US inflation is not as weak as it first appears

February 10, 2021 @ 18:23 +03:00

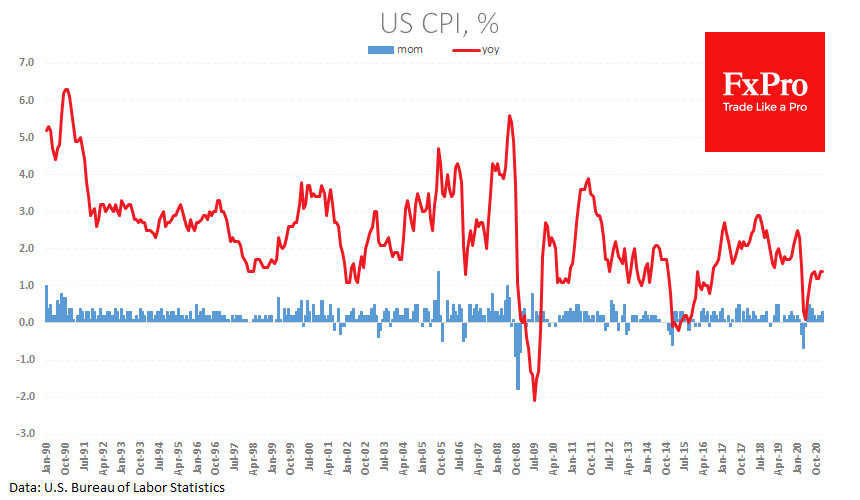

US consumer inflation maintained its 1.4% y/y growth in January, according to a new report. The core price index was virtually unchanged over the last two months, slowing the year-on-year gain to 1.4% from 1.6% previously.

But inflation is not as weak as it first appears. Oil prices added 3.5% to the energy component in January after rising 2.6% in December and is likely to continue going up after Crude Oil rebounded to the 12-month high. Meanwhile, food prices continue to increase, reaching 3.8% y/y.

Due to the low base effect (prices lost 1.1% in March-May 2020), annual inflation is set to rise sharply by the end of the first half of the year.

High inflation is good news for equities, precious and industrial metals. After all, it reflects strong demand and falling purchasing power of money, which should spur spending of dollars on goods and assets. There is one stipulation: The Fed should not scare the markets with any hint of a turnaround towards policy tightening. The Powell speech this evening is worth keeping an eye on in this regard.

The FxPro Analyst Team