Crypto Review - Page 48

June 6, 2023

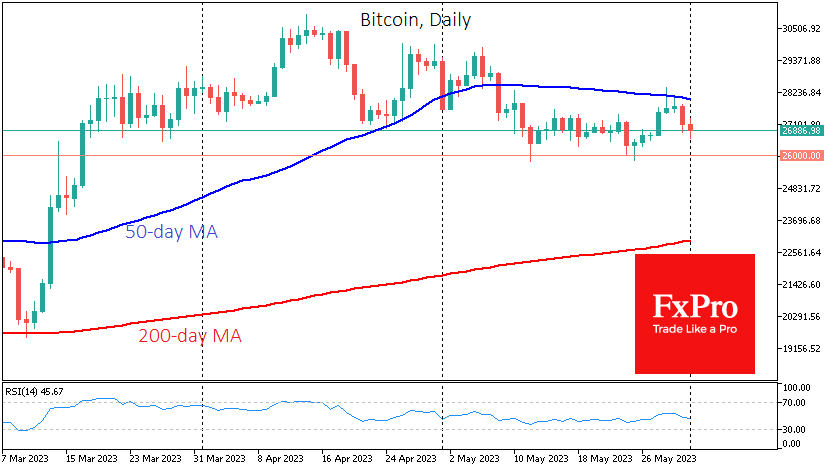

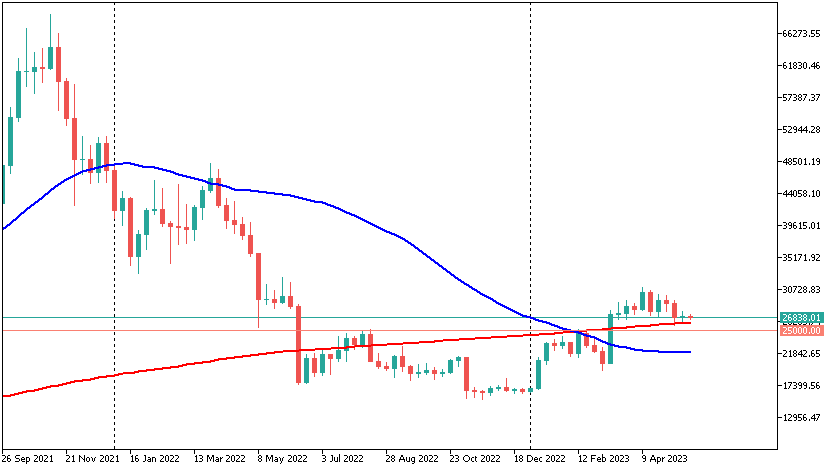

Market picture The cryptocurrency market hit a sell-off on Monday night, losing 3.8% in the last 24 hours, down to a capitalisation of $1.091 trillion – near almost three-month lows. Bitcoin is losing 4% to 25.7 over this period; Ether.

June 1, 2023

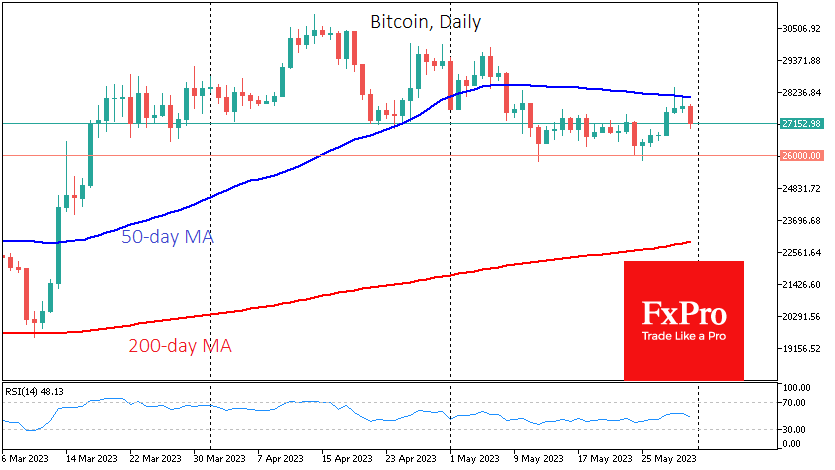

Market picture The crypto market has lost another 0.8% of its capitalisation in the last 24 hours, rolling back to $1,128, where it was last Friday. Bitcoin is down 1.4%, Ether is down 0.8%, and the top altcoins are mostly.

May 31, 2023

Market picture Cryptocurrency market capitalisation fell 1.8% over the last 24 hours to $1.136 trillion. After failing to build on the weekend’s gains, the cryptocurrency market came under pressure during the Asian session on Wednesday morning as sellers moved into.

May 30, 2023

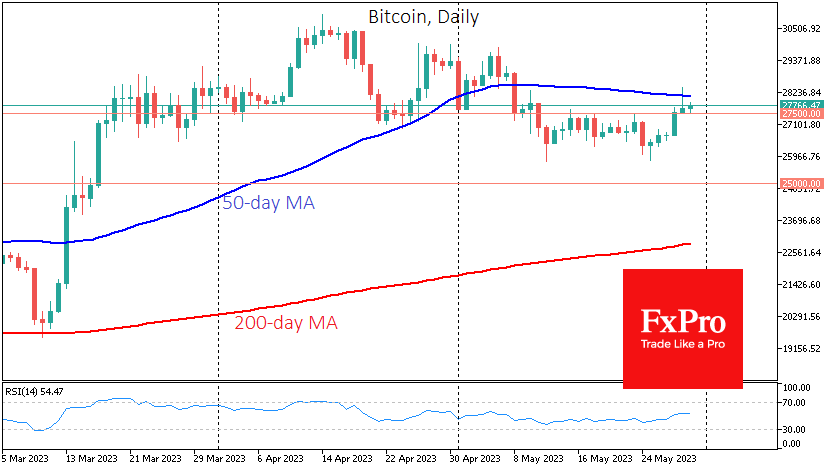

Market picture The crypto market cap has fallen by 0.5% over the past 24 hours to $1.156 trillion, as it pulled back from the extremes at the start of trading on Monday. However, the market has remained positive for the.

May 29, 2023

Market picture The announcement of the debt ceiling deal triggered a natural spike in interest in Bitcoin on the expectation of increased retail interest in risk assets as institutional investors in Europe and America head off for a long weekend..

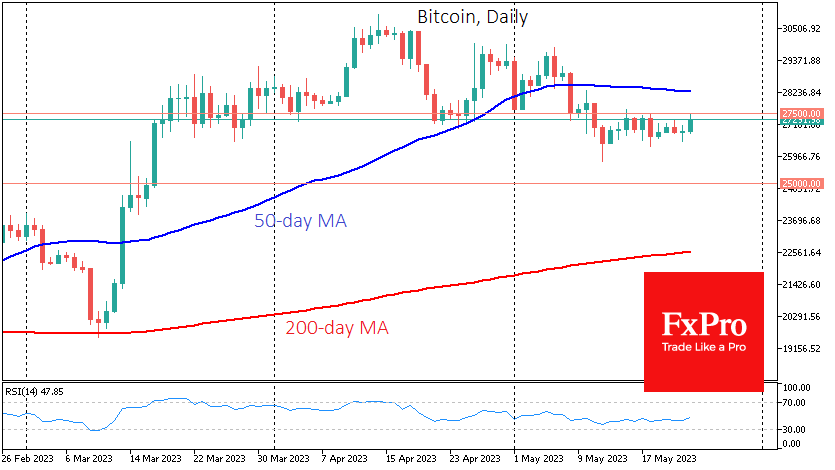

May 25, 2023

Market picture The cryptocurrency market cap has fallen 1.6% over the past 24 hours to $1.10 trillion, back to the levels from which the market rebounded almost two weeks ago. At the same time, bitcoin is down 2%, Ethereum is.

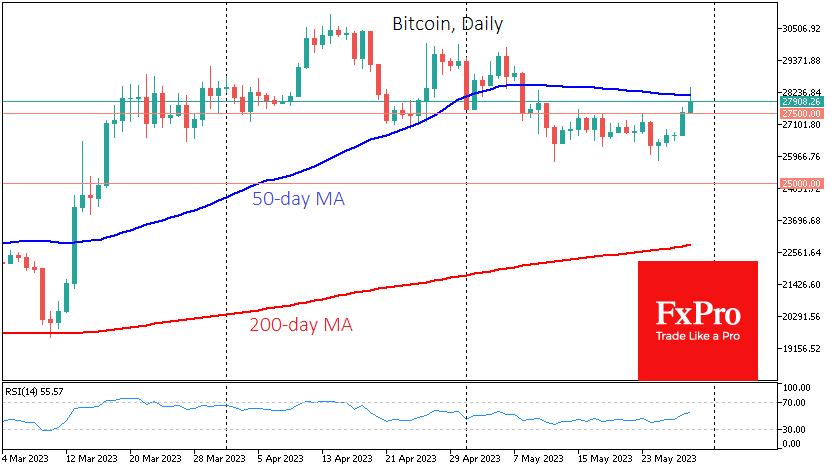

May 23, 2023

Market picture Crypto market capitalisation rose 1.4% over the last 24 hours to $1.138 trillion. After quiet trading on Monday, most gains came on Tuesday morning. The timing of the move is due to news on the US debt ceiling,.

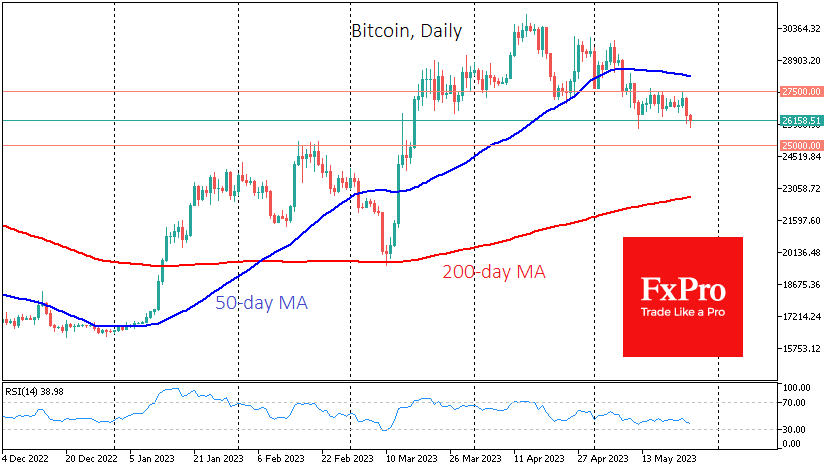

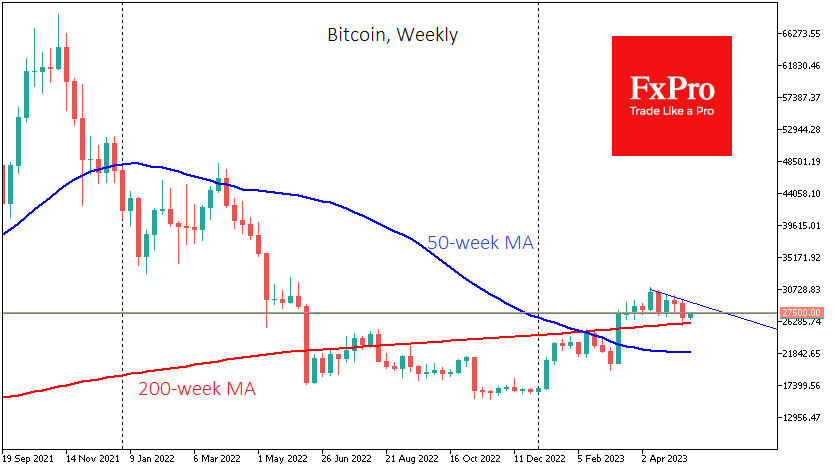

May 22, 2023

Market picture Cryptocurrency market capitalisation fell 2% over the week to $1.12 trillion, mostly fluctuating between $1.11 trillion and $1.14 trillion. The market is in no hurry to pick a trend, bringing the cap back into its chosen range and.

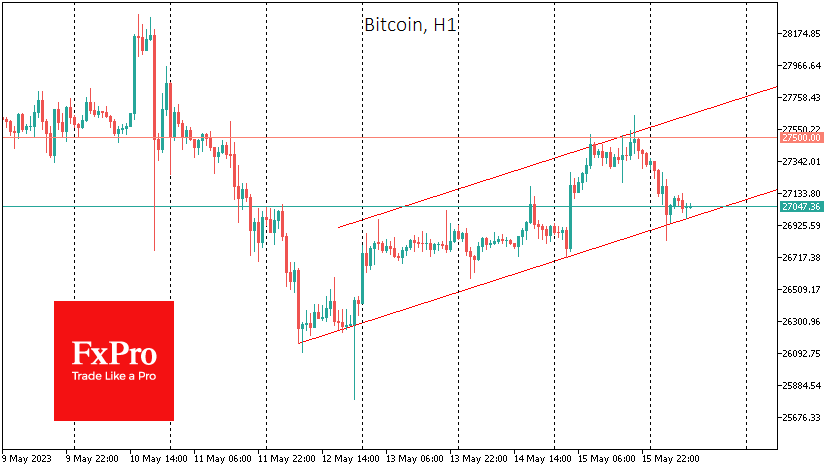

May 18, 2023

Market picture The crypto market capitalisation rose 0.55% over the past 24 hours to 1.134 trillion. Late Wednesday afternoon, another attempt was made to break above 1.14 trillion, following the US stock market rally on the government debt ceiling news..

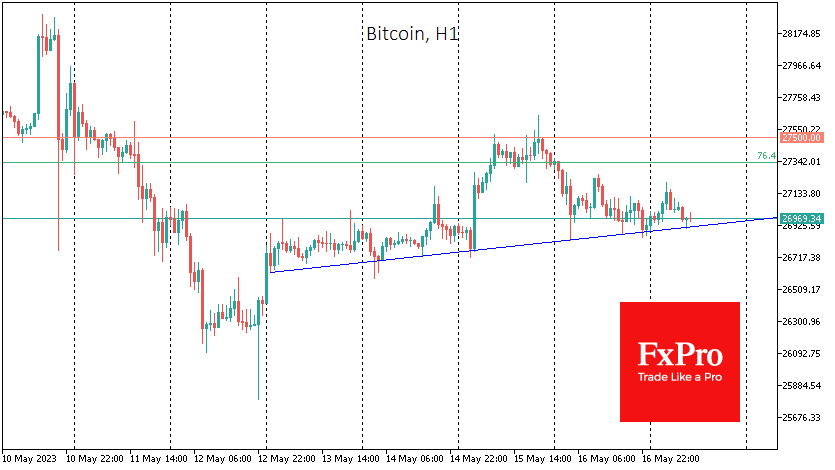

May 17, 2023

Market picture The cryptocurrency market capitalisation remained near $1.127 trillion as attempts to develop growth came up against selling pressure near $1.14 trillion. The top cryptocurrencies over the past 24 hours have ranged from a 0.7% decline (Solana) to a.

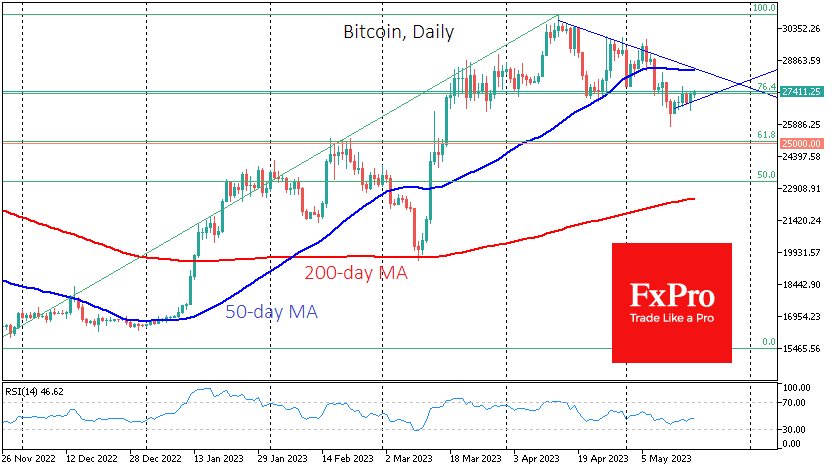

May 16, 2023

Market picture The total crypto market capitalisation is down 1.7% over the last 24 hours to $1.13 trillion. Bitcoin is down 1.6%, Ether is losing 1%, and among the top altcoins, only Litecoin and Tron show positive dynamics, adding around.