US Markets lost major support, Asian Indices are melting

September 20, 2021 @ 12:13 +03:00

Global markets closed last week on the back foot, and no significant positive factors emerged in Asian trading, increasing the flight to safety.

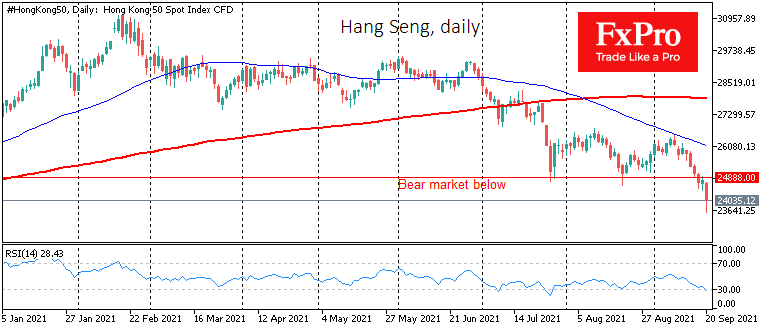

The Hang Seng lost as much as 4.5% in the first four hours of trading today, cutting losses now to 3%. Japan’s Nikkei225 pulled back below 30000, proving too heavy after recently updating 31-year highs.

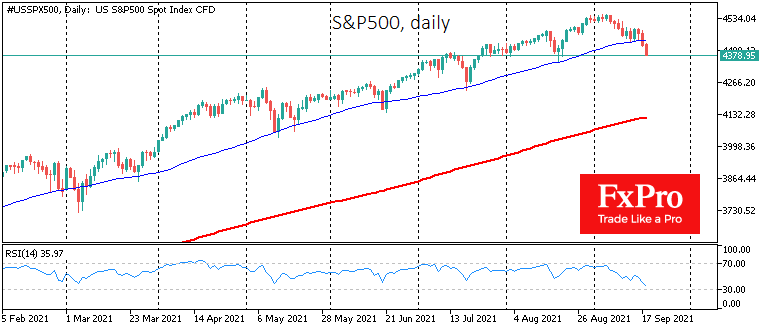

The S&P500 closed Friday below its 50-day moving average, which is seen as a negative signal that could open the way for a deeper technical correction.

But it is worth warning that such a technical signal is not enough reason to become bearish right now. The September quarterly expiration so far is closely repeating the previous one in June. In both cases, the S&P500 closed the week below its 50-day average. But in June, around the start of trading in Europe, buyers stepped in. Now we see much less buying demand, but it is too early to conclude yet.

A strong signal that the bears will prevail in the markets is when the S&P500 falls below the previous low of 4353. In that case, a more active process of long position unwinding might start, and the declines in the indices might gain momentum.

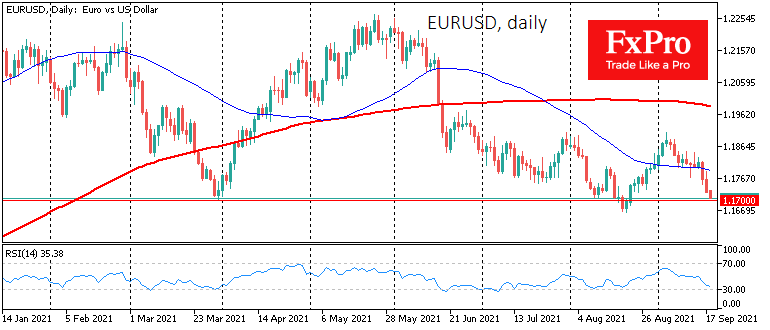

EURUSD came close to 1.1700, an area of lows since March this year, passing a vital support test around the lower range bound.

Market volatility could also increase ahead of Wednesday evening’s Fed meeting. Uncertainty is weighing on the markets, although historically, the Fed comments have had more of a positive effect than amplifying the sell-off in the down markets.

The markets’ caution is by no means accidental as the soft labour market report was followed by comparatively strong data on inflation and business activity, putting the appropriateness of stimulus and its secondary effects back on the agenda.

Under these circumstances, it would make sense for medium-term investors to wait for Fed comments on Wednesday evening or a test of local lows before getting active in the markets, as the situation could change drastically overnight.

The FxPro Analyst Team