Virus-hit stocks shed $3 trillion; safe havens thrive

February 27, 2020 @ 15:42 +03:00

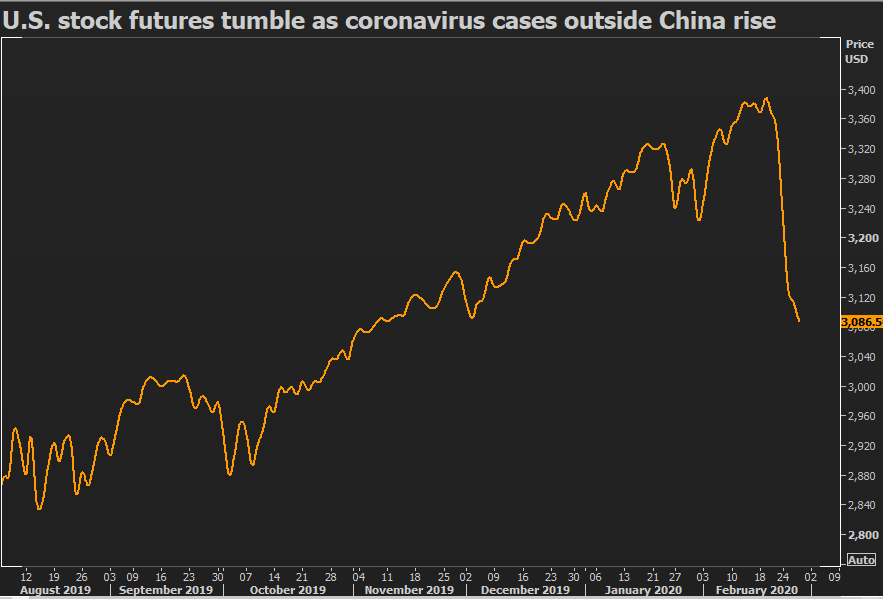

Stocks resumed their plunge, wiping out more than $3 trillion in value this week alone, and U.S. Treasuries yields hit record lows on Thursday as the coronavirus spread faster outside China and investors fled to safe havens.

The number of new coronavirus infections in China – the source of the outbreak – was for the first time overtaken by fresh cases elsewhere on Wednesday, raising pandemic fears.

The pan-European STOXX 600 index opened 2.3% lower and Italy’s blue-chip index sank. Dozens of European companies have warned about potential damage to their profits.

In the United States, Microsoft became the second trillion-dollar company to warn about its results after Apple. Frankfurt-listed shares were down 4%.

Global equities have now fallen for six straight days. Wall Street’s so-called fear gauge was near its late 2018 highs.

Spot gold rose 0.5% to $1,649 per ounce and silver gained 1% to $18.03 an ounce. Gold prices hit a seven-year high at near $1,688 per ounce on Monday.

Meanwhile, the yield on U.S. Treasuries, which falls when prices rise, dropped below 1.3% and the yield curve continued to send recession warnings. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.5%, taking it more than 4% lower for the week. Safe-haven currencies such as the Japanese yen and the Swiss franc gained on Thursday with the Japanese currency heading towards 110 yen to the dollar, up nearly 2% so far this week. The dollar fell 0.32%.

Virus-hit stocks shed $3 trillion; safe havens thrive, Reuters, Feb 27