US indices get support on a downturn, but Asia and Europe sticking to profits

September 16, 2021 @ 12:45 +03:00

Caution is an investor’s best friend these days.

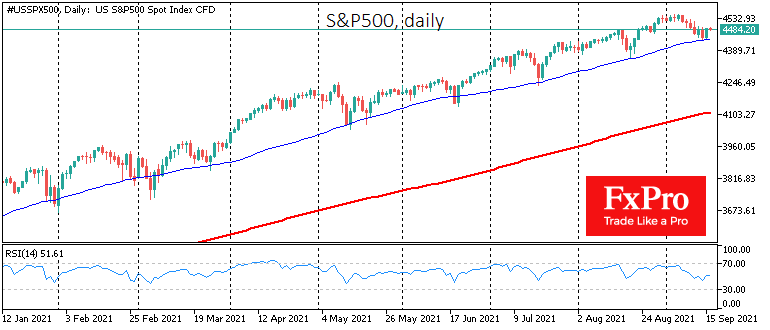

US indices were supported the night before after the S&P500 touched its 50-day moving average. The S&P500 gained 0.85%, the Nasdaq gained 0.82%, and the Dow Jones gained 0.68%. It must be said that this time the market rose in a broad front (there were 2.6 times as many rising stocks as falling ones), and the VIX fear index lost 6.6%.

However, this positive US momentum is a local and short-term story, tied to the quarterly expiry of options and futures. Less optimistic sentiment prevails in markets outside the USA.

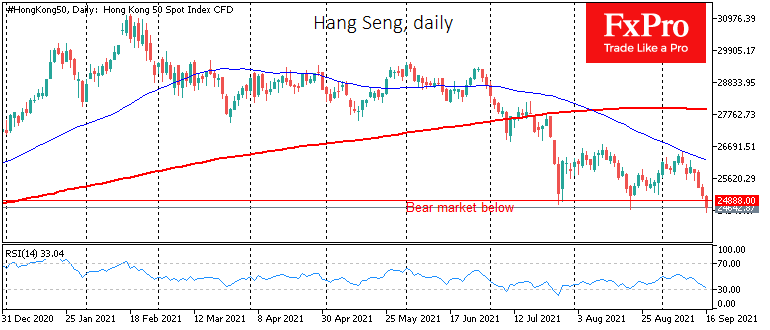

Chinese markets developed declines on Thursday morning on fears of the aftermath of the Evergrande property developer default and the revaluation of the casino sector in Macau. Since last November, the ongoing selloff has dragged the Hang Seng to new lows, bringing the index’s loss to 21% from its February peak. Among market participants, this is considered the start of a bear market. Previously in July and August, the bulls had pushed the index out of this territory, but this time the pressure of bad news outweighed the appeal of cheaper stocks.

The Nikkei 225 is pulling back from a 31-year high, losing momentum after rallying 9.5% since the start of the month. An overbought correction and selling on the rise promise to accompany the market in the near term.

The bears are also not losing ground in other markets. The EURUSD is hovering near its 50-day average. Attempts of intraday gains in the pair are stumbling over massive selloffs during active trading in the US, preventing the Euro from steadily gaining above 1.1800.

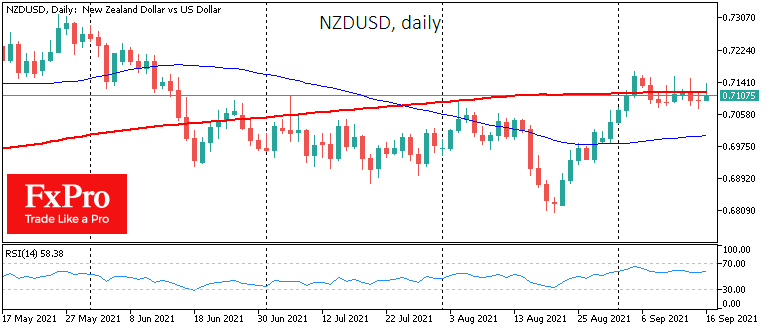

The New Zealand dollar only briefly enjoyed gains this morning after very strong Q2 GDP data showing the economy growing by 2.8% QoQ and 17.4% YoY against expectations of 1.2% and 16.4%, respectively. The NZDUSD has added 50 pips shortly after the publication, but by the start of trading in Europe, it gave back all gains, reversing to 0.7100, around which it has been lingering since early September. Sell the high tendency is keeping the pair below its 200 SMA.

The intrinsic strength of the bears is also conspicuous in the GBPUSD, which has stuck to 1.3820, near which the 50 and 200-day moving averages are concentrated. At the same time, the UK published impressive wage growth and inflation rates reports that were noticeably stronger than forecasted, that often noticeably supporting the pound. Thus, the mood in the financial markets is dominated by profit-taking on the upside. In addition, the currency market is in no hurry to sell off the dollar, keeping it from significant average levels.

It is quite possible that stock bears and dollar bulls have taken a wait-and-see approach ahead of the Fed’s decision and comments next week. In addition, it is worth keeping an eye on the friction of US lawmakers on the infrastructure package and the government debt ceiling scheduled for next week.

The FxPro Analyst Team