Does the dollar face global selling-off?

June 10, 2020 @ 12:10 +03:00

In the run-up to the Fed meeting, markets are keeping pressure on the dollar. The dollar index has fallen to its lowest levels since March 11. It was steadily under these levels in July of last year. The weakening of the USD often associated with markets optimism. Except for a few worrying points, the situation is more like an escape from dollar assets, rather than general optimism of market participants.

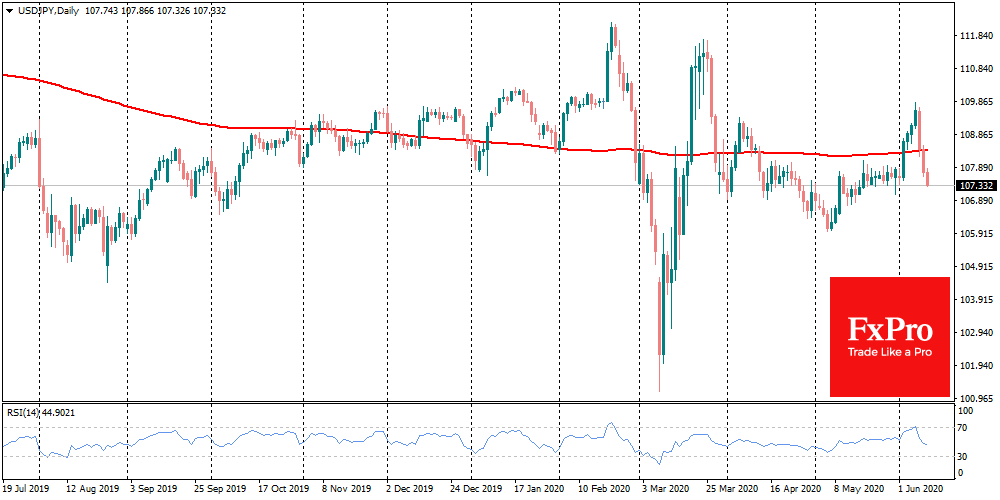

So far this week, the Japanese yen has enjoyed an impressive demand. The dollar fell 2.1% against it after a failed attempt to rush 110 last Friday. The steady decline of USDJPY is a clear sign of increased demand for protective assets from Asian investors. It’s still too early to sound the alarm, as Japanese Nikkei225 continues to grow. However, one should be careful to watch its growth, especially as the yen is also rising against the euro and other major currencies.

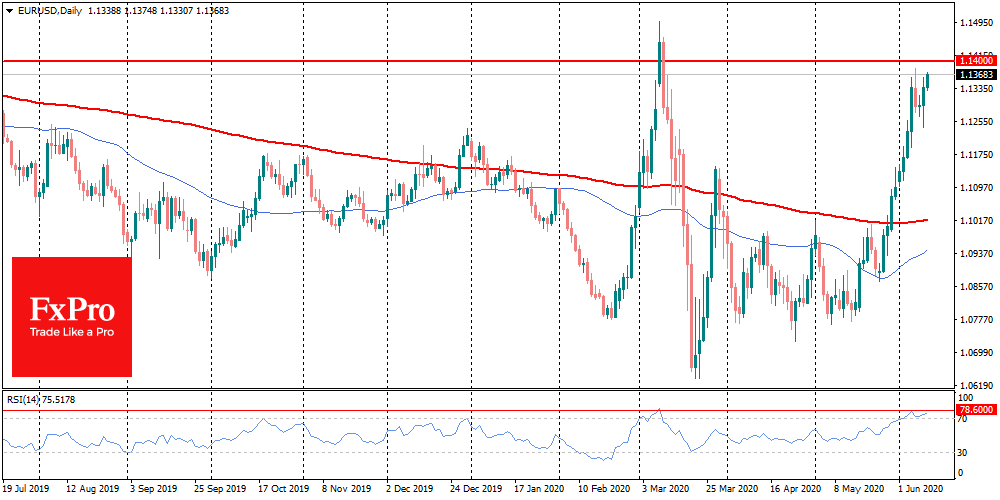

The single currency after a short recharge is again finding the strength to grow against the dollar, showing growth in the 12th session of the last thirteen. EURUSD is one step from Friday’s highs and only 50 points from 1.1400 – a critical resistance level.

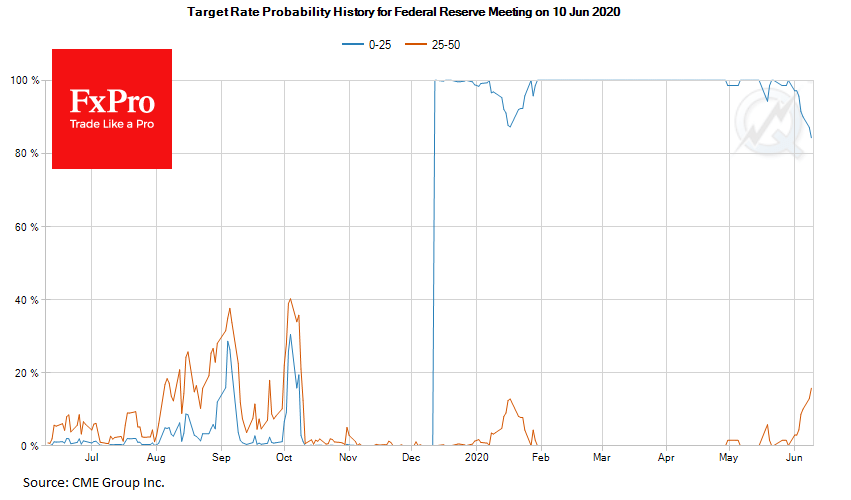

The sale of dollar assets is also noticeable in the US debt markets. The yields on government bonds have increased along the whole yield curve, especially noticeably rising at the longer end of the curve. Short-term bonds show an exciting distortion. The current yield levels correspond to the 15% probability of the Fed’s rate increase later this afternoon. However, this is purely a technical distortion, because the chances of raising rates decline from meeting to a meeting until March 2021.

On the surface, global investors have worried about the ability of the US to pay its debts, especially in light of growing tension with China, that holds more than a trillion dollars of US government bonds.

But this hypothesis does not stand up to criticism. After all, in this case, European assets would be under even higher pressure, as countries are even more buried under the weight of debt. It would also be logical to expect an outflow of investors from emerging markets, which will suffer at the background of the shaken financial system.

In our view, the possible bet of investors in the US is the fear of rising inflation in the coming months due to the realization of deferred demand and increasing income levels amid the support packages from the government.

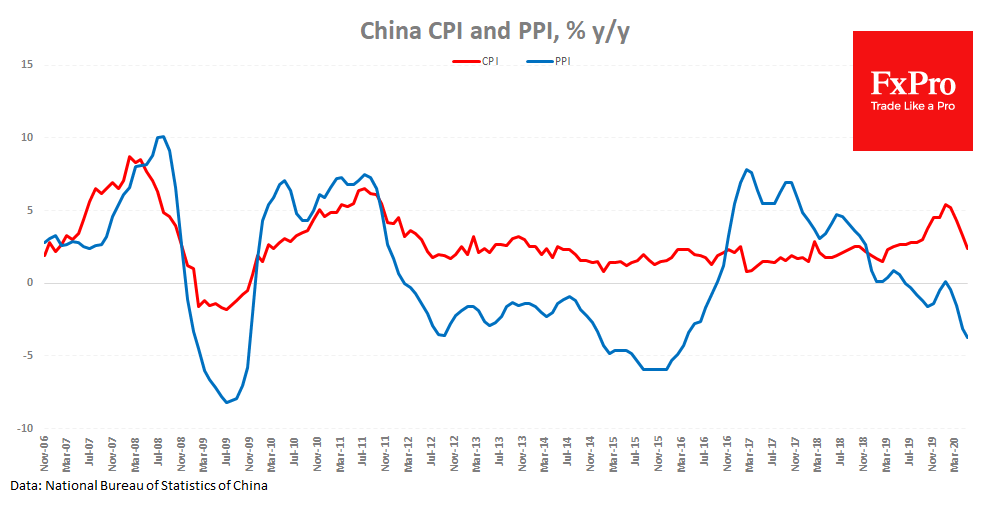

This hypothesis will be tested later today when consumer inflation estimates for May are released. On average, analysts do not expect price changes for the month and assume a slowdown in yearly inflation from 0.3% to 0.2%. But here traders should pay attention to the figures from China, which one step ahead in coronavirus curve. Consumer inflation there slowed to 2.4% in May from 3.3% a month earlier, which is much stronger than expectations. Producer prices also continued to plunge into negative territory to -3.7% YoY. Both indicators came out significantly weaker than expected, indicating that price pressure is declining, reflecting the weakness of the economy.

The FxPro Analyst Team