USDCAD and GBPCAD Analysis

July 11, 2018 @ 14:14 +03:00

The Bank of Canada (BOC) is expected to raise its interest rate today for the first time in six months due to stronger economic data. The market will focus on the accompanying quarterly monetary policy report for any additional forward guidance. Although GDP and CPI forecasts may not alter, the central bank’s message on risks to the outlook including trade will be noted. The BOC will be incorporating the announced tariffs into its projections. The rate decision arrives as Canada faces trade related uncertainties including US steel and aluminium tariffs and NAFTA talks. Governor Poloz has said that the impact from trade disputes will figure in the decision process. With a rate hike priced in, the direction for the Canadian Dollar will depend on the outlook. There is a possibility of a “dovish hike” because of the elevated trade uncertainty.

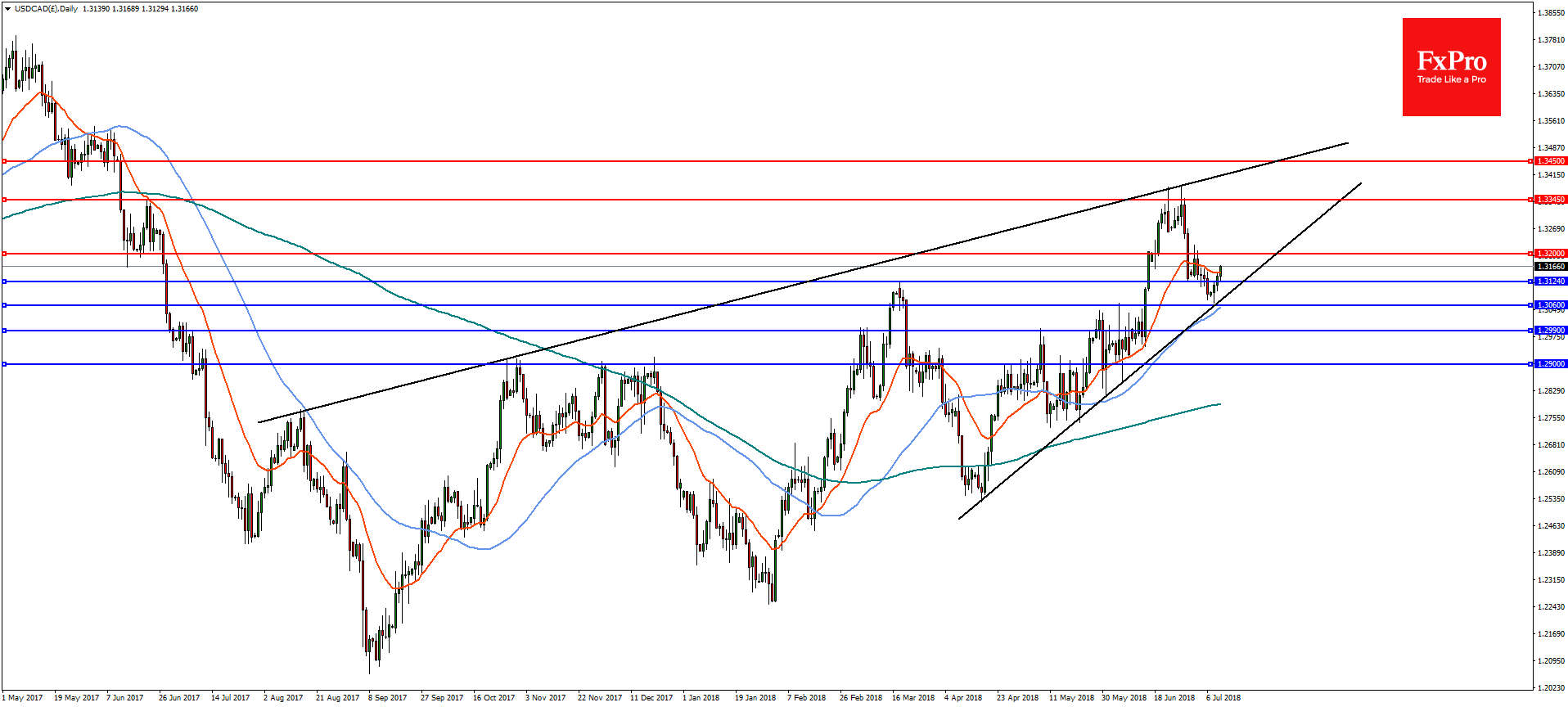

USDCAD In the daily timeframe, USDCAD is trading with an ascending wedge and while above the confluence of trend line, Fibonacci and horizontal support at 1.3060, is likely to continue to the upside with resistance at 1.3200 and 1.3345. However, a break of 1.3060 could open the door to declines towards support at 1.2990 and then 1.2900.

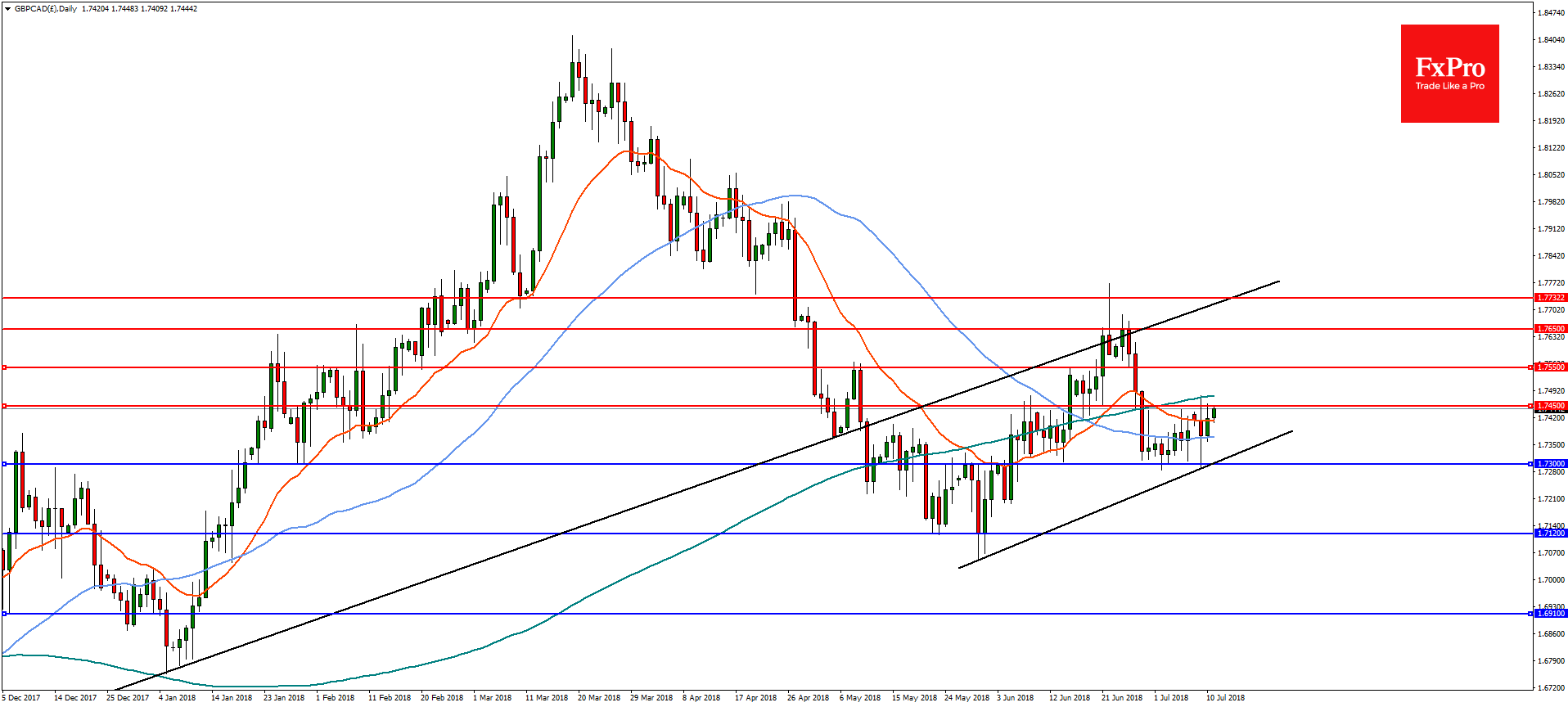

GBPCAD On the daily chart, GBPCAD is testing resistance at 1.7450 and a break will open the way for a move to 1.7550 and then 1.7650. On the flip-side, a bearish reversal will need to break strong support at 1.7300 in order to change the outlook with further support at 1.7120.