Hidden demand for the dollar on declining stocks and bonds

February 19, 2021 @ 13:43 +03:00

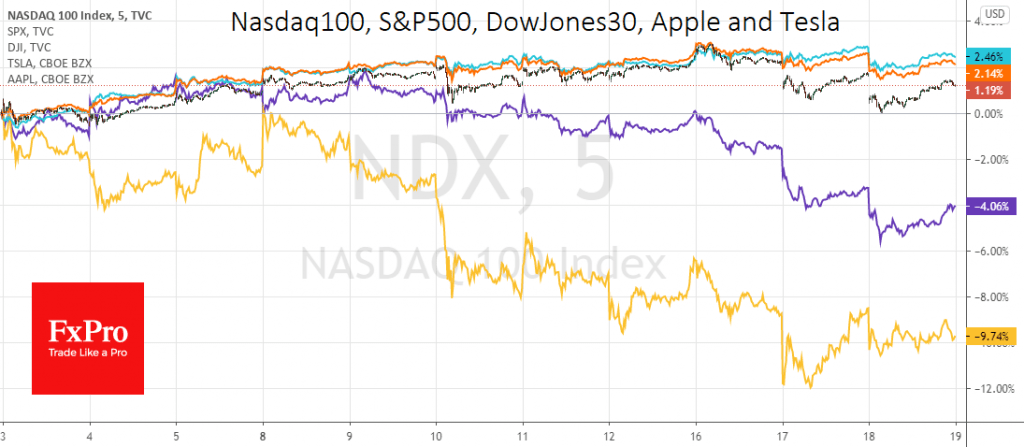

Global markets are intensifying trends of profit-taking from the gains of previous months. This is clearly visible in the weaker performance of the Nasdaq100 (-0.7%) compared to the S&P500 (-0.44%) and DowJones30 (-0.38%). Against this backdrop, Asian indices retreated from all-time peaks on Friday.

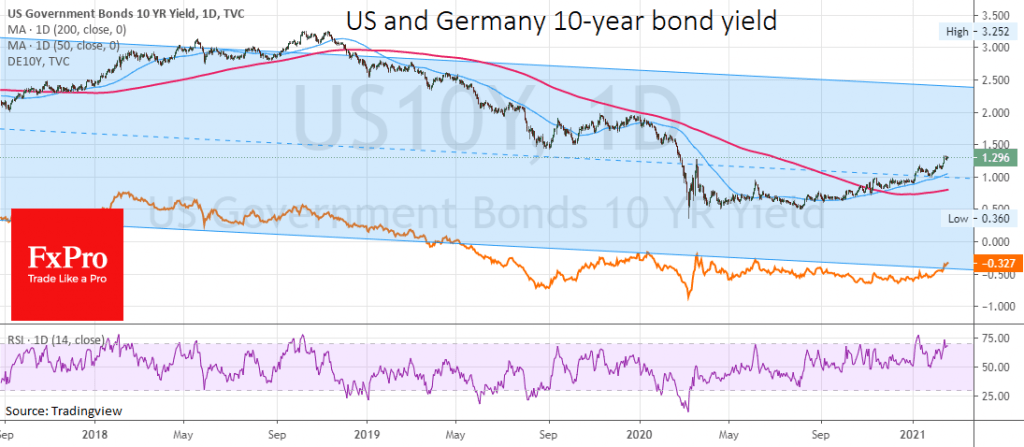

The decline in the equity market is accompanied by continued pressure in the debt markets. US 10-year government bond yields are above 1.3%, having recovered to the levels of late February last year. Higher yield means a lower price. An important watershed line looks to be the yield level of 1.5%, which acted as support in 2019.

Surprisingly, rising yields are now swaying investor confidence, compared to the situation last year when we saw a great demand for defensive bonds vs an uncertain outlook for stocks.

German 10-year bonds yield are also rising to the highs since July’s -0.34%, but overall these are swings near the centre of the 2.5-year trading range.

Stock indices have been overheated and are now under moderate pressure, which is intensifying amid a mass of reports that investment gurus have been taking profits from the rise of market stars such as Apple and Tesla. All this adds to the pressure on indices with a high proportion of high-tech stocks, such as the Nasdaq, where trading volumes are rising as the index declines.

The quiet selling of last year’s market star shares and the persistent rise in yields are all the hallmarks of the large funds, which were the first to buy the idea of a V-shaped recovery and are now selling this fact to the broader masses.

The big question for short-term investors is what asset are the big funds exiting into by selling stocks and bonds? What if it is an exit into the dollar?

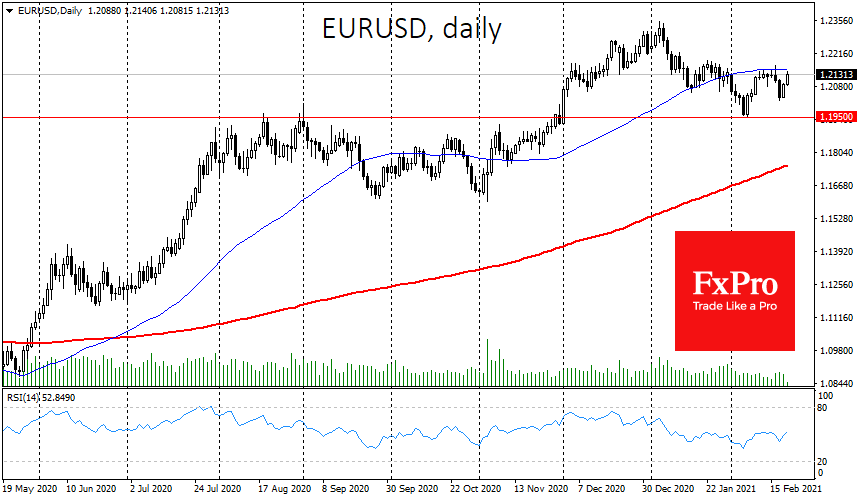

We see EURUSD remaining below its 50-day average and USDJPY breaking above the 200-day, having been rising for almost two months.

USDCNH has stabilised in the 6.40-6.50 range. USDCAD has been hovering around 1.27 for more than two months and USDMXN for more than three months, despite the surge in oil prices. The NZD and AUD have also been having a hard time rising for the last two months, despite the commodity price march.

All this reflects the sellers’ strength and could be a precursor for a reset of the dollar, at least in terms of a few weeks to months.

The FxPro Analyst Team