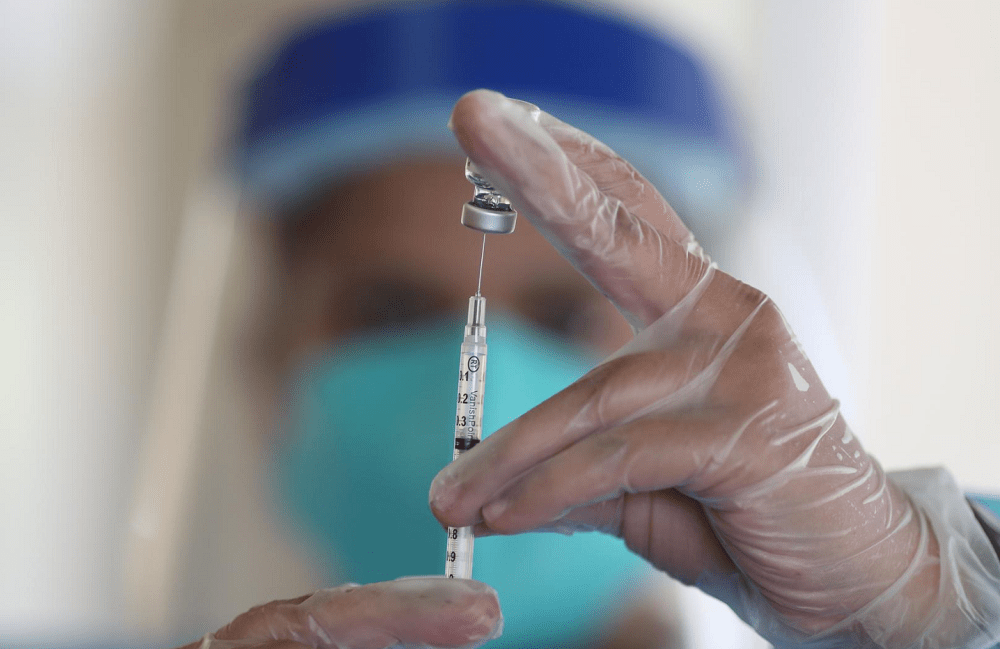

Wall Street hedges against possible bumps in U.S. vaccine rollout

January 22, 2021 @ 10:09 +03:00

As U.S. stock prices have marched to record highs, futures contracts for Wall Street’s “fear gauge” show some investors are buying insurance against market turbulence that could erupt if surprise glitches hit the U.S. rollout of COVID-19 vaccines. This hedging can be seen in futures on the Cboe Volatility Index expiring in March and beyond, which are trading well above the index’s current levels. Uncertainty over the rollout has also helped keep the “fear gauge” hovering above its long-term average near 20, even as the S&P 500, Dow Jones Industrial Average, Nasdaq and small-cap Russell 2000 have rallied to record highs this week.

Investors said they would watch how close President Joe Biden can come to his goal of administering 100 million doses of the vaccine in the first 100 days of his term. On Thursday, he signed executive orders aimed at expanding testing and vaccinations. “The next 100 days or so will be focused on the vaccine rollout and employment,” said Stacey Gilbert, portfolio manager for derivatives at Glenmede Investment Management. “If unsuccessful, that could potentially be negative for the market.”

Breakthroughs in COVID-19 vaccines and assumptions that life will return by summer to a semblance of normalcy have helped boost the S&P 500, now up more than 70% from its March lows. There have been rallies in shares of banks, small caps and other companies that would benefit most from economic reopening.

The VIX in turn has drifted lower since March, when it surged to a record closing high of 82.69 after years of muted swings in U.S. stocks. Massive monetary and fiscal stimulus, along with optimism toward an economic recovery, have helped subdue the fear gauge.

Yet missed vaccination targets could bolster the case for investors looking to take profits, potentially ushering in more market swings. Fund managers in a recent BofA Global Research survey named potential problems with vaccine distribution as the market’s top “tail risk” – an event that could cause severe dislocations in asset prices.

Analysis: Wall Street hedges against possible bumps in U.S. vaccine rollout, Reuters, Jan 22