Weak China inflation pressing CNY

December 11, 2023 @ 18:22 +03:00

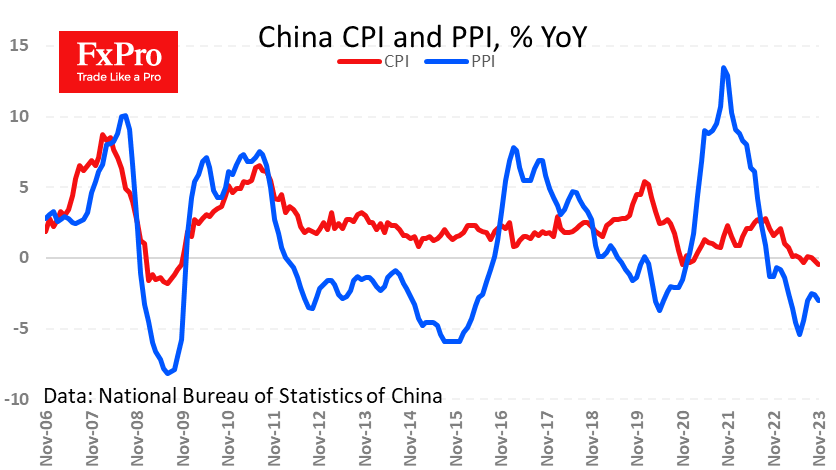

Consumer prices in China accelerated their decline in November, losing 0.5% yoy vs. 0.2% yoy expected and the same amount a month earlier.

Producer prices also intensified their decline, losing 3.0% y/y vs -2.6% previously and a softer-than-expected -2.8%. PPI has been in negative territory for the past 13 months, also losing 1.3% y/y in November 2022.

The weakness in consumer prices has brought the markets’ focus back to the health of the national economy and led analysts to suggest that consumers are choosing to save. This is a negative signal for markets, which had hoped that domestic consumption in China would be a growth driver in the face of waning external demand.

Low inflation is a negative for the local currency for the following reasons. First, falling consumer prices point to problems with domestic demand, indicating room for stimulus. Second, the intensified fall in producer prices also hints at sales problems of the “global factory”.

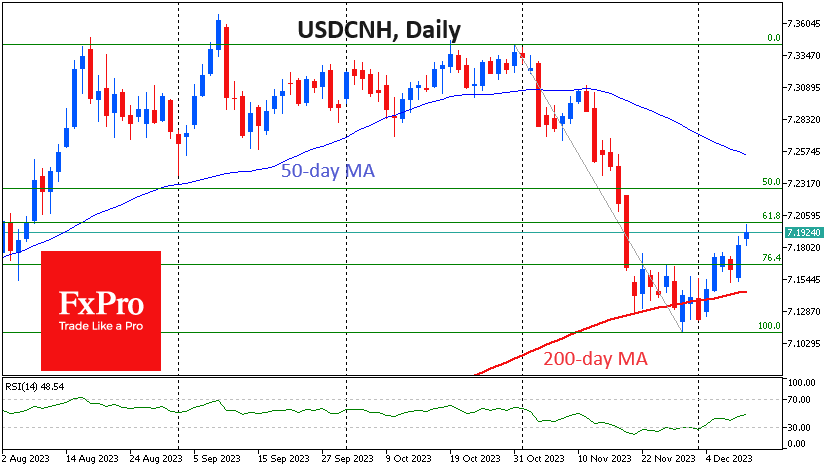

A weaker yuan for China would be an attempt to address several issues at once, from improving the competitiveness of Chinese exports to trying to boost retail sales by encouraging Chinese to spend now rather than save.

The USDCNH exchange rate approached as close as 7.20 on Monday, playing off the weakness in inflation and the general dollar trend that prevailed on Monday. In addition, the pair’s ability to quickly move back into territory above the 200-day average and begin to recover from a local oversold condition should be considered a bullish signal for the pair. The pair’s ability to consolidate above 7.20 would be an indication that we are seeing more than a correction from the decline. If this is the case, the road to 7.26 potentially opens up, and beyond that, possibly to all-time highs above 7.36.

The FxPro Analyst Team