Bitcoin’s continued struggle for the long-term trend; Ethereum more optimistic

June 09, 2023 @ 11:36 +03:00

Market picture

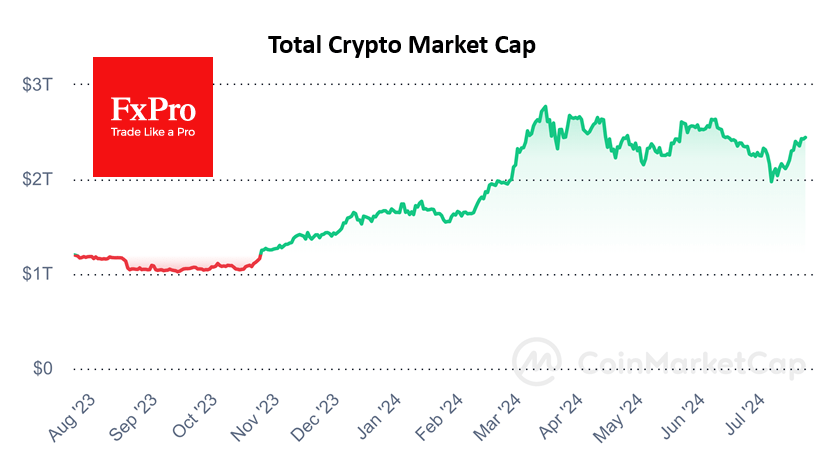

The crypto market capitalisation has been virtually unchanged over the past 24 hours, remaining near 1.1 trillion. Bitcoin is marginally higher, up 0.1%, while Ethereum is down 0.3%. Top altcoins show more amplitude, ranging from a 3.2% drop (Cardano) to a 1% gain (Polygon).

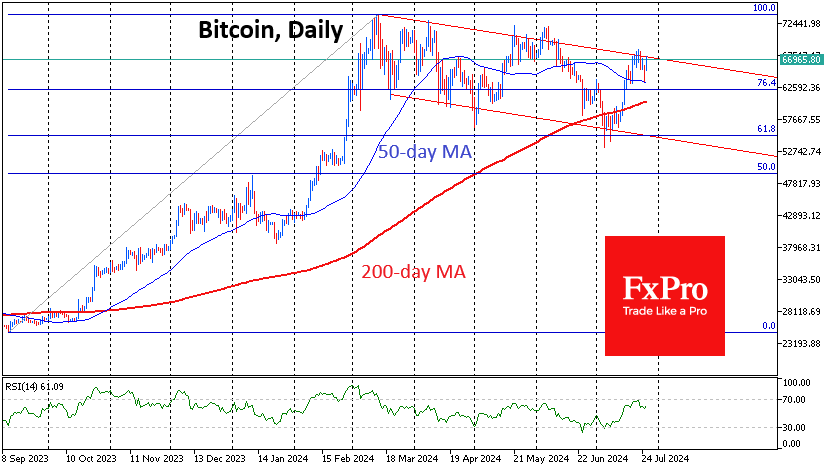

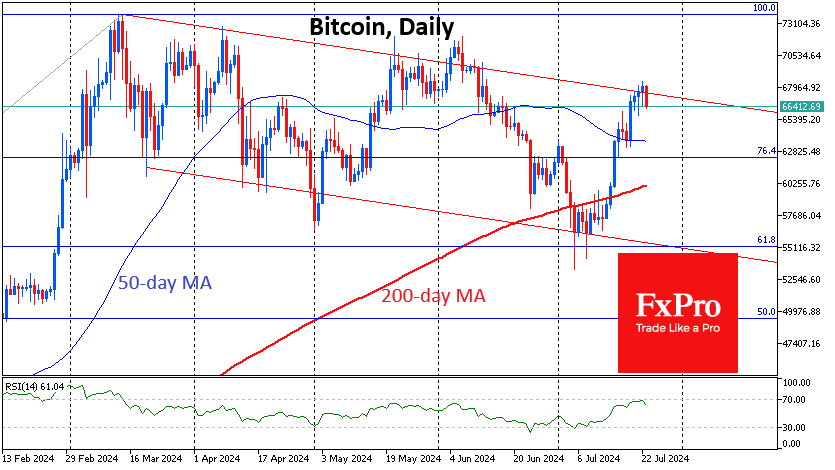

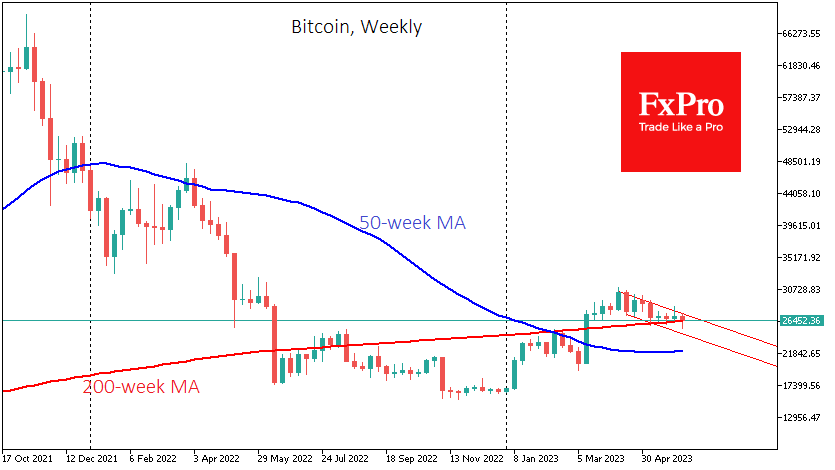

Bitcoin is trading near $26.5K – in the middle of the previous day’s trading range and just above the psychologically important 200-week moving average. A break below this level could trigger a deeper decline to $24.5K (previous high) or even $22.2K (50-week moving average).

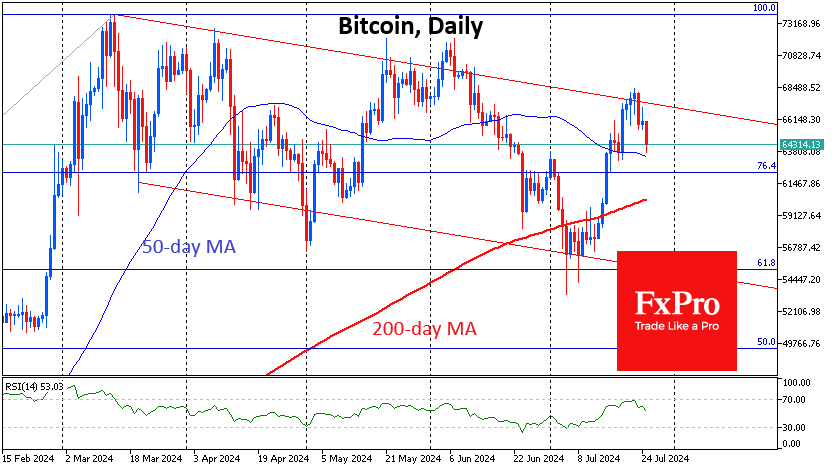

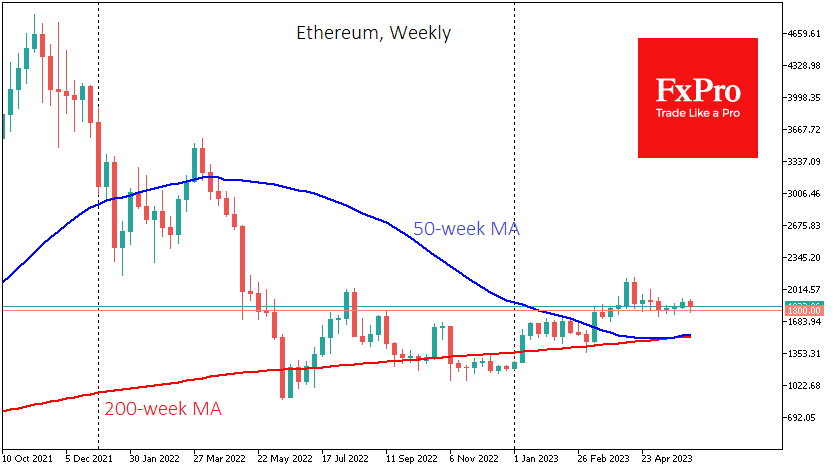

In Ethereum, the 50-week moving average has crossed up from the 200-week moving average, and a price above this crossover would indicate a continuation of the bullish trend.

News background

Gary Gensler, SEC chief, said his agency intends to refrain from relaxing its crypto market policies. According to him, digital assets should be registered as securities and regulated under the laws already in place in the US. At the same time, the SEC has not recognised BTC and ETH as securities.

Details of the SEC’s case against Binance have been revealed. According to the regulator, Binance and Binance.US transferred more than $12 billion to the accounts of Changpeng Zhao. In addition, the exchange helped circumvent US sanctions. The CEO of Binance himself called the allegations false, claiming that the amount on Binance.US was around $2 billion.

The Coinbase exchange has no plans to discontinue stake services or make listing adjustments due to the SEC claims, Coinbase CEO Brian Armstrong said. He noted that Coinbase Earn’s stacking programme generates about 3% of the exchange’s total net revenue.

The European Union has called for stricter rules on cryptocurrency advertising on social media. The European Consumer Organisation (BEUC) has filed a complaint with the European Commission against popular resources and pushing for controls on promoting cryptocurrency products at the EU level.

The UK’s Financial Conduct Authority (FCA) has finalised new, stricter rules for promoting and advertising cryptocurrencies in the country. The new rules are due to come into force on 8 October.

The FxPro Analyst Team