What is ahead: EU CPI, US NFP

August 29, 2025 @ 16:57 +03:00

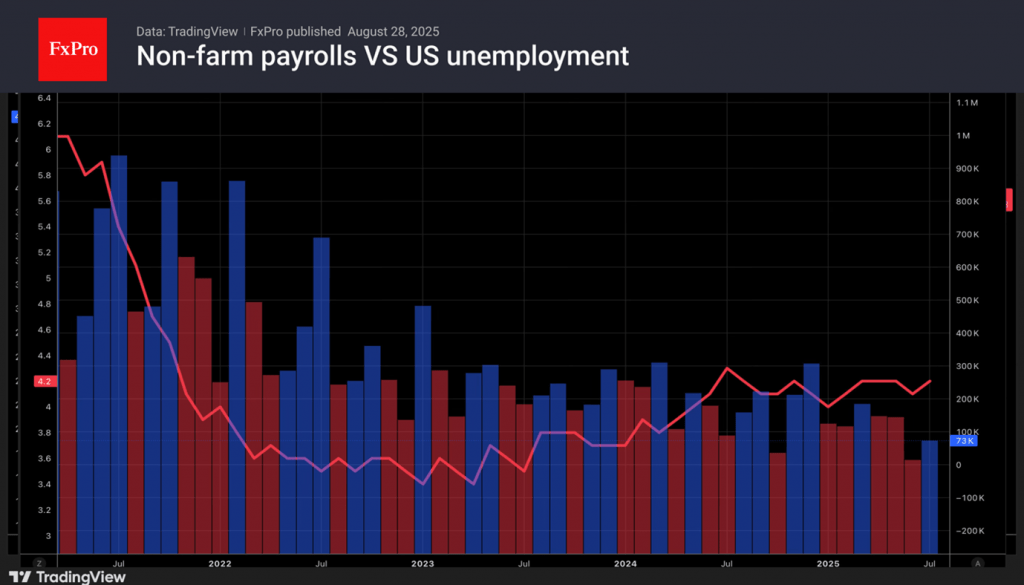

The key event of the first week of September will be the August US labour market report. Disappointing statistics for May-July led to a dovish shift by the Fed. If the data continues to deteriorate, the Fed may cut rates more than once before the end of 2025.

Employment dynamics are influenced not only by Donald Trump’s anti-immigration policy but also by Elon Musk’s Department of Efficiency’s mass layoffs of civil servants. Until recently, civil servants who were laid off were considered employed. Significant adjustments should be expected by autumn. Trading Economics expects non-farm employment to grow by 50,000. This will be another blow to the US dollar.

Statistics on business activity from the Institute for Supply Management will give an idea of the state of the US economy. At the beginning of the week, pay attention to estimates of European inflation in August. Many believe that the ECB has ended its cycle of monetary policy easing. Consumer prices will help us understand whether this is true or not.

The FxPro Analyst Team