Profit-taking of a crypto mini-rally

October 28, 2022 @ 10:23 +03:00

Market picture

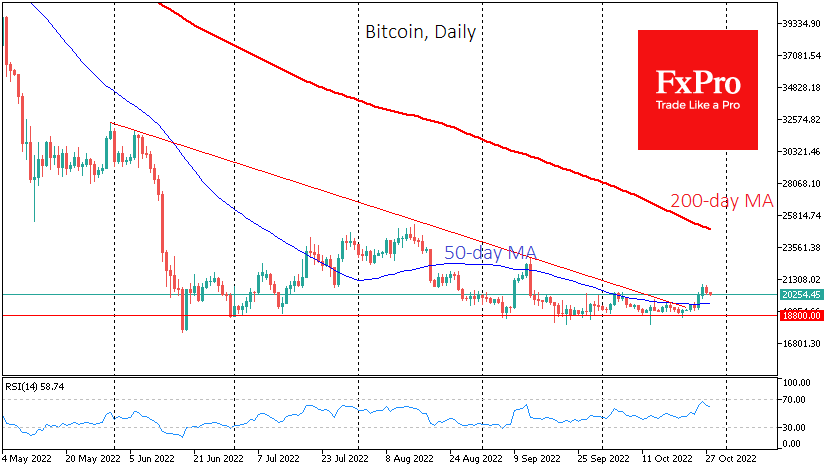

Bitcoin has regained some of the positions gained earlier in the week, losing 2.7% in the past 24 hours to $20.3K. Ethereum, which was previously rising more actively, is now actively correcting, down 3.5% to $1500.

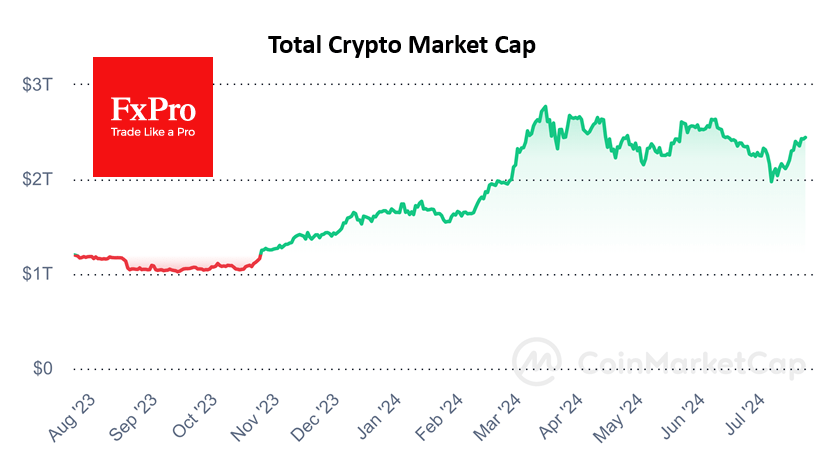

Total crypto market capitalisation is down 2.5%, with top altcoins losing between 1.7% (BNB) and 10% (SHIB) in the past 24 hours.

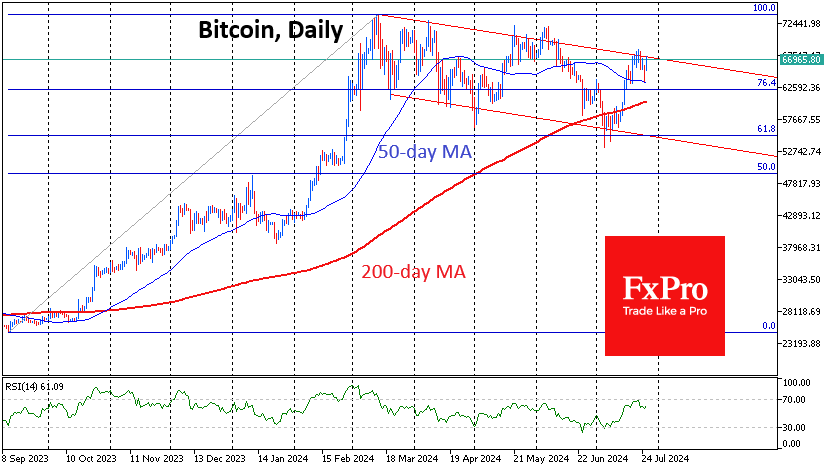

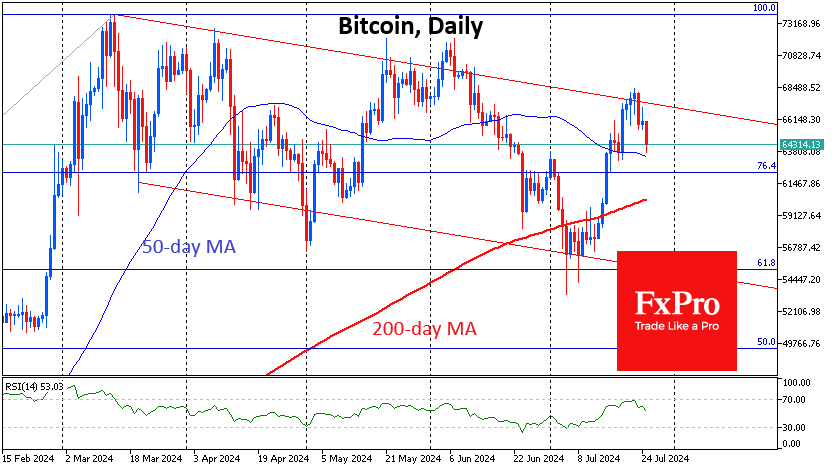

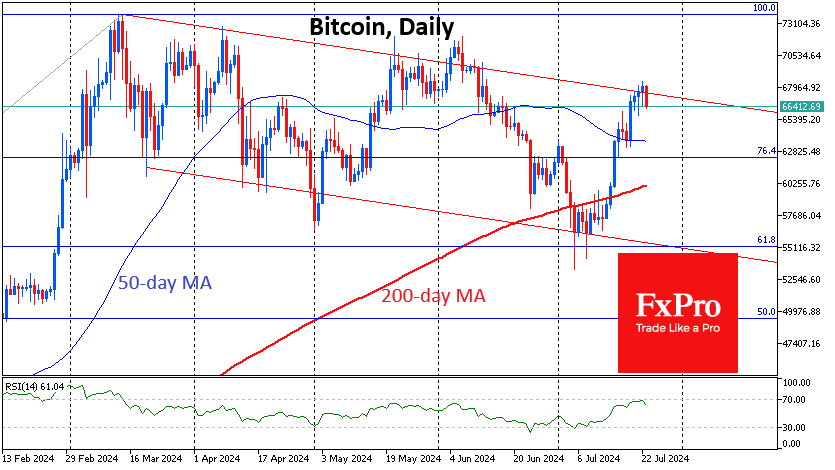

Bitcoin is correcting after touching the $20.8K area, but the price above previous local highs and the 50-day moving average leaves us in a short-term bullish scenario.

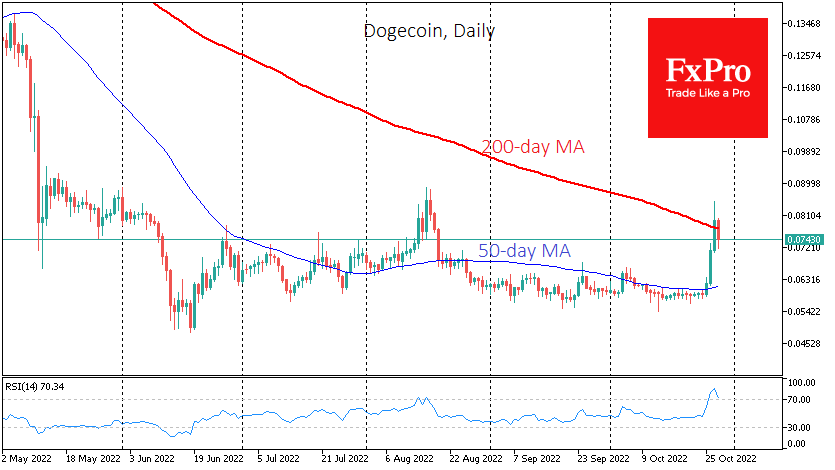

Dogecoin (DOGE), Elon Musk’s favourite coin, has jumped 35% in the last three days, reacting to news of his purchase of the social network Twitter, in the hope that it will be allowed to buy into the social network. On the other hand, overall market pressure prevented Doge from taking the 200-day average with a run-up, causing a wave of profit taking and taking 7% away from the start of the day on Friday.

News background

According to CryptoQuant, long-term investors (HODLers) now control the most significant volume of BTC since October 2015. This is a positive sign, as they usually do not sell crypto even during turbulence in the market.

Raul Pal, the founder of Real Vision, said the crypto market would grow 300 times to $300 trillion in ten years. He said the crypto sphere is already flooded with venture capital investments, although big players are cautious because of regulatory issues.

According to Bitnodes, five countries – the United States, Germany, France, the Netherlands, and Canada – account for the most significant number of nodes that form the bitcoin infrastructure. The Russian Federation is in ninth place with 178 nodes (1.2%).

Australia has submitted a draft budget that would make bitcoin a digital asset and not be taxed as fiat foreign currency.

Kazakhstan plans to test its digital currency on BNB Chain, the Binance blockchain.

The FxPro Analyst Team