NZDUSD and AUDNZD Analysis

July 13, 2018 @ 13:19 +03:00

The New Zealand Dollar (NZD) remains under pressure this week with the resumption of the US-China trade war headlines. The NZD did put in a recovery as China refrained from retaliating immediately to the latest round of US tariffs of $200bn, but it is possible that the trade war will come into focus again as President Trump completes his tour of Europe. The NZD offers an unattractive yield compared to the USD with the economy that is running slower than expected. Moreover, the Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr has indicated that the door is open to a rate cut. If trade war actions escalate, which is quite likely, then the USD will strengthen as a safe haven and push the NZDUSD pair lower.

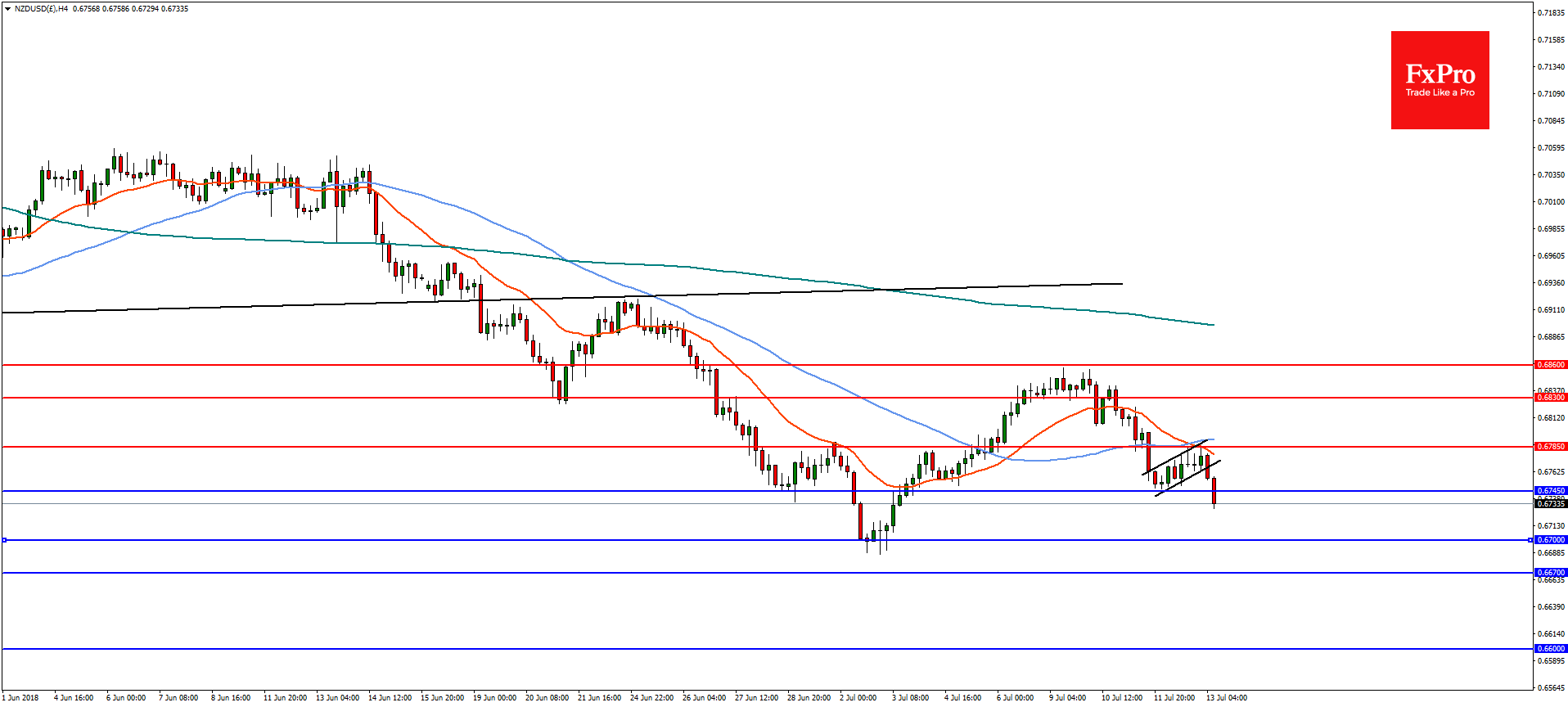

NZDUSD On the 4-hourly chart, NZDUSD is continuing to trend lower after reversing from resistance at 0.6860. The pair is now breaking lower from a bear flag with a projected target of 0.6670 but there is some immediate resistance at the psychologically important 0.6700. A reversal and move above 0.6785 would negate the view with upside resistance at 0.6830.

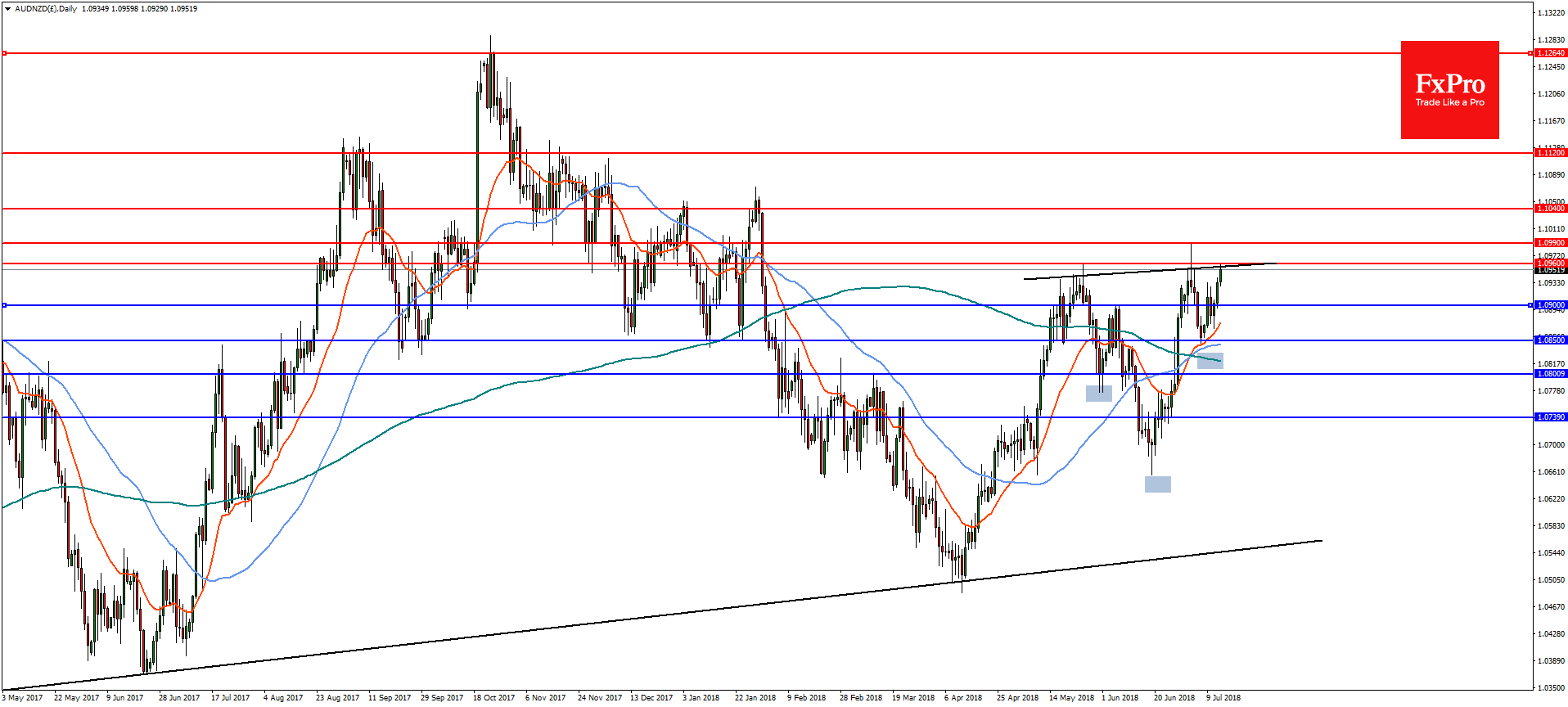

AUDNZD On the daily chart, the AUDNZD cross is trending to the upside as the AUD continues to be stronger than the NZD. There is a possible inverted head and shoulders pattern with a projected target of 1.2640 near the highs of September 2017. A break of the 61.8% retracement of the September highs at 1.0990 is needed to see the pair continue to the upside with resistance at 1.1040 and 1.1120. On the flip-side, a reversal will run into support at 1.0900 and then 1.0850.