FxPro: USDT sell-off briefly breathed life into Bitcoin (BTC)

October 16, 2018 @ 16:38 +03:00

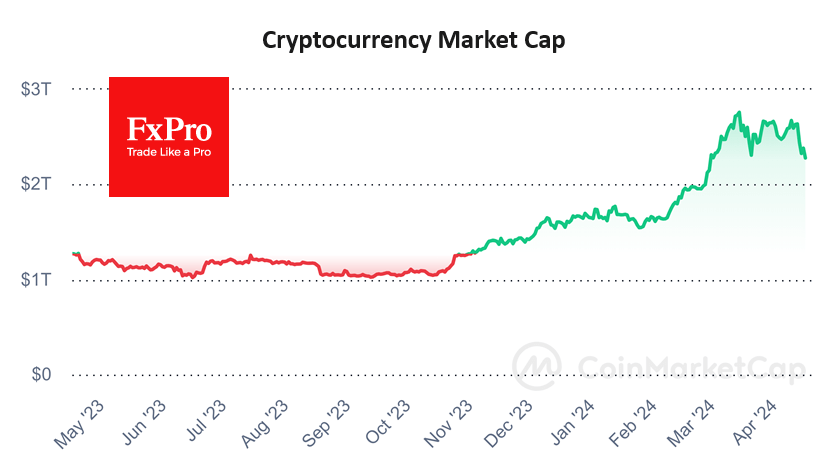

The beginning of the week for crypto investors was unexpectedly positive: Bitcoin (BTC) and other digital currencies rose sharply by 10% or more. The benchmark coin reached almost $7,000 on CoinMarketCap and on Bitfinex and several other crypto exchanges BTC traded with a premium up to $7,500. One of the possible reasons for the sharp growth was Tether (USDT) sale-off on Bitfinex crypto exchange, OKEx and Huobi also intensified downward pressure, as these exchanges are also actively using USDT. As a result, its rate fell by almost 6% to $0.94.

The sell-off and reputational issues to the USDT, including manipulating of BTC rate at the end of last year, as well as deep doubts about the existence of real dollars on company’s bank accounts, provoked demand for other stablecoins. Gemini Dollar (GUSD), Paxos (PAX) and TrueUSD (TUSD) are regulated and have the support of banks that’s why the traders are more confident in them. It is likely that in the medium term one of the new stablecoins could be a serious competitor to USDT which until that moment had been the only substitute for fiat dollars in digital trading.

The BTC growth could also be linked with the Asian money inflow into the crypto sector. The trading volume of Bitcoin jumped by 138% in a day to $7.4 billion. Nevertheless, on Tuesday morning Bitcoin was in the red zone, losing just over 1%. Altcoins as often happens are mirrored the dynamics of the benchmark cryptocurrency.

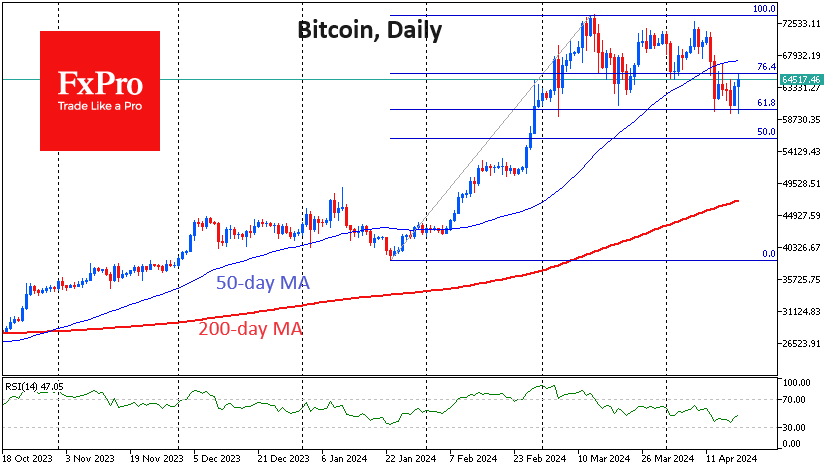

Over the past day, the BTC was unable to hit the important resistance level at $6,800, and at the moment BTC is losing momentum in terms of trading volumes. Once again, the bulls can only hope that the “bottom” near $6,000 will be impenetrable and BTC will outlive another sale.

Meanwhile, the list of the richest Chinese, considering an almost full-scale ban on the crypto industry in the country, includes the founders of Bitmain, which produces equipment for mining, as well as the owners of the largest crypto-exchanges OKCoin, Binance and Huobi. Miners and traders, as expected, were not included in the richest list proving again that only “shovel sellers” and intermediaries are the biggest beneficiaries of “hype”.

Since we are talking about new technologies, it is worth mentioning hackers as another one winning party. According to CipherTrace, in 2018 hackers stole $927 million of cryptocurrencies. Up to now the market suffers of regulatory uncertainty, speculators and scammers. How long the “whales” will silently watch the “collapse” – no one really knows.