Gold shines on an anti-fiat thesis

January 12, 2026 @ 15:30 +03:00

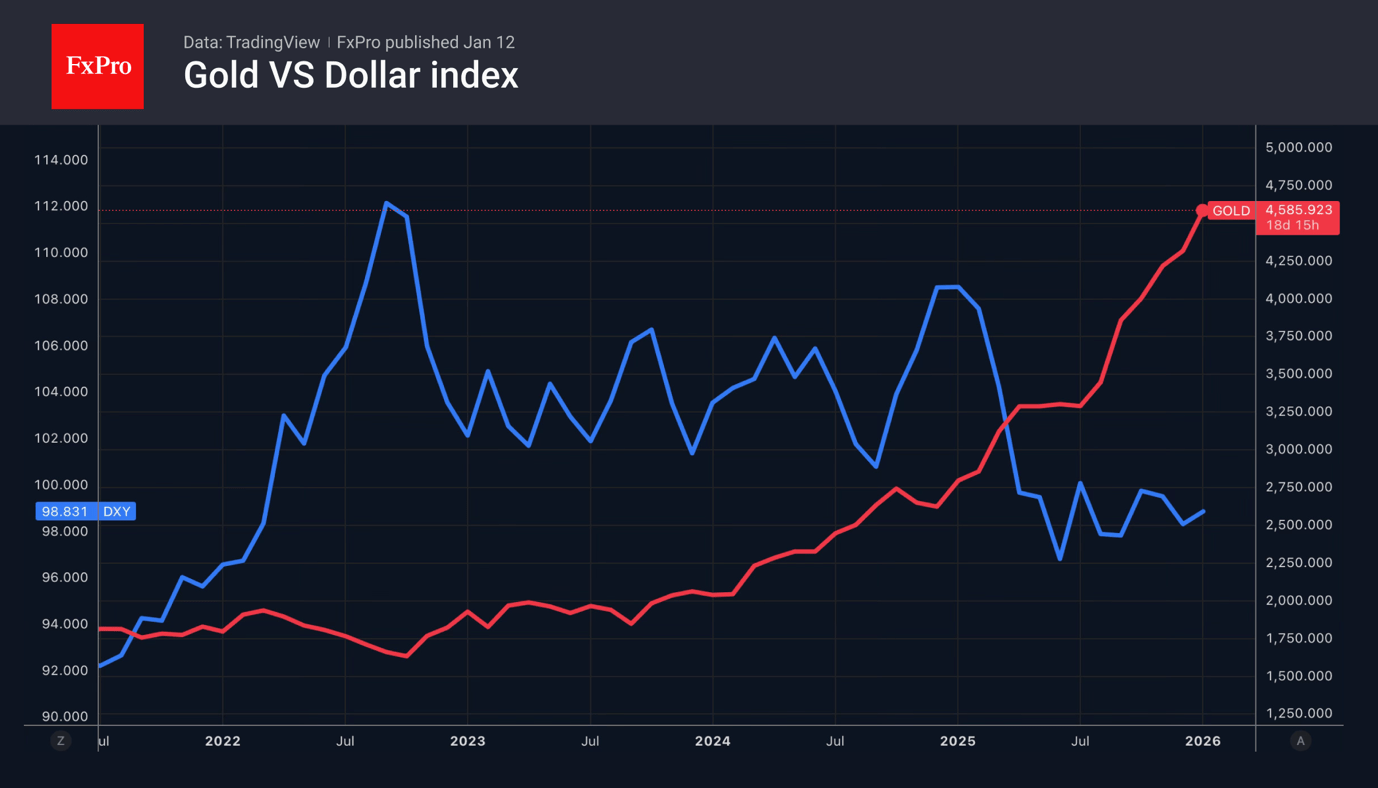

- The dollar suffered due to threats to the Fed’s independence.

- Gold managed to renew its record highs.

While labour market statistics strengthened the US dollar, the Justice Department’s lawsuit against Jerome Powell seriously weakened it. The USD index recorded its worst fall in three weeks due to fears that the White House could undermine the Fed’s independence, filling the FOMC with very dovish members. This risk stands in striking contrast with the current expectations of just two cuts by the end of 2026.

The US administration’s lawsuit against Lisa Cook is not without logic. She will remain a member of the FOMC for a long time to come. By comparison, the developments involving the Fed Chair appear considerably more perplexing. Jerome Powell is due to leave his post in May. Moreover, thanks to him, the Committee has been leaning towards lowering rates at recent meetings. The case concerning the renovation of the Federal Reserve building may set a precedent for investigating the circumstances surrounding the recent demolition of the East Wing of the White House.

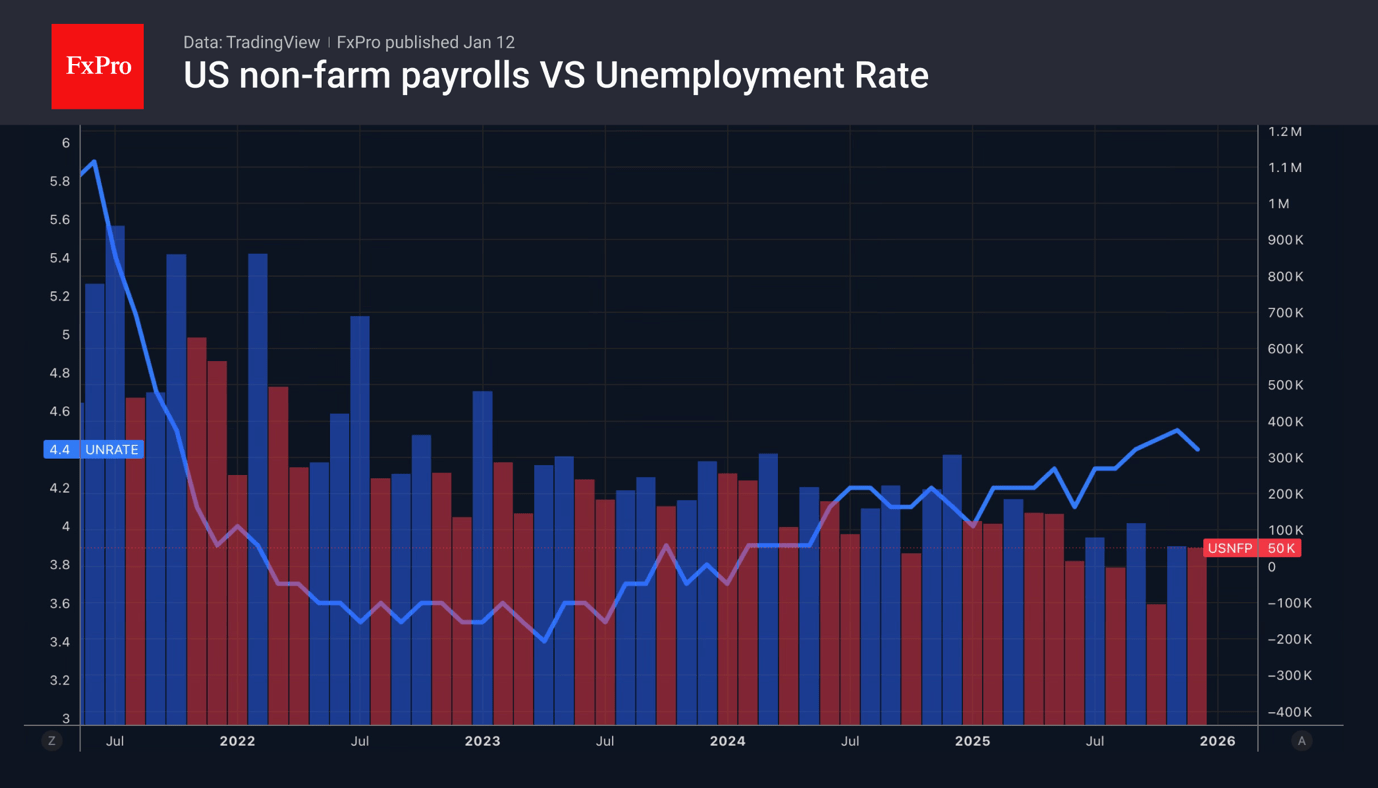

Markets perceive the resumption of pressure on the Fed as a reason to close short positions on EURUSD. December employment growth in line with forecasts and a drop in unemployment to 4.4% gave derivatives reason to reduce the chances of easing in March to 29% and in April to 42%, with a full cut not priced in until June. The five-month pause, coupled with wide spreads on US and other bonds, had created a solid foundation for the US dollar to strengthen over the previous two weeks.

The Supreme Court is ready to come to the greenback’s aid. It has stated that it will rule on the legality of the White House tariffs on 14 January. The US economy could receive additional stimulus in the form of a return to tariffs. Its acceleration could force the Fed to keep rates high for a long time. This will support the bears on EURUSD.

However, the risks of tariffs being declared illegal do not scare the White House. According to Kevin Hassett, the US will be able to quickly bring its tariff policy back to its previous format. Washington has a plan B that is just as effective as plan A.

The revival of the topic of the Fed’s loss of independence allowed Gold to update its record high. For the first time in history, the precious metal exceeded $4,600 per ounce. According to JP Morgan, gold is an anti-fiat currency. The growth of public debt and attacks on central banks are increasing interest in debasement trading. The company is ready to hold up to 20% of its portfolio assets in precious metals and similar assets, changing the classic 60/40 model.

The FxPro Analyst Team