World markets step back from peaks

November 18, 2020 @ 12:35 +03:00

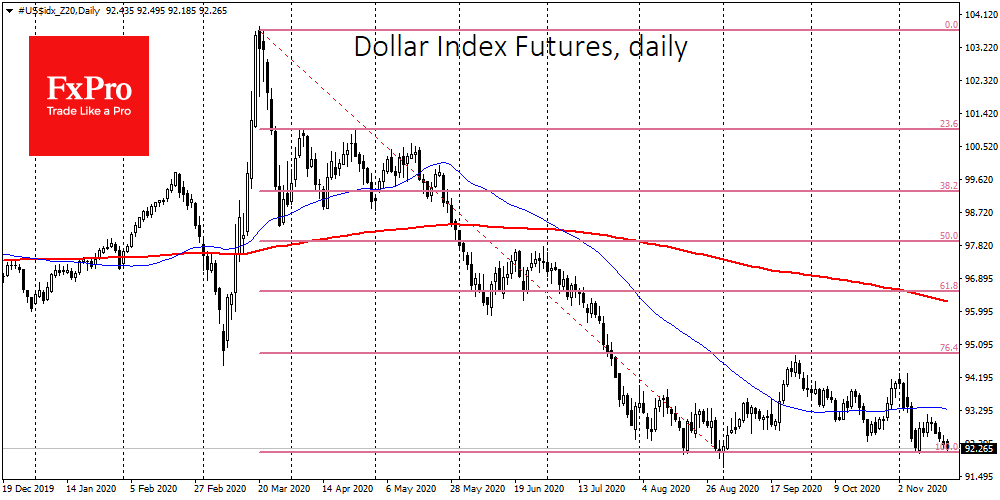

Global markets are retreating from their recent highs due to signs of a weakening recovery. But this is not helping the dollar, which is losing in a fifth consecutive trading session against a basket of the world’s leading currencies.

In recent days, we saw a decline in the US consumer sentiment and a slowdown in retail sales growth. The Fed’s speeches also raised the degree of caution in the markets. Yesterday, Powell once again confirmed that the coming months would be “challenging” and the economy still has “a long way to go” to recover. The Fed also reiterated the need for new support measures and called to postpone US deficits problems to a post-crisis time.

The weakening of the dollar feeds interest in equities and commodities. However, it may be the case today that the decline of the dollar is driven by cautions that it will save its purchasing power rather than a desire to invest in risk-related assets.

The Fed’s comments also support expectations of an expansion of the QE programme, although there is doubt in stock markets that these measures are sufficient to support further growth.

We observed earlier that stock indices have skyrocketed, and further dynamics will be very indicative. Yesterday and this morning, investors are inclined to sell stocks after the recent rally, allowing them to touch areas above 3,600 on the S&P 500 and 30,000 on the Dow Jones.

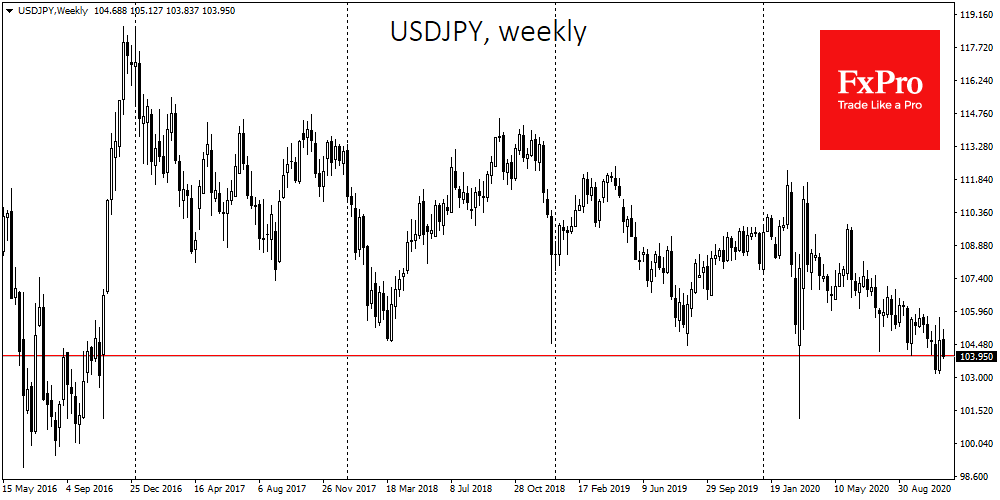

It is also worth paying attention to USDJPY as an important indicator of risk demand. Earlier this month it was down to 103.25 and then rushed upwards to 105.60 in the expansion of the Bank of Japan QE and the post-election rally. But since last Thursday it has been systematically down, falling again below 104.0 this morning, under an essential support level. It is interesting to note that the Japanese and American indices tested highs earlier this week but failed to reverse USDJPY upward.

Several times we have seen evidence that a steady strengthening of the yen often goes hand in hand with or precedes a weakening of the markets.

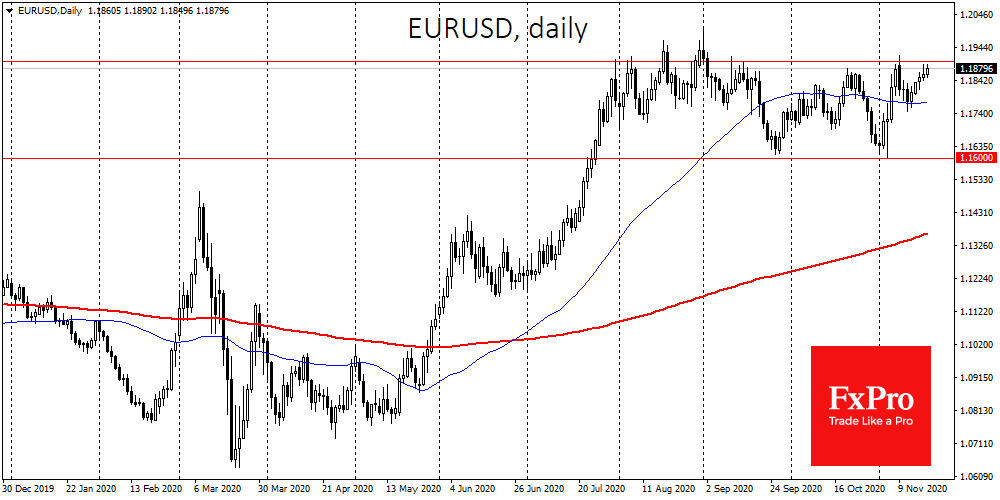

At the same time, the euro, replicating the yen, is also moving to its local highs, having settled at 1.1900. These dynamics make us wonder whether the euro has changed from risky to protective status. In this case, the rise of the euro is bad news for markets and especially for European markets, where EURO50 has only recently managed to break through to its highs since March, and the DAX30 is stuck above 13000.

The FxPro Analyst Team