US stocks find support

February 09, 2022 @ 12:56 +03:00

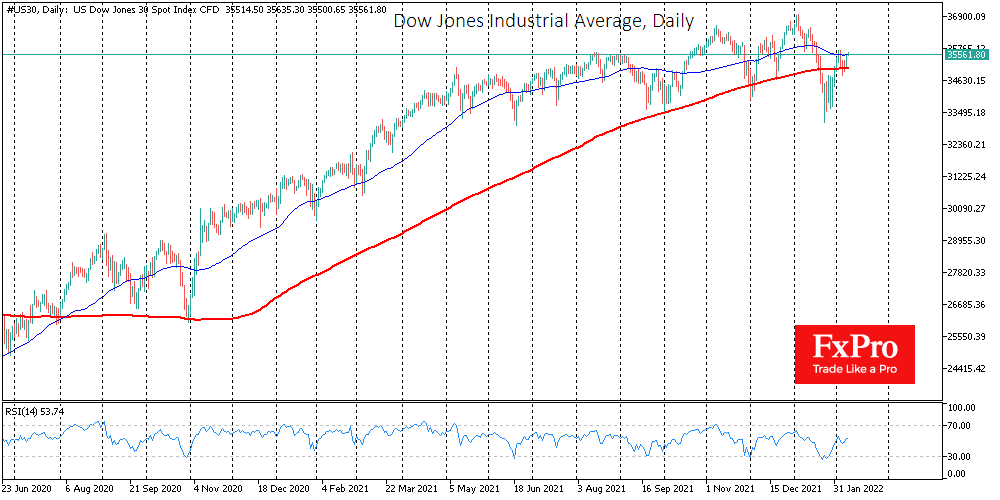

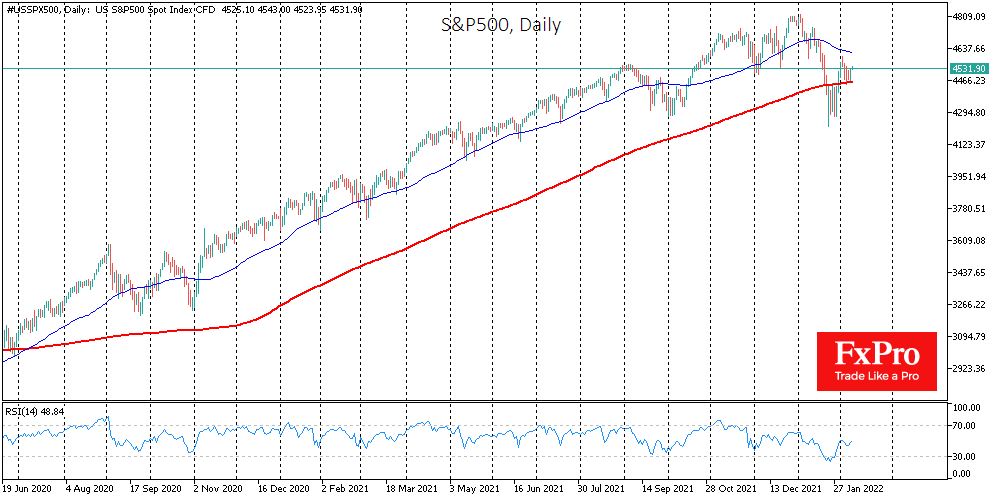

Stock markets continue their shaky recovery. On Tuesday, intraday trading patterns in US equities point to a buying trend on declines. The S&P500 and Dow Jones indices rebounded from their 200-day simple moving average.

Both indices were below those levels in the second half of January. Still, by the beginning of February, they managed to get back above them on the substantial buying activity of the retail investors.

Yesterday’s stock market dynamics slightly reduced the tension. Increased buying at the end of the session indicates a buying mood for professional market participants.

There have been increasing reports from US investment banks that markets have already priced in a tight monetary policy scenario and will not press equity prices further. Moreover, BlackRock recently noted that markets had priced in overly hawkish expectations.

The bond market also looks oversold, declining in previous weeks at the fastest pace since 2008. This is a good reason, at least for a technical rebound. In addition, buyers are supported by strong economic and wage growth, promising corporate earnings stability for the foreseeable future.

The switch to a monetary tightening phase turns the market into a more frequent and deeper corrective pullback mode but does not trigger a bear market before a rate hike even begins.

Strong fundamentals support a bullish technical picture, with a recovery from the strongest oversold S&P500 RSI and the ability to pop above the 200-day average.

From this perspective, the January drawdown has cleared the way for growth, recharging buyers.

On an equity level, we can see stabilisation and sharp upward moves in stocks that have been weak since June and shone in the pandemic before that: Peloton, Netflix, GameStop. In theory, this could be a dead cat bounce, but it reduces the selling pressure in blue-chip stocks such as Apple, Amazon, Microsoft, Google and straightens out the overall market sentiment.

The FxPro Analyst Team