US PPI is rising stronger than expected

October 11, 2023 @ 16:56 +03:00

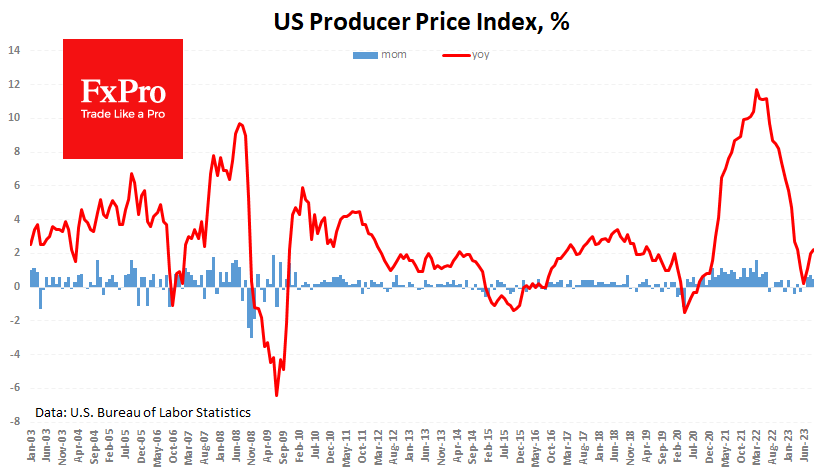

Headline PPI rose 0.5% m/m instead of the expected 0.3%. In the same month a year earlier, the index was higher by 2.2% instead of the expected 1.6% y/y. This divergence in the estimates of annual rates is due to an upward revision of the previous months’ figures. Simply put, producer price inflation turned out to be higher than expected.

US producer prices are rising stronger than expected, bringing a new round of price acceleration back into investors’ circle of concern.

Headline PPI rose 0.5% m/m instead of the expected 0.3%. In the same month a year earlier, the index was higher by 2.2% instead of the expected 1.6% y/y. This divergence in the estimates of annual rates is due to an upward revision of the previous months’ figures. Simply put, producer price inflation turned out to be higher than expected.

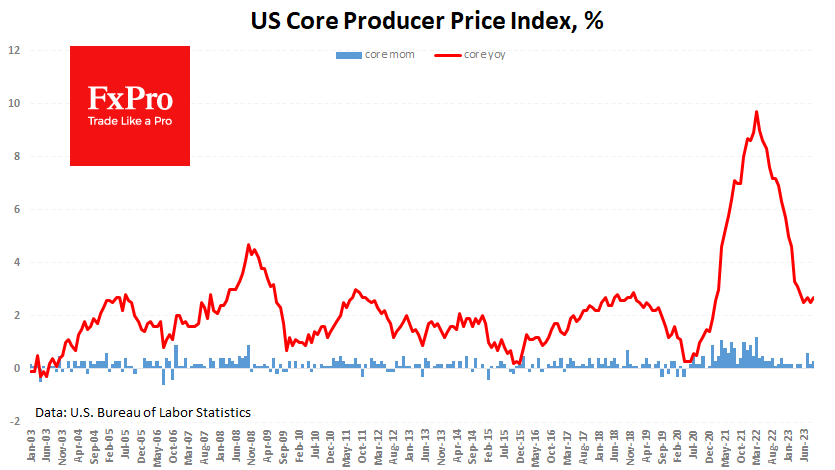

An important factor is the growth of the index cleared from the volatile food and energy components. The growth accelerated from 2.5% to 2.7% instead of the expected slowdown of 2.3%.

The markets’ attention remains focused on tomorrow’s consumer price data. And we should now expect it to exceed the expected 3.6% y/y due to today’s inflation surprise.

Looking longer term, the reversal to producer price acceleration will push consumer inflation, preventing it from getting back on track towards the 2% target. But the big question is whether this will force markets to abandon their expectation that the Fed is done raising rates, a scenario that has been gaining traction in investors’ minds since early last week.

The FxPro Analyst Team