Gold Analysis

July 12, 2018 @ 15:34 +03:00

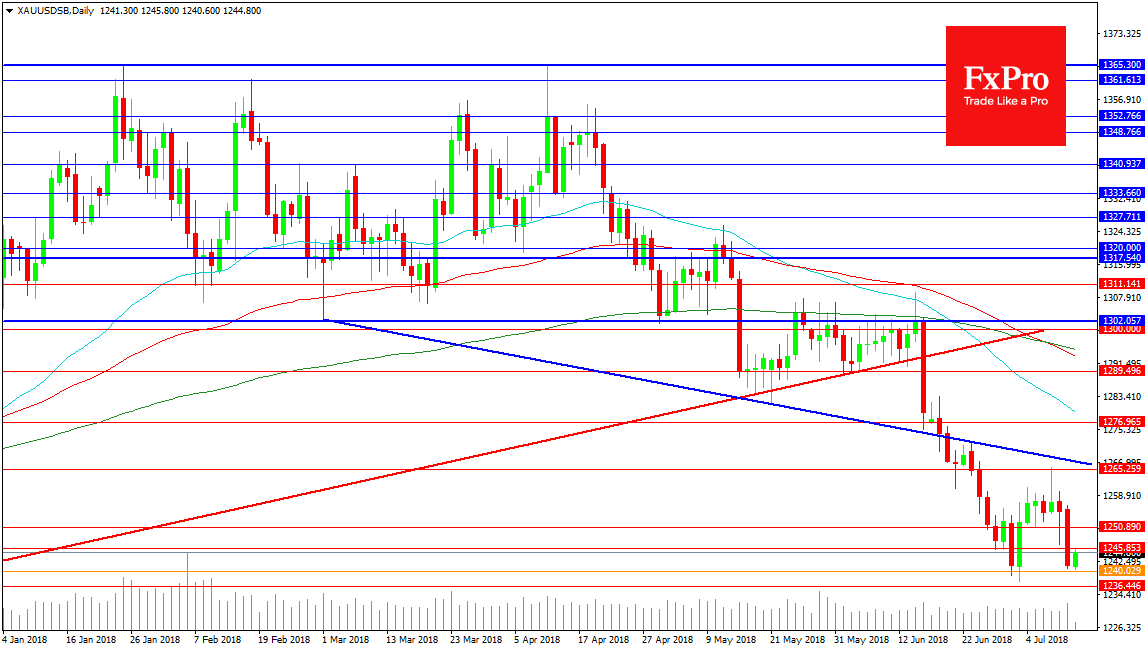

The metal has plunged lower to support at 1240.00 yesterday after retracing last month’s decline to the 1265.80 level. The 1240.00 area was the target for the double top from 1365.30 and it would appear that sellers are taking profit in this area. The low reached was 1237.50 and any move under this area could point to an extension of the move towards 1200.00. It is also possible that buyers step in around the lows and develop a double bottom pattern on the chart. This would initially target the 1290.00 on current estimation.

Resistance comes in at 1250.89 followed by the 1265.25 area. A push beyond encounters the falling blue trend line while a continued advance would meet with 1276.95 and the 50 DMA at 1279.45. The 100 and 200 DMAs are found around 1294.00. A break to 1300.00 would be considered as neutral on this daily chart but a push higher to 1311.00 would tip the balance in favour of bulls. A break above 1320.00 or 1327.00 would put gold bulls in clear space for a run to 1350.00 and beyond to 1365.00.