A harder dollar push

September 24, 2020 @ 12:47 +03:00

The US dollar returned to growth yesterday afternoon, but this time stock indices failed to accompany it.

As might be expected, the simultaneous growth impulse for the dollar and US markets is rarely sustainable.

Among the reasons for the recent sell-off are doubts about the stability of the recovery.

The Fed urges markets to make a reasonable assessment of the situation, noting that the economy remains in a deep hole. However, it is on its way up.

Interestingly, observers of the Fed’s comments also concluded that the regulator is not at all against stopping the markets from rising. This has become a moral cause for pressure on indices and it is unlikely that the US Central Bank will take any new action if volatility increases.

So further strengthening of the dollar is a working scenario that is unlikely to last for several months. If so, the short-term targets for the dollar should be considered based on a rollback scenario after the recent downturn, rather than a new growth impulse to multi-year highs.

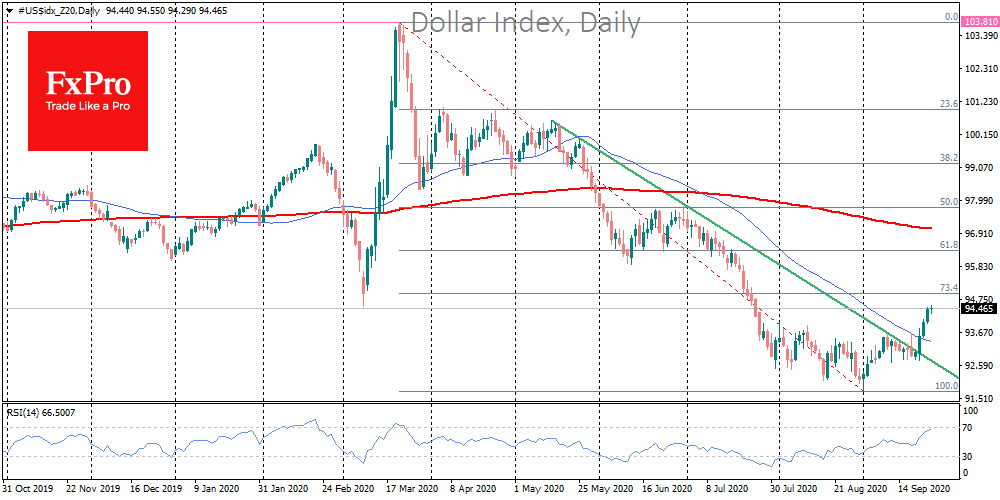

The dollar index has recently increased, currently standing at 95.4, the March lows. Further growth from current levels opens a direct path to 96.3, where the USD reversed upward in December 2019 and resisted pressure in June.

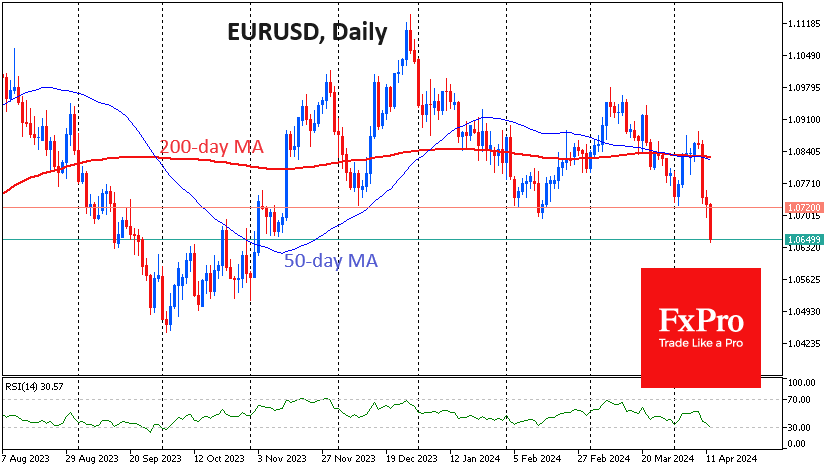

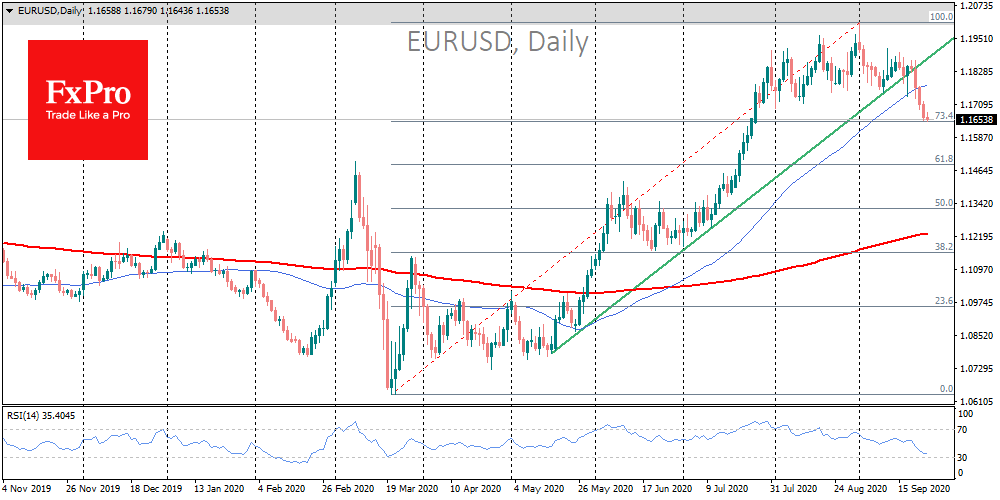

The performance of the euro pair shows a high potential for further decline, with the area of 1.1500 promising to be a next major target.

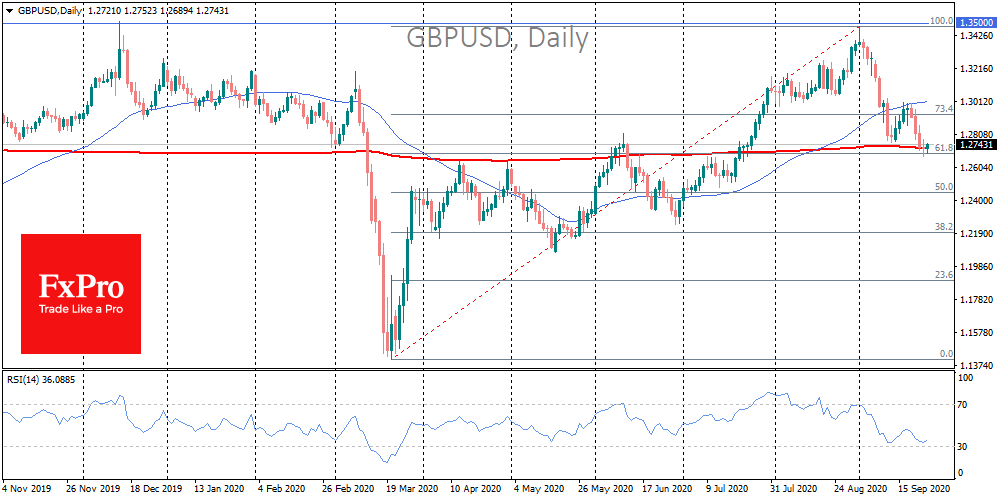

The British pound suffered much worse in September than the European currency, returning the dollar 38.2% of its March-August rally and is already testing the 200-day average. From the current levels of 1.2700, the bears’ closest target is possibly near 1.2500.

However, complicated negotiations on Brexit and the increased correlation of the pound with risk demand are forcing us to seriously consider the return of GBPUSD to 1.2000.

The FxPro Analyst Team