Gold: growth potential already outweighs downside risks

October 06, 2021 @ 12:21 +03:00

Gold’s near-term prospects are bleak, but observations on the price dynamics indicate cautious buying for the longer term, limiting the downside potential.

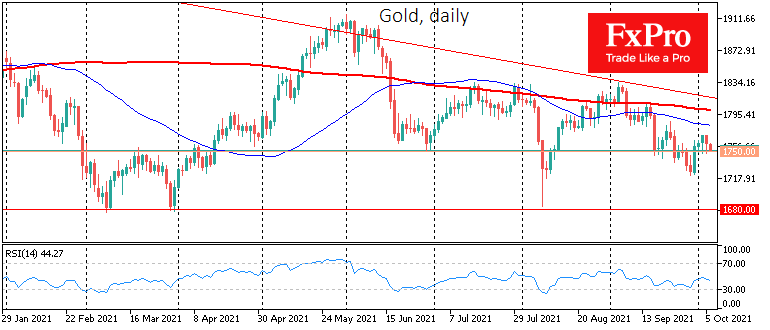

In early September, the sellers, with a strong move, brought the gold back below the significant 50 and 200-day moving averages and the descending resistance line formed by the August 2020 and May-June peaks of this year. Locally, gold is also being pushed ever lower, as shown by a series of declining local lows since June.

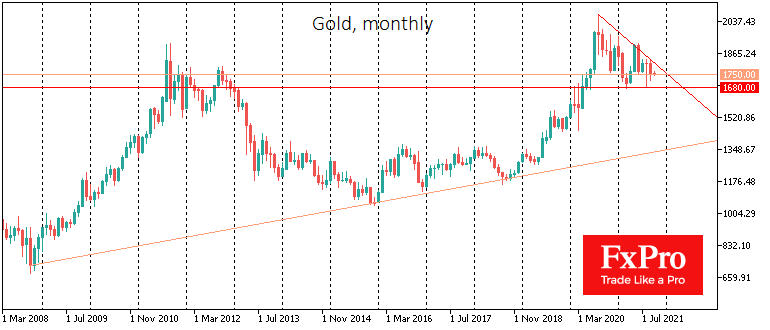

Fundamental factors are also playing clearly against gold. The US monetary policy cycle is unfolding, promising a reduction of stimulus in the form of balance sheet purchases. More importantly, the Fed is expecting an interest rate hike in about a year. This is much faster than it has been since the global financial crisis. It is important to note that gold and silver broke their steep upward trend in 2011 precisely on the tightening of US policy signals.

Last year gold barely and briefly managed to rewrite the highs of ten years ago, while silver never reached them. Rising interest rates are bringing back the attractiveness of bonds, while precious metals are not yielding.

Fears that the Fed’s monetary policy will miss out on inflation and collapse the dollar have also so far failed to materialise. Investors perceive the current policy as adequate, switching to buying dollars, judging by the markets’ reaction.

But there is a bright side of shorter timeframes for trends cycles in gold: a faster decline to attractive levels reduces the chances of long-term depression in the sector.

Although we continue to see a prevailing downtrend, in the coming days and weeks, traders should pay attention to the dynamics of gold near $1680. A dip to these levels would undo all the gains from pre-pandemic levels. This is where prices have received meaningful support since June last year. We saw roughly the same nullification of the crisis growth cycle after 2011 when the price of gold found long-term support near $1000 in 2015.

This time too, a return under $1700 promises to attract long-term buyers betting on trends beyond the pandemic and intensified money printing and long-term economic growth and demand for the metal.

Therefore, short-term traders can already start looking at gold for a good entry point on the local oversold area. Longer-term investors seem looking closer to the sector and buying, as the balance of potential and risk is now skewed towards the former. Momentum dips below $1700 may be accumulation points for long-term investors and the starting point of a multi-year bullish cycle.

The FxPro Analyst Team