China smoothed out the market reaction

August 08, 2019 @ 12:36 +03:00

Market focus China remains the focus of markets, shaping the agenda. It should be noted that the People’s Bank of China helped markets to recover after a shock at the start of the week. The PBoC set the USDCNY rate below the market. Such actions often have serious consequences – all the more, given that for the first time since GFC, the official dollar exchange rate was above 7 yuan.

On this news, global stock indices began to add on Thursday morning, reducing fears around possible currency wars. It is likely that the PBoC will continue to restrain the onslaught of national currency sellers, gradually weakening the renminbi, in response to fears of a sharp slowdown in economic growth. As the FxPro Analyst Team said, it has not loomed on the horizon: fresh data showed that Chinese exports in July grew by 3.3% y/y, contrary to forecasts predicting a decline. On this news, Asian markets continued a neat recovery, although they are still far from wrecking the failure of the beginning of the week. It looks like this wound will take a long time to will heal.

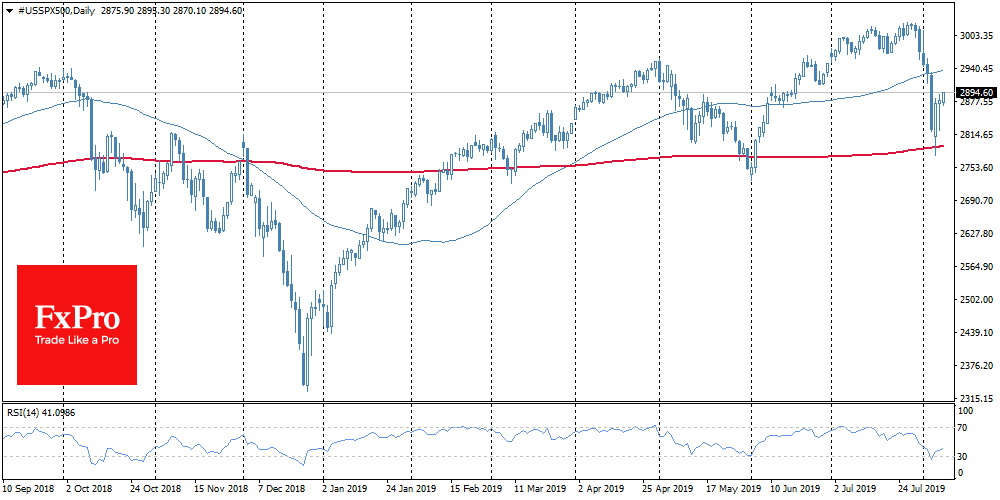

Stocks The US markets closed Wednesday trading in diverse directions: S&P500 and Nasdaq added 0.1% each, Dow lost the same amount. ChinaA50 rose 1.3% this morning, cutting this week’s losses to 2%. Creeping market recovery suggests that the situation remains under control, and the recent collapse of stocks was in the hands of investors, making them attractive for purchases. S&P500 confidently rebounded from the 200-day average, and now continues to develop growth.

S&P500 components quickly felt customer support after the recent failure, which is a signal of the prevalence of bulls, as was the case in March and May. Still, investors remain wary.

EURUSD The single currency has stabilised at 1.1200 since the end of the day on Monday. The pair sharply added during the period of increased market volatility, but now it is in no hurry to decline, despite the restoration of purchases on stock exchanges. Market participants paused in anticipation of further signals of where the market would move. The recent episode of the EURUSD surge in the escalation of trade conflicts seems to be an exception to the general rule. Since the announcement of Trump’s intention to revise the trade agreement with China, the pair has dropped from 1.23 to 1.10.

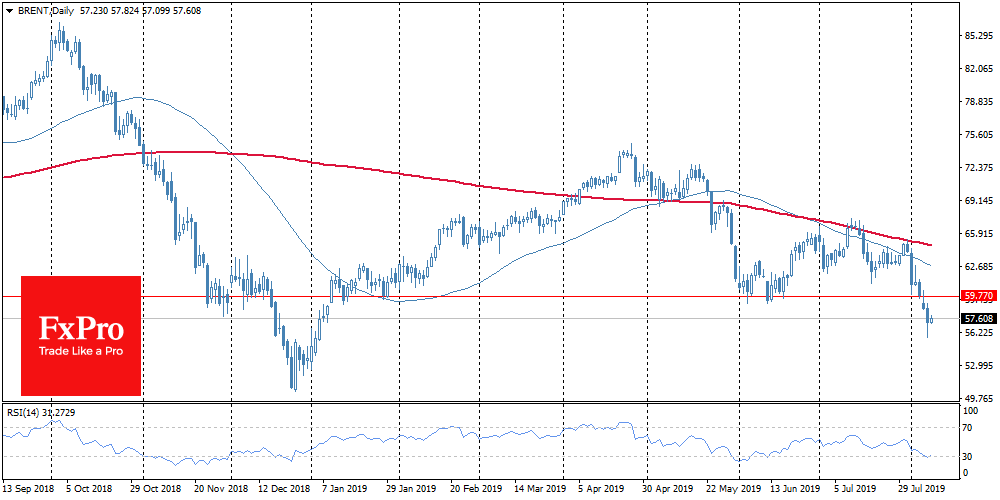

Brent Oil added 0.7% to 57.60 at the beginning of trading on Thursday after drop up to 4% on Wednesday. The sale was reinforced by the fact that the bears managed to sell Brent at once to several important levels under $60, which automatically goes down towards the bears’ territory. Fundamentally, the price of oil is undermining the daily worsening forecasts for the global economy. World central banks soften policies in order to support economic growth. However, that has a delayed effect of 3-9 months, while the wariness of regulators and politicians now only increases the nervousness of the market.

The FxPro Analyst Team