Yen bears have a good chance of reaching lows not seen since 1990

February 19, 2024 @ 15:01 +03:00

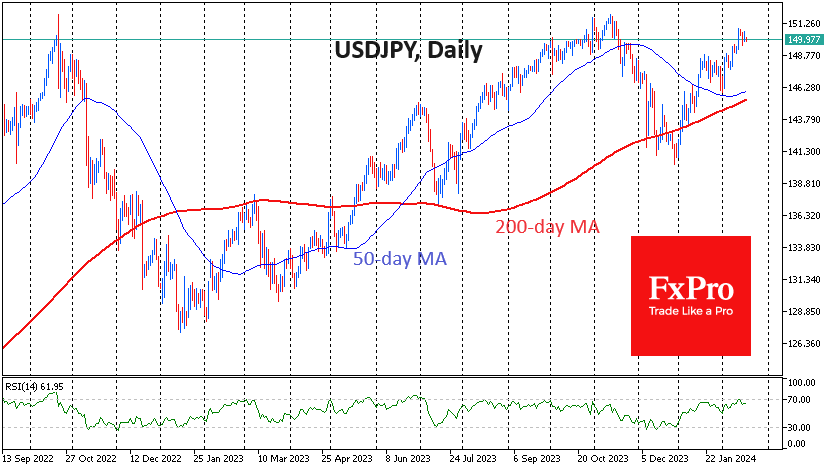

The Japanese yen is hovering near 150 per dollar, retreating from last week’s four-month highs of 151. The 150-152 area is hazardous for short-term traders, as this is the level from which the Japanese Ministry of Finance intervened in October 2022 and November 2023 to stop the currency from depreciating.

However, it would be too naive to expect a reversal from 151.8, as it has happened several times before. A weaker yen makes Japanese exports more competitive and thus stimulates the economy. In addition, the currency’s weakness fuels imported inflation and puts downward pressure on prices.

By using this tool moderately, the country’s finance ministry and central bank can address their long-term problem of a stagnant economy and deflation. The momentum of the yen’s depreciation in 2022 was excessive, exceeding 30 per cent in seven months. Interventions and the unwinding of long positions in the market have given the yen back about half of this decline.

The second wave of pressure started in March 2023 and lasted about seven months, taking USDJPY back to the peak of the previous cycle. This time, it is harder to say whether we saw intervention or whether the market switched to buying the yen as the outlook for the dollar changed sharply. As with the first wave, the pullback has lost strength, giving back about half of the initial move, or about 7.5%.

The current phase of USDJPY gains began in early January and is taking the yen to extremes before the beginning of March. At the same time, bets on further Yen weakness have risen to their highest levels in over two years. This extreme positioning creates a breeding ground for a downside move, as is the case with such counter-trend strategies.

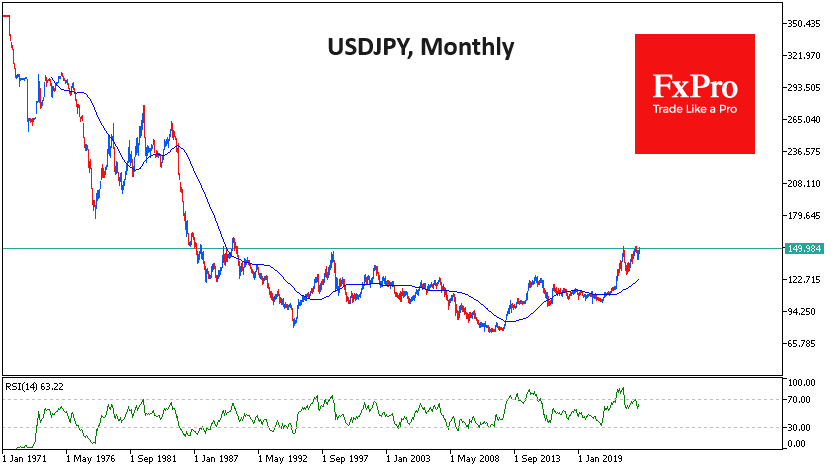

The yen’s growth impulses have allowed the economy to adjust, so there is no need to defend precisely the 152 level. USDJPY is now 14% higher than a year ago. This is not a critical drop. In our experience, officials start to get worried about exchange rate movements when they approach 20% year-on-year.

In the case of the yen, one should be prepared for neither the Bank of Japan nor the Ministry of Finance to refrain from active action and perhaps even verbal intervention until the 160 yen/$ level, which is the next round level coinciding with the 1990 peak.

Officials may allow the yen to weaken thanks to slower inflation and lower commodity. Japan’s economy has contracted for the past two quarters, suggesting a need for support. Meanwhile, the outperformance of the stock market suggests confidence that the economy is not overly burdened by exchange rate volatility and will soon benefit from more competitive prices for its goods.

The FxPro Analyst Team