World’s Largest Pension Fund Loses $165 Billion in Worst Quarter

July 03, 2020 @ 13:17 +03:00

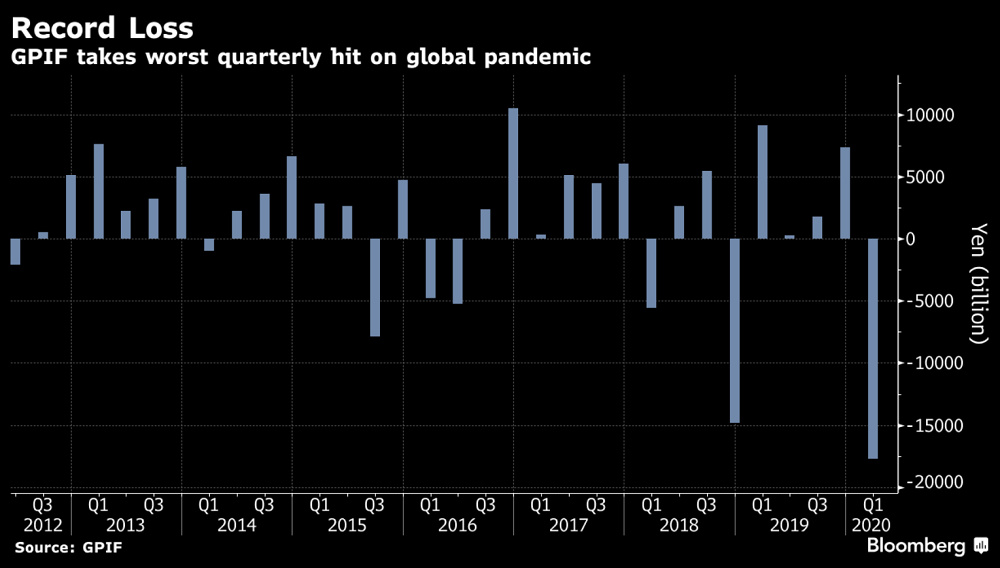

The world’s biggest pension fund posted a record loss in the first three months of 2020 after the coronavirus pandemic sparked a global market rout in the period. Japan’s Government Pension Investment Fund lost 11%, or 17.7 trillion yen ($164.7 billion), in the three months ended March, it said in Tokyo on Friday. The decline in value was the steepest based on comparable data back to April 2008, reducing the fund’s total assets to 150.63 trillion yen. Foreign stocks were the worst performing investment, followed by domestic equities.

The results come just months after the fund revamped top management and revised its asset allocation to focus more on overseas debt. The loss, which wiped out gains for the fiscal year, may attract political attention as social security remains a major concern for tens of millions of Japan’s retirees. Overseas bonds were the only major asset to generate a positive quarterly return. The securities gained 0.5%, compared with losses of 0.5% for domestic bonds, 18% for local equities and 22% for foreign stocks. In April, GPIF raised its asset allocation to foreign bonds by 10 percentage points to 25%, while keeping the target for foreign and domestic stocks unchanged at 25%.

During the January-March quarter, the MSCI All-Country World Index of global stocks slumped 22%, the worst since the global financial crisis. Yields on the 10-year U.S. Treasuries slumped 125 basis points to near record lows during the same period, fueled by unprecedented measures from the U.S. Federal Reserve and intense demand for haven assets. From April, the GPIF has adjusted its portfolio, setting a general target to keep 25% each in all four asset classes, with the allocation of each assets allowed to deviate by different ranges.

World’s Largest Pension Fund Loses $165 Billion in Worst Quarter, Bloomberg, Jul 3