Another monthly dip of S&P500, will it recover quickly this time?

September 13, 2021 @ 11:56 +03:00

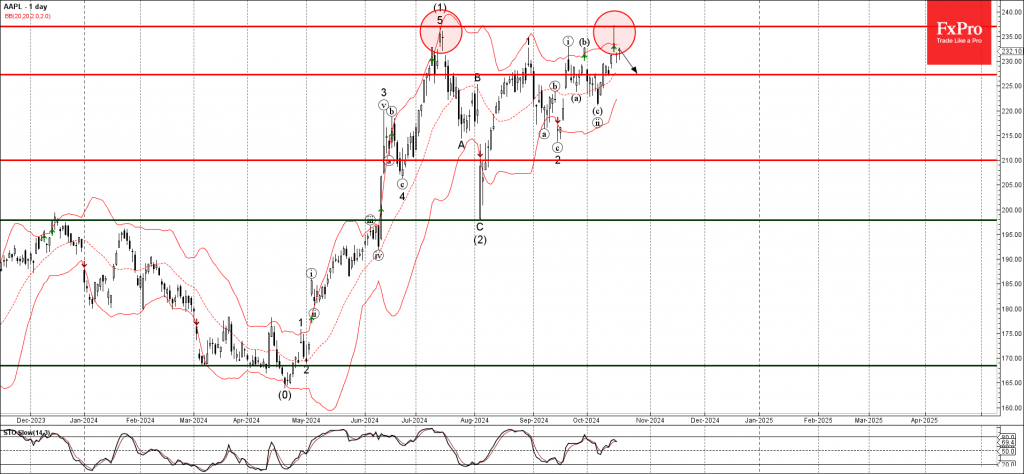

Demand for risk assets in financial markets continues to shrink with two significant drivers. Firstly, sentiment is undermined by the sustained sell-off in equities that has dominated the week during the US trading session. Secondly, China is not backing down on its ideas to limit the strength of the big technology corporations, while the US court decision bit off some profit from Apple.

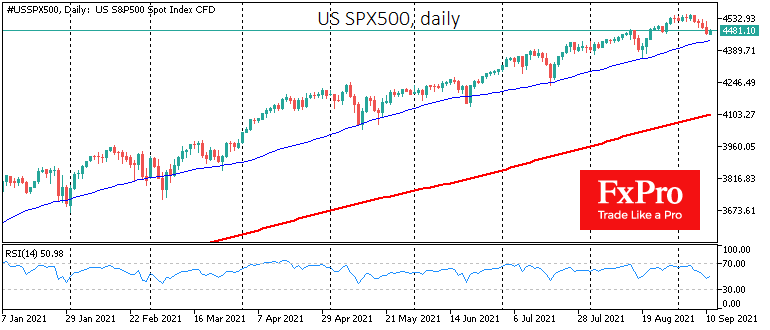

The US S&P500 came under pressure during the New York session on Friday, with pressure intensifying towards the close of trading, reflecting the wariness of professional managers. The index is again a couple of steps away from its 50-day moving average. The index has fallen to this line around the middle of each month since May, and each time it finds support on dips there.

However, it is dangerous to rely on correlations in the markets as they break too frequently. It is worth paying attention to the performance of the American stocks near the 50-day average and not deciding for a short-term move before it tests these levels. Consolidation under 4430 could launch a deeper correction towards the 200 SMA at 4100. A pullback from 4430 would focus on returning to the historical highs above 4550 within just a week or two.

The FxPro Analyst Team