Very few reasons for markets to cheer above-expectations NFP report

May 08, 2020 @ 17:39 +03:00

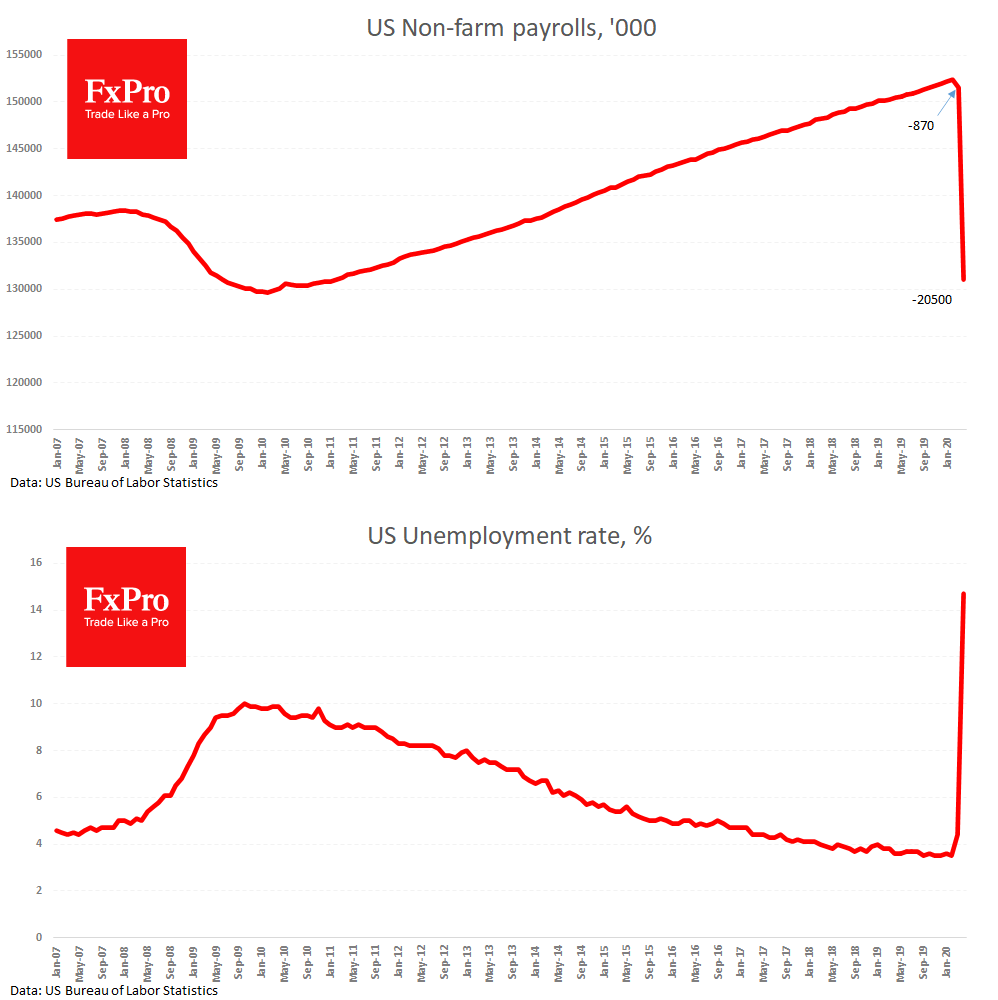

The decrease in the number of people employed in the US in April turned out to be less than expected by one and a half million people. However, this is not the case when such a slip can cause a lasting rally of markets. According to the recent report, the number of jobs decreased by 20.5 million people after a decrease of 0.87M a month earlier (revised from -0.701M) to 131 million. The last time so few jobs were in early 2011. However, nine years ago, this number of employees corresponded to 9% of the unemployment rate against 14.7% now. This is the highest rate in the history of the indicator since 1948.

As during the global financial crisis, one should pay attention to a broader unemployment measure, which takes into account those who underemployed for economic reasons (U-6). This indicator rose to 22.8%, affected almost every fourth.

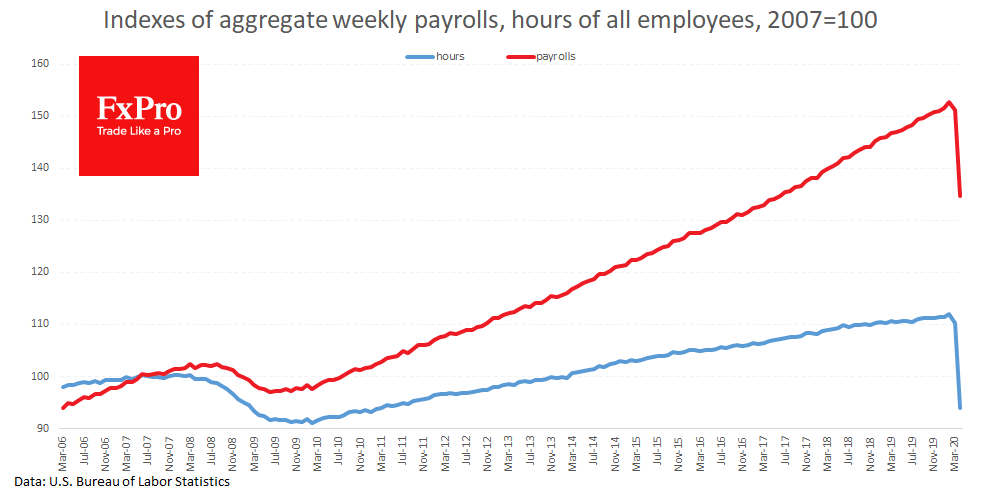

Those who remained at work received significantly more. The average hourly wage increased by 4.7% per month and 7.9% compared to April last year. And this is very strong, given that the average working week has increased by 0.1 to the previous month. The same trend, although less pronounced, was in 2009-2010. Layoffs first wiped low-paid employees. In the early stages of “optimisation,” this leads to a jump in average salaries and overall productivity. In total, the index of total hours worked in the US economy decreased by 16% from the peak of February, and wages received by 13%. Historically, these estimates are close to economic dynamics.

Since America has a plan to lift some quarantine restrictions, it will be essential to look at how things will develop further: whether employers will further optimise productivity, or immediately return to hiring employees.

The FxPro Analyst Team