Will the Fed restore faith in the dollar, and will it hurt shares?

December 16, 2020 @ 12:40 +03:00

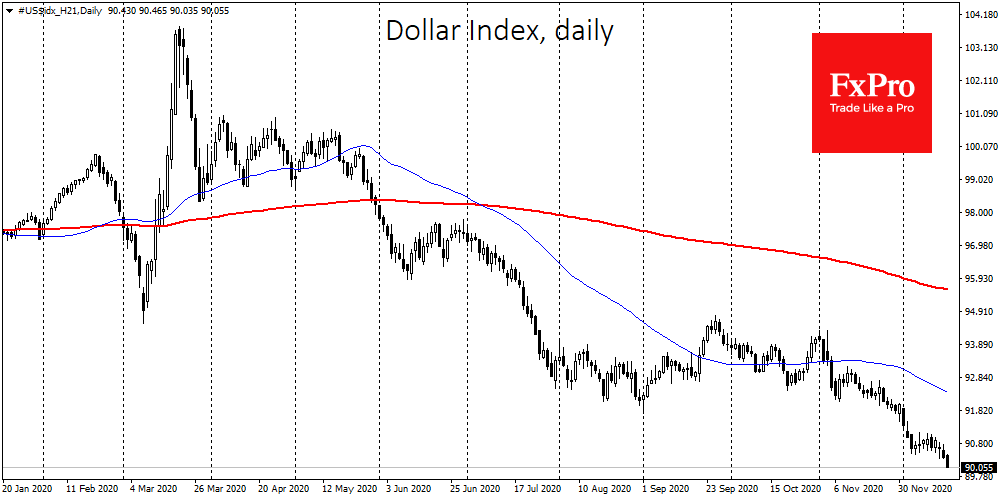

The dollar index is hovering near 2.5-year lows ahead of this year’s final Fed meeting. This will be one of the key meetings expected to publish updated economic forecasts and rate expectations as well as adjustments to monetary policy parameters, likely promising to maintain QE in the coming years.

The easy part of the job for the Fed is that suppressed inflation allows for a soft approach to monetary policy. Despite a 6% fall in the dollar last year, US consumer prices rose by only 1.2% in November. The core PPI released at the end of last week noted an increase of 1.4% compared to the previous year, and the overall index is only adding 0.8%. This gives a clear signal that inflation will remain subdued for the foreseeable future.

The labour market indicators are also forcing the Fed to act with employment at 6.5% or almost 10 million jobs below their February peaks and 11.7 million below what it could have been given the pre-crisis growth pace.

In other words, two key parameters, inflation and unemployment, clearly compel the Fed to maintain or even further soften its policy. However, the Fed should take a broader view. Next year the American government would need to borrow $5.8 trillion in treasuries and bonds to finance the deficit and maturing securities. This amount could increase in the event of extensive new aid packages from the government.

However, markets are mainly showing an appetite for US shares, which have seen record inflows from both domestic and foreign investors. The appetite for bonds is much more modest, as US Treasury long-term bonds are falling in price (yield increase).

From a historical perspective, their yields are not far from record lows. However, the trend could pick up quickly if investors doubt US debt sustainability or only concentrate on buying stocks.

In such circumstances, the Fed may help the Treasury by providing demand for government bonds. But another an important point is the management of expectations, which could disrupt some of the investor interest for equities and bring back demand for “safe” debt securities. Demand for insurance increases if the future is uncertain. The Fed would not be wrong to remind markets that the future is clouded and that liquidity measures are unlikely to exclusively feed equity price increases.

The FxPro Analyst Team