Weak global economy and US supply growth weigh on oil price

August 17, 2023 @ 14:01 +03:00

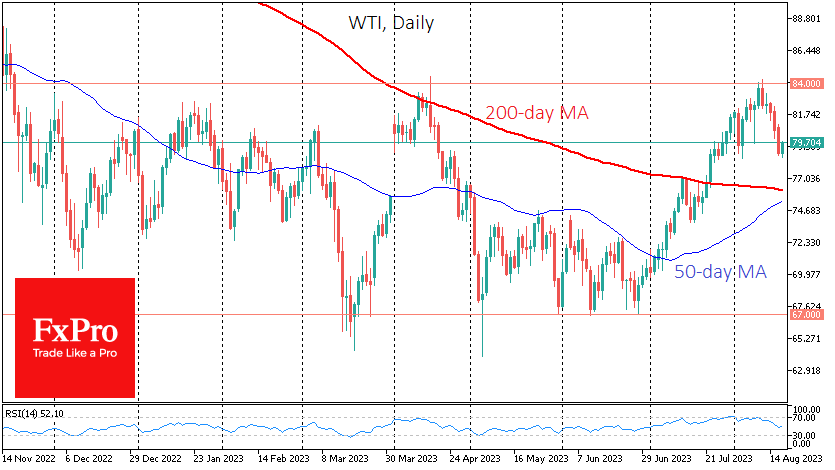

WTI crude oil is down almost 7%, having fallen for the last seven days. The sell-off intensified as the price touched levels above $84. As has happened several times this year, this reversal could be a precursor to a fall to the lower end of the range around $67.

Risk appetite is waning in global markets as rising yields on US and European bonds make them more attractive from a risk/reward perspective.

China continues to publish disappointing growth reports, and problems in the country’s construction sector are spreading through the economy. The Politburo’s latest stimulus measures appear insufficient. As a result, markets are revising the demand outlook for the largest crude oil consumer.

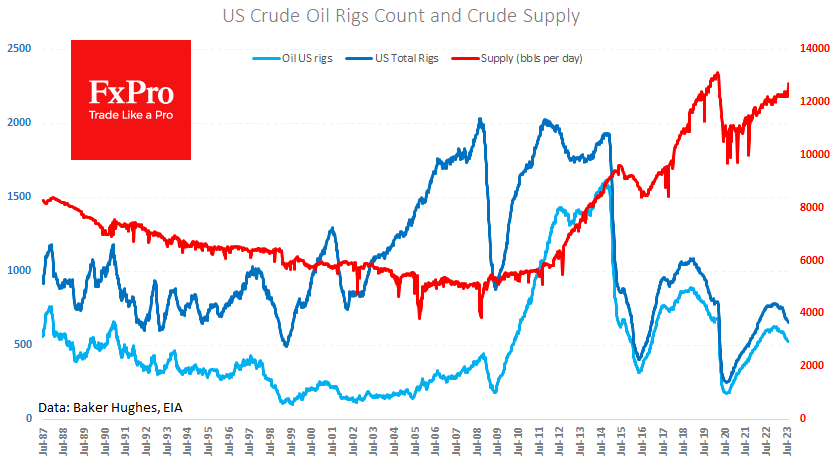

At the same time, US producers are ramping up production. According to the weekly report released on Wednesday evening, average daily production climbed to 12.7M BPD last week – the highest since March 2020 – a notable breakthrough after several months of stagnation at 12.2M.

The jump in production looks like a reaction to the price rising to the top of the trading range since last November.

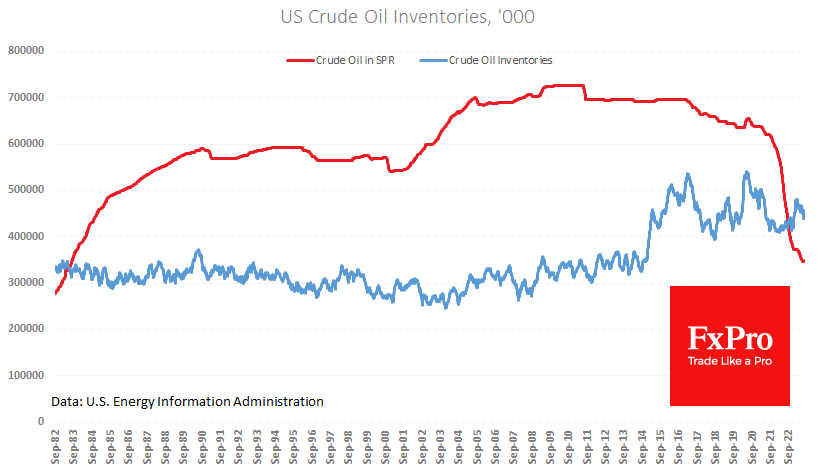

Demand has also played its part. Commercial stocks were up just 3% year-on-year, and the one-week drawdown at the end of July was the largest on record.

And this coincides with the start of cautious oil purchases into the Strategic Petroleum Reserve.

The latter two reasons look bullish for crude, but the speed at which the US has ramped up production over the past two weeks and increasingly worrying signs of slowing global demand outside the US, look more compelling for now.

From a technical perspective, WTI crude oil, having reversed from the upper boundary of the price corridor since November, is now moving towards its lower boundary at $67. So far, there is only one major obstacle: a potential crossover of the 50 and 200-day averages at $76.

The FxPro Analyst Team