USDJPY turns to a correction; how deep can it go?

July 29, 2022 @ 13:12 +03:00

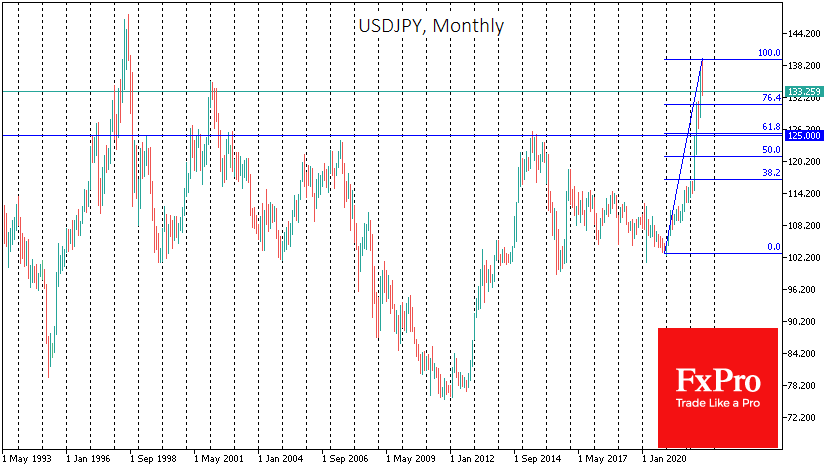

The Japanese yen has gained 3.4% against the dollar in less than 48 hours, recovering to 132.7 from a month and a half ago. Before that, from early March to mid-July, USDJPY soared by more than 20% on diverging monetary policy from the Fed and BoJ.

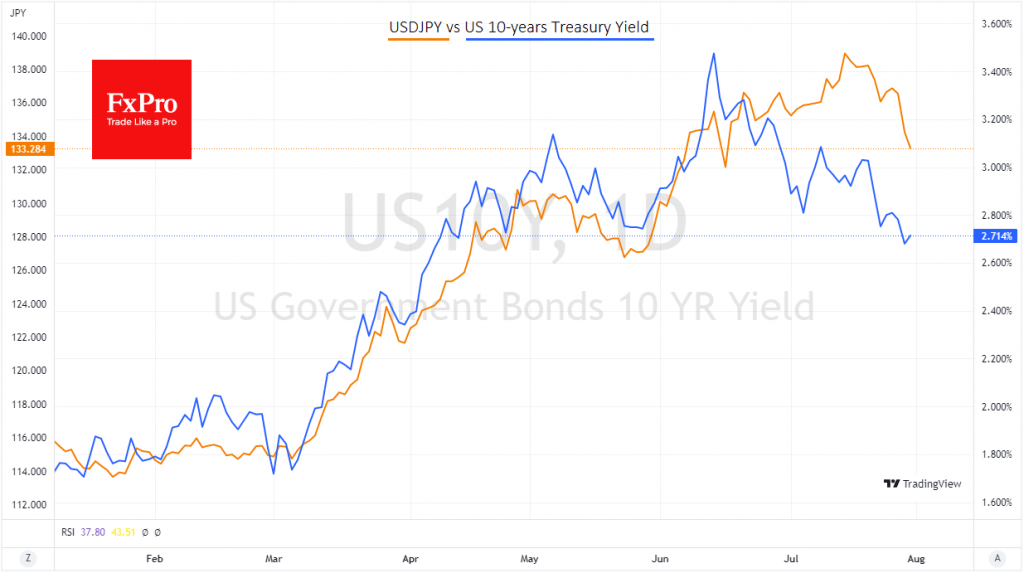

However, the markets have recently started to speculate that the Fed will soon return to a rate cut in a year’s time. Against this background, the yields of American 10-year bonds are falling, narrowing the spread between them and the same Japanese securities. However, we must note that the currency market was one month late with its reaction, changing the USDJPY trend one month after the reversal in U.S. 10-year bonds.

The sell-off in USDJPY intensified after the Fed meeting, although the trend in other currency pairs is not as evident. Most likely, USDJPY has moved into the correction phase of the last movement and has not yet exhausted its downside potential.

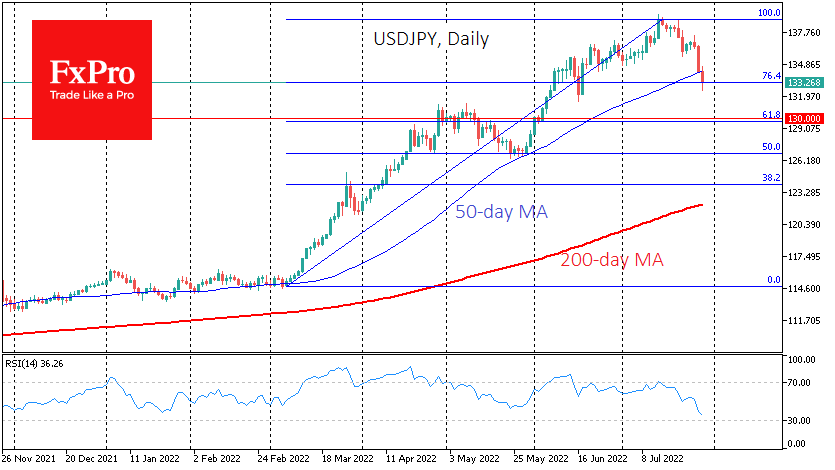

The first line of defence of the uptrend in the form of the 50-day moving average has an onslaught on Friday morning. Now the focus for the short-term traders is the pair’s ability to hold on to the 76.4% Fibonacci retracement line from the March-July rally, which passes at 133 – near the current price.

However, it would not be surprising if the correction extends to 130, the more significant 61.8% Fibonacci retracement line of that rally and the psychologically important round number, where the April-May rally had already stopped for a breather.

Suppose the August lull in the currency market turns into a correction. In that case, the USDJPY might well slide to 125, which is the next major round level, the area of cyclical peaks for most of the last 20 years and 61.8% of the Fibonacci retracement of the pair’s momentum from the beginning of 2021.

The FxPro AnalystTeam