US stock futures point to opening dip as investors monitor efforts to reopen the economy

May 12, 2020 @ 12:10 +03:00

Stocks futures were little changed in early morning trade on Tuesday as investors evaluated the latest attempts to reopen the economy.

Futures on the Dow Jones Industrial Average dipped 53 points, implying a Tuesday opening decline of about 61 points. Futures on the S&P 500 and Nasdaq also pointed to slight Tuesday opening losses for the two indexes.

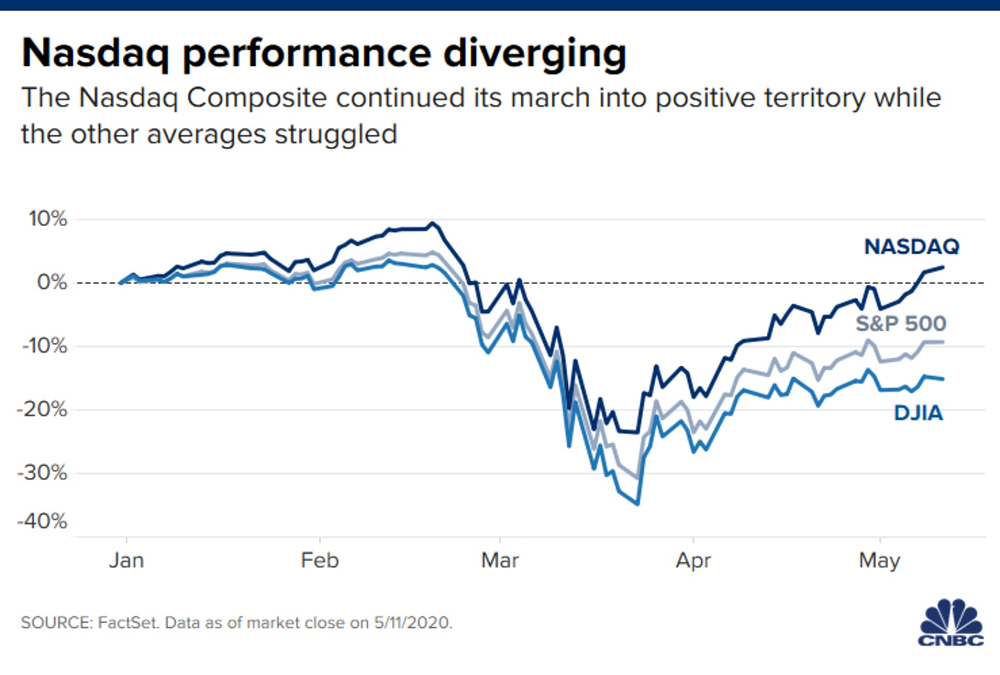

The tech-heavy Nasdaq Composite rose for a sixth day in the previous session, posting its longest winning streak this year. With Monday’s gain, the gauge is firmly in the green on the year, up 2.4% and sitting just 6.5% from its record high reached on Feb. 19.

The Dow fell about 100 points to start the week, while the S&P 500 was little changed on Monday.

Investors continued to pile into tech firms whose businesses proved to have the most resilient in the age of coronavirus crisis. Shares of Amazon and Netflix both soared more than 30% this year, while Microsoft gained 18%. Chip maker Nvidia also hit an all-time high on Monday, bringing its 2020 gains to 37%.

While bouncing swiftly from their March lows, the S&P 500 and the Dow are still well in the negative territory for the year, down 9.3% and 15.1%, respectively. Energy remained the worst-performing sector among the 11 S&P 500 groupings, with a 36% loss in 2020.

Meanwhile, traders continued to weigh attempts to reopen economies against fears of an increase in coronavirus cases that could lead to future lockdowns.

New York Gov. Andrew Cuomo said Monday the state’s restrictions on certain low-risk businesses and activities will lift on Friday. The World Health Organization said several countries that eased coronavirus restrictions, including China, have seen increases in the number of positive Covid-19 cases.

US stock futures point to opening dip as investors monitor efforts to reopen the economy, CNBC, May 12