Crypto Review - Page 59

October 10, 2022

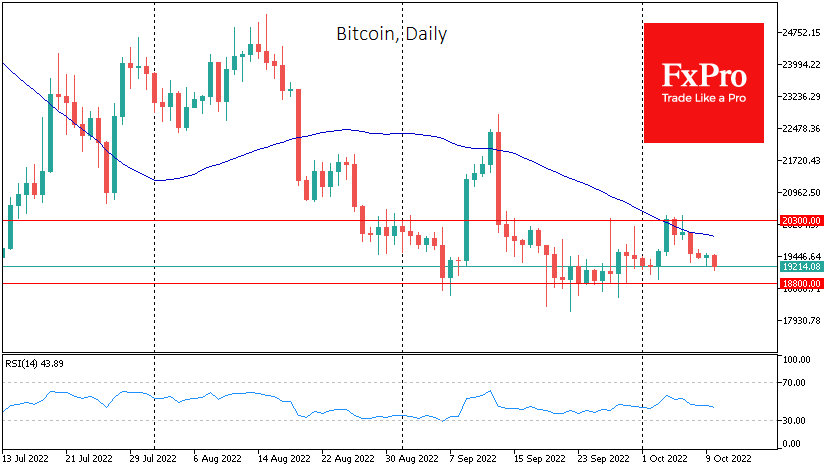

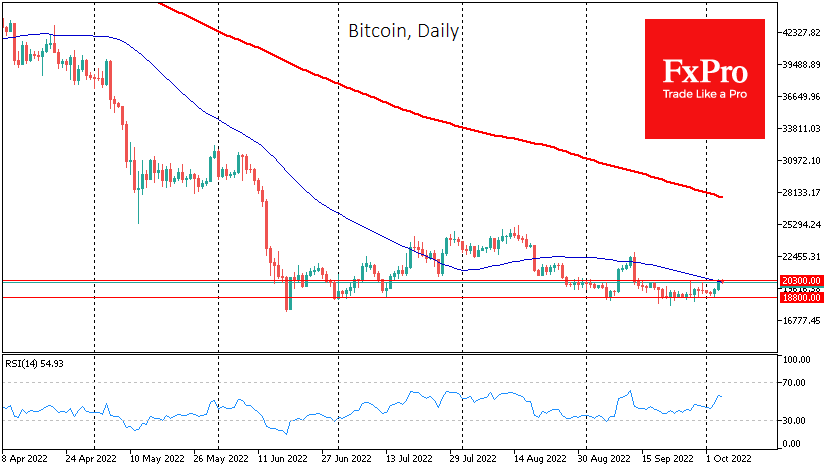

Market picture Bitcoin rose 1.3% over the past week, finishing near $19,500. Ethereum added 1.3% to $1320. Other leading altcoins from the top 10 showed mixed dynamics, from a decline of 2.8% (BNB) to a growth of 17.2% (XRP). Total.

October 7, 2022

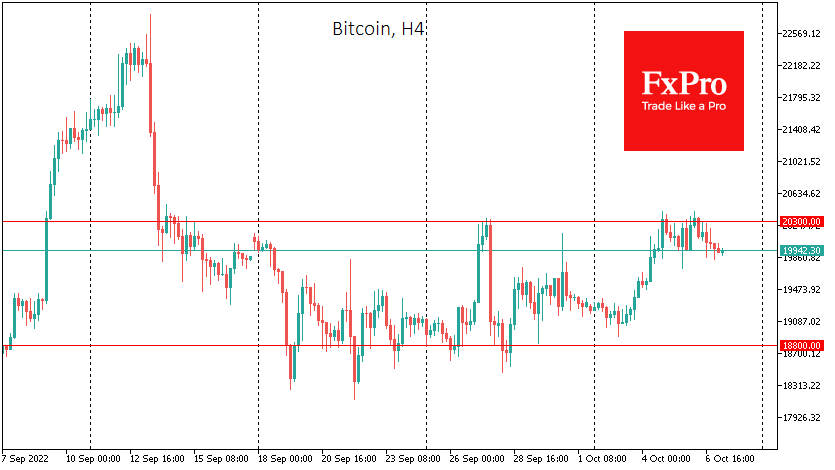

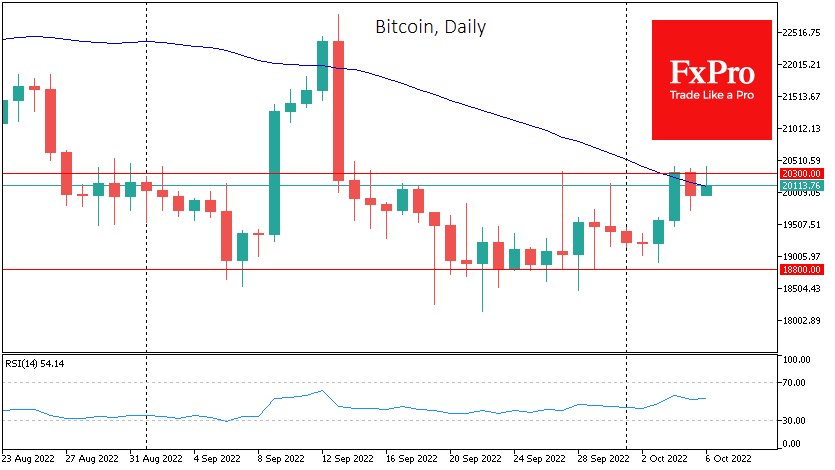

Market picture Bitcoin has lost 1.9% over the past 24 hours, trading just below $20K at the time of writing. A sharp spike in stock markets has bogged down in indecision over the past few days, keeping investors in the.

October 6, 2022

Market picture Bitcoin was down 1.7 per cent on Wednesday, ending the day at around $20K amid a retreat in stock indices and a stronger USD. BTC corrected downwards after a two-day rise. The cryptocurrency Fear and Greed Index was.

October 5, 2022

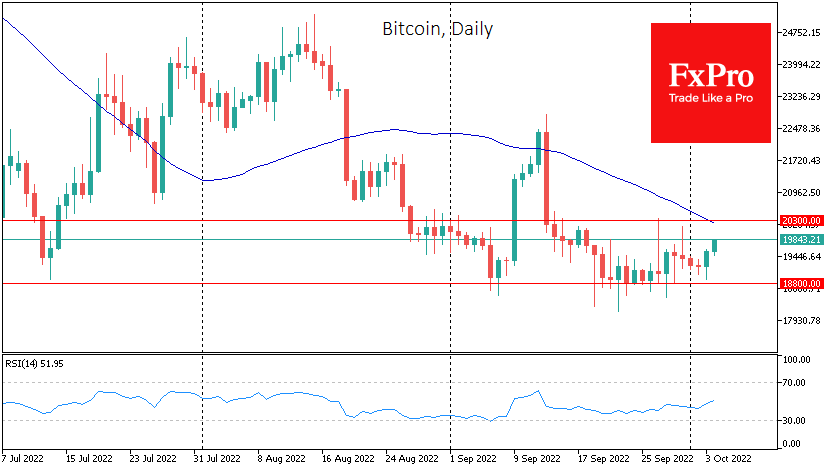

Market picture Bitcoin rose 2.9% in the past 24 hours, surpassing the psychologically significant round level, now trading at $20.2K. Ethereum rose to $1350, adding 2%, which aligns with the entire crypto market valuation growth. The Bitcoin price is testing.

October 4, 2022

Market picture Bitcoin has gained 2.8% over the past 24 hours to $19750 but remains broadly zen. Against the backdrop of falling equity markets, the first cryptocurrency’s balanced moves looked like a sign of domestic strength. But yesterday, the equity.

October 3, 2022

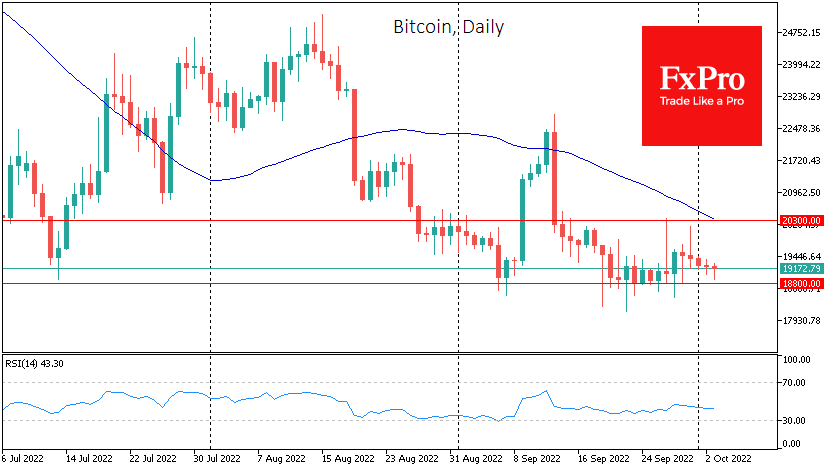

Market picture Bitcoin is up 2.5% over the past seven days, trading at $19,300 on Monday morning. Ethereum added 0.2%, to $1300. Other leading altcoins in the top 10 have shown mixed dynamics, ranging from an 8% decline (XRP) to.

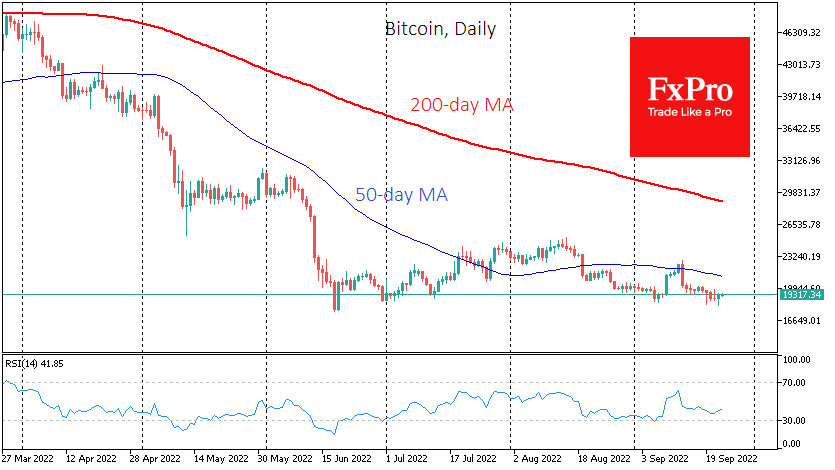

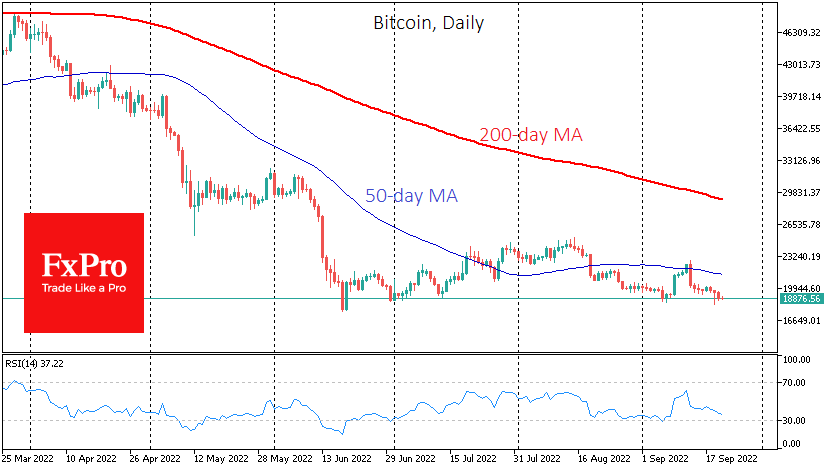

September 30, 2022

Market picture Bitcoin has remained in position for the past few days, trading at $19,500 on Friday morning. As in previous days, the attempt to sell the cryptocurrency following the stock market was met with buying. This neat bottom-drawing by.

September 29, 2022

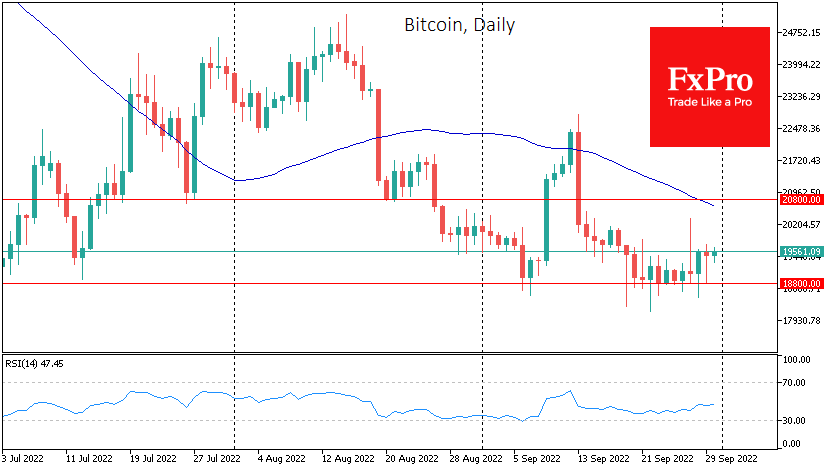

Market picture Bitcoin is up 3.1% over the past 24 hours, trading around $19,400. After a downward momentum early in the day, the first cryptocurrency received some support thanks to a recovery in risk appetite. Ethereum is gaining 3.5% overnight.

September 27, 2022

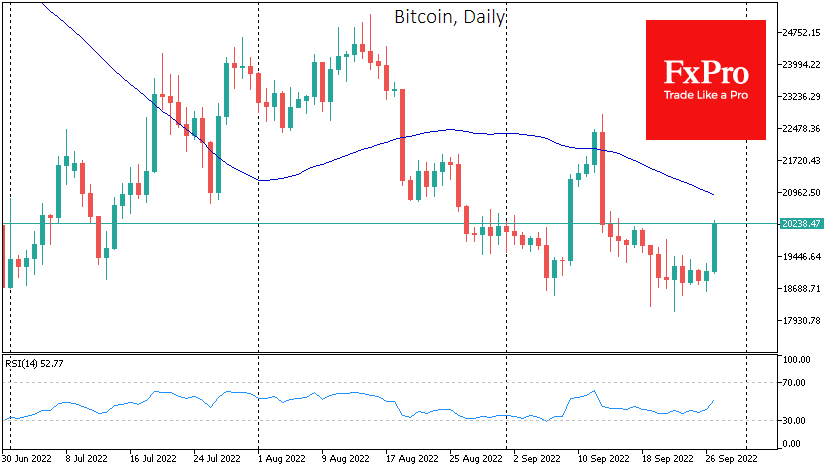

Market picture Bitcoin rose 1.1% on Monday, and on Tuesday morning, it “shot up” another 5.5%, adding 7.5% over the past 24 hours. This growth momentum has brought the price of the first cryptocurrency back above $20K, in stark contrast.

September 26, 2022

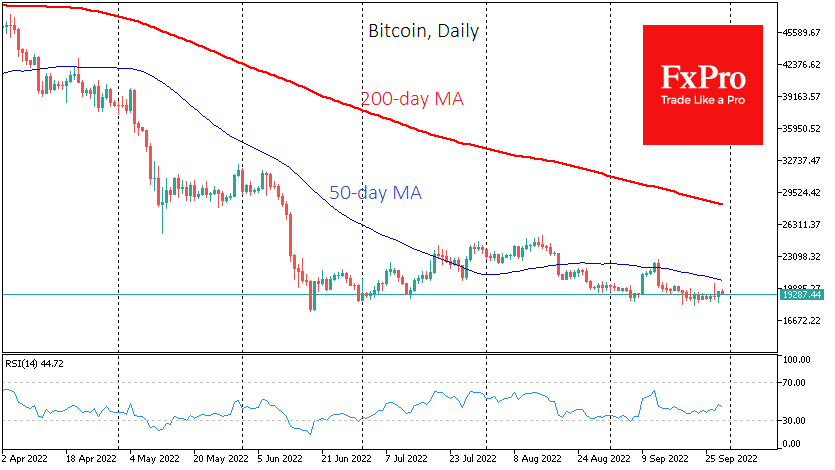

Market picture Bitcoin is down 4.1% over the past week, ending near $18,900. Ethereum lost 5.8% to $1290. Other leading altcoins in the top 10 showed mixed dynamics, ranging from a 3.7% decline (Cardano) to a 27% increase (XRP). Total.

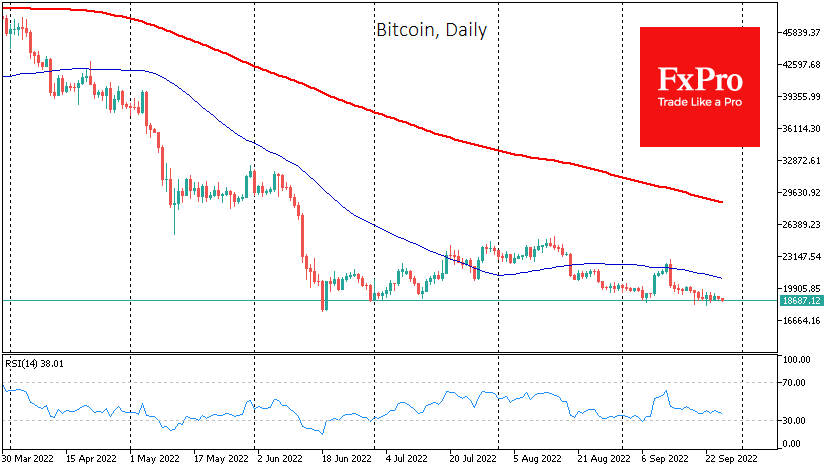

September 23, 2022

Market picture Bitcoin has gained 3.8% in the last 24 hours to $19.4K. Quotes have stabilised near the lower bound of the three-month range. Ethereum gained temporary support after falling below $1300 and is up 6.7% in 24 hours. XRP.