline below this level in November last year reinforced the sale of oil, which lasted almost two months. In April and June 2017, the intensified decline continued for 1 and 3 weeks, respectively, “washing out” of 10% and 15%, respectively.

The FxPro Analyst Team