US Retail Sales are growing steadily, except for building materials

August 15, 2025 @ 16:35 +03:00

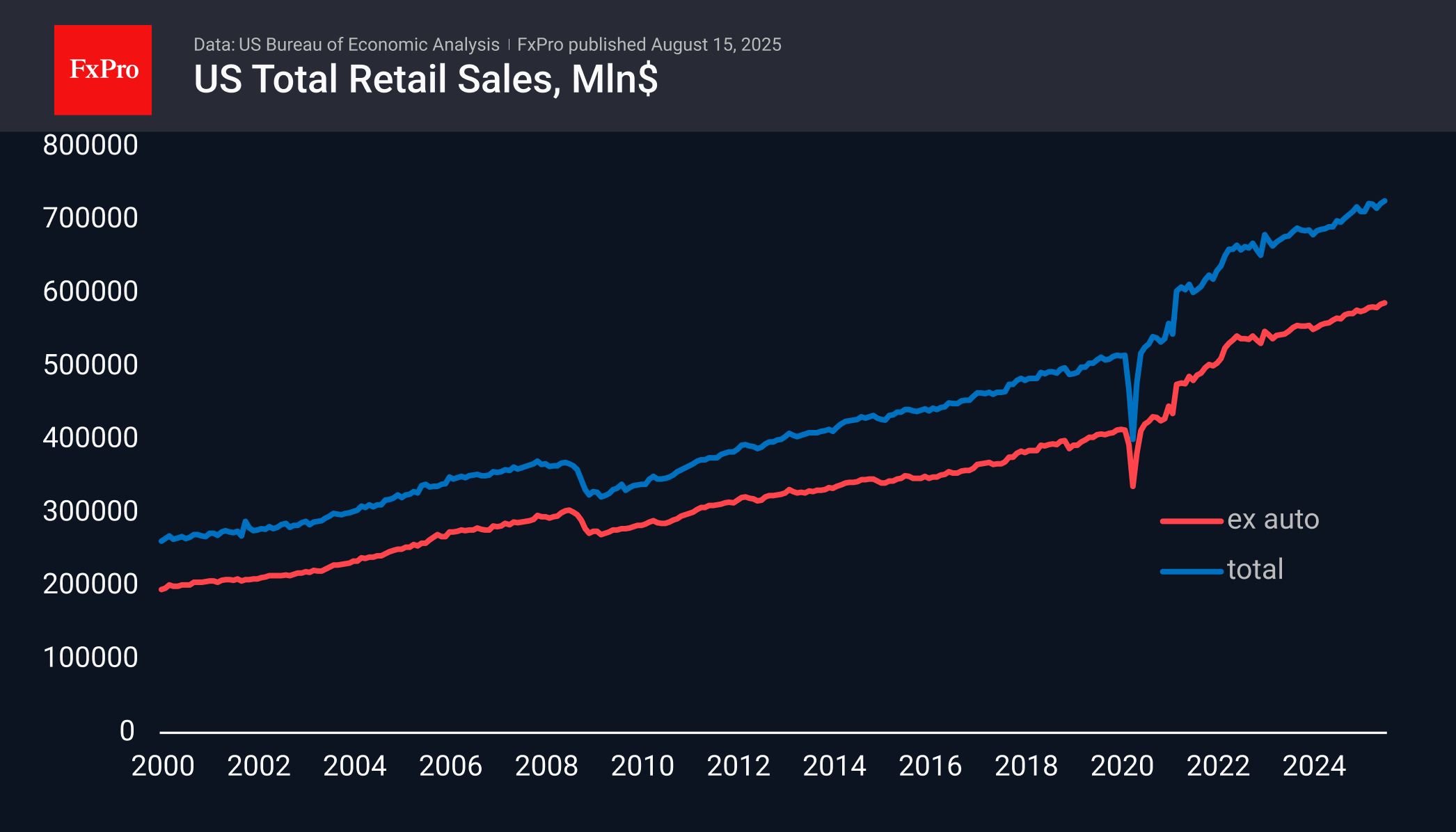

Retail sales in the US came in line with expectations, allowing markets to breathe a sigh of relief after surprises from CPI and PPI. Sales in monetary terms rose 0.2% m/m after 0.8% a month earlier. By July last year, growth was 3.9%, outpacing inflation of 2.7%. Sales excluding automobiles rose 0.3% m/m after rising 0.8% the previous month. This indicator shows a surprisingly steady upward trend since the beginning of 2024 and does not indicate any difficulties in consumer activity.

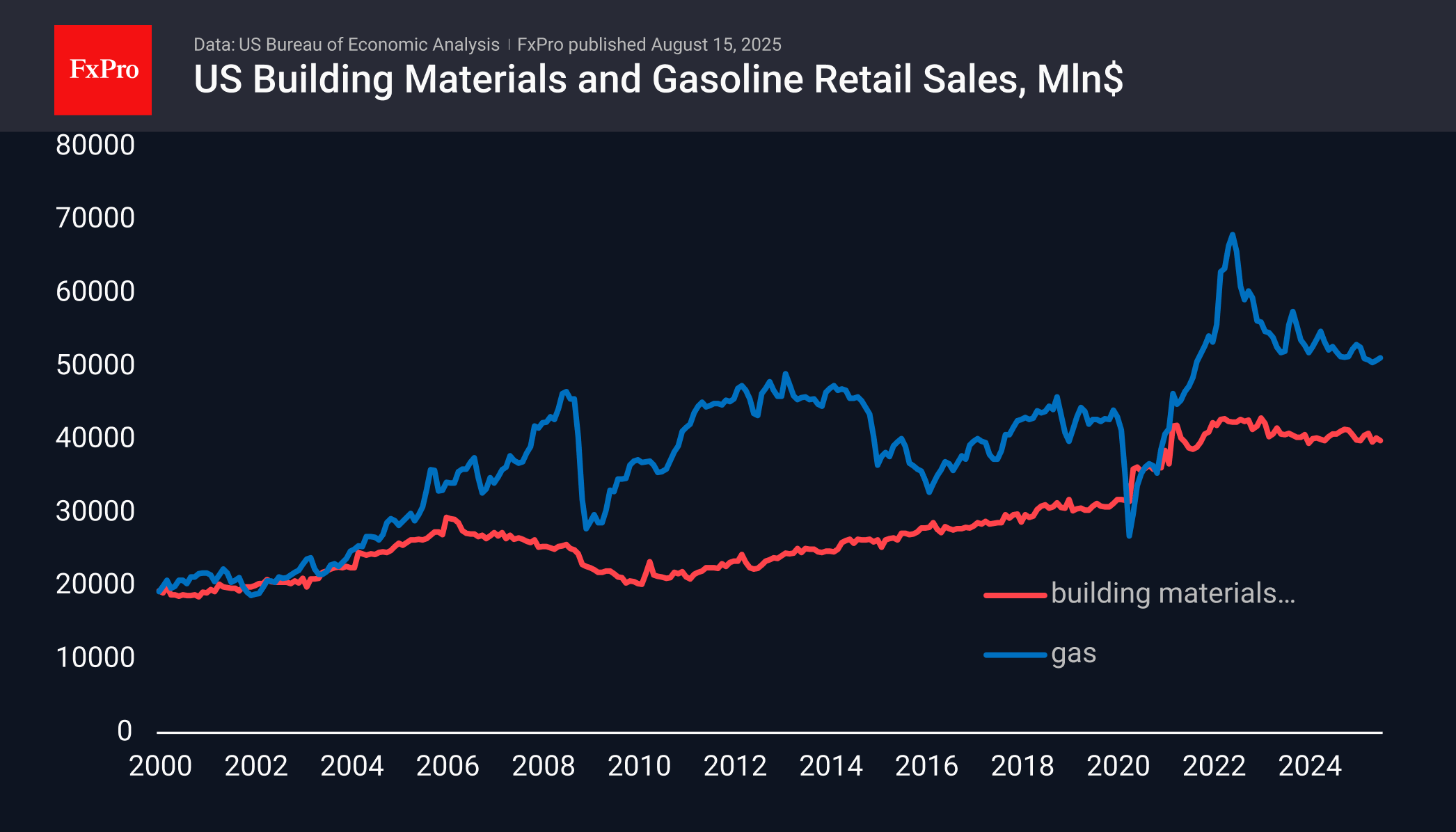

This may be indicated by the decline in sales of building materials over the last three years or so, raising fears of a possible repeat of the mortgage crisis. At that time, spending peaked at the end of 2005 and declined over the next five years. At the same time, in 2007, problems with banks began to surface one after another, linked to the cooling of the market.

On the other hand, the biggest negative impact on financial stability was the decline in prices. Today, prices are rising, but volumes are falling, dispelling fears of a repeat of the US mortgage crisis.

The FxPro Analyst Team